Here are the latest developments in global markets:

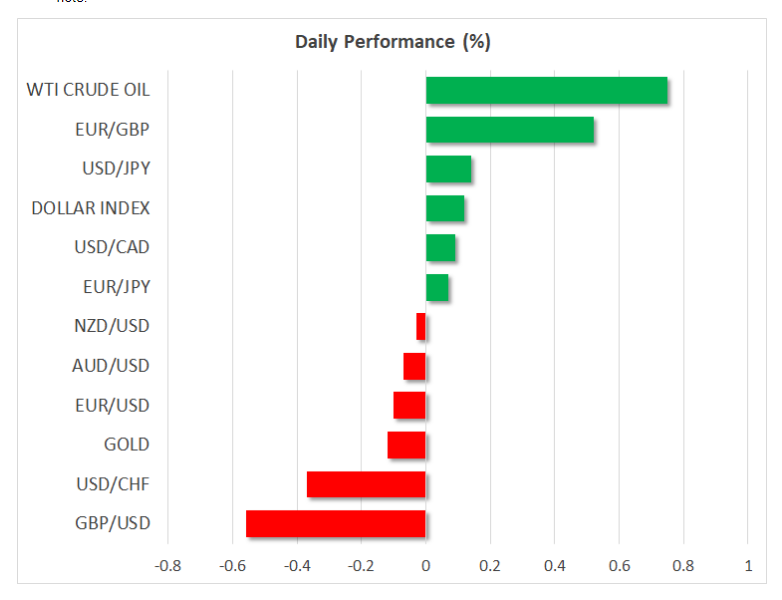

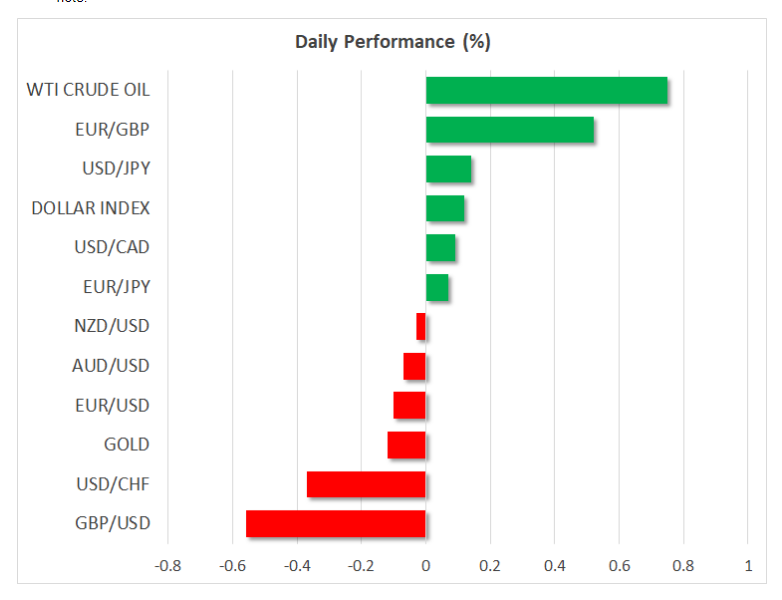

- FOREX: The dollar’s index against a basket of six major currencies traded higher by 0.1% after touching its lowest since early July of 93.81 earlier on Friday. Still, the index mostly consolidated yesterday’s considerable losses. Dollar-advancing on Friday was most evident against the yen and sterling. The former, unable to attract safe-haven flows, took a beating lately. Evidently, dollar/yen, euro/yen and pound/yen scaled two-, five- and four-month highs on Friday; the latter though later retreated, trading lower by 0.4% on the day. Pound/dollar was down by 0.6%. Sterling’s fall probably came on the back of profit-taking following gains which allowed cable to rise to a two-and-a-half-month high near 1.33 on Thursday, and in light of the fact that fears for a no-deal Brexit remain in place after the impasse at the Salzburg summit this week. Euro/dollar was down by 0.1% at 1.1761 after piercing through the 1.18 handle earlier in the day to post a three-month high of 1.1803. The reaction to the eurozone’s September flash PMIs was muted, though the common currency fell earlier in the day when data showed the respective PMI prints for Germany and France coming in below expectations for the most part. In terms of the euro-wide data, the divergence between services and manufacturing was evident; the PMI reading for the latter was below expectations, coming in at its lowest since September 2016; though at 53.3 it still remained in expansion territory.

- STOCKS: Upbeat equity market sentiment from Wall Street and Asia reverberated into Europe, with major benchmarks in the continent all being in the green. At 1145 GMT, the pan-European Stoxx 600 was up by 0.35% and not far below a one-and-a-half-month high of 385.20 tracked earlier on Friday. The blue-chip Euro Stoxx 50 traded up by 0.5%, being on its 10th straight session of advances, something not experienced in more than twenty years. Meanwhile, the UK’s FTSE 100, the German DAX and the French CAC 40 rose by 0.8%, 0.4% and 0.6% correspondingly. The bullish movement was again attributed to easing concerns over global trade. This raises questions though: is there really concrete evidence that this is the case? – the implication is that markets may be running ahead of themselves. Elsewhere, futures tracking the Dow, S&P 500 and Nasdaq 100 were little changed. The Dow and S&P finished at all-time highs on Thursday, with the Nasdaq 100 closing not far below its record peak. Heightened volatility may be in store for US equities on Friday due to “quadruple witching” (see below).

- COMMODITIES: WTI and Brent crude traded higher by 0.8% and 1.1%, at $70.89 and $79.57 per barrel respectively. The two benchmarks retreated yesterday after President Trump used Twitter to criticize OPEC for pushing prices up; the cartel and its allies will be meeting to discuss output this weekend. In precious metals, dollar-denominated gold is marginally down, having hit an eight-day high of $1,211.02 per ounce earlier on Friday. The metal benefitted on the back of the greenback’s recent retreat and looks set to finish the week on a positive note.

Day ahead: Canadian data due, with trade developments also in focus

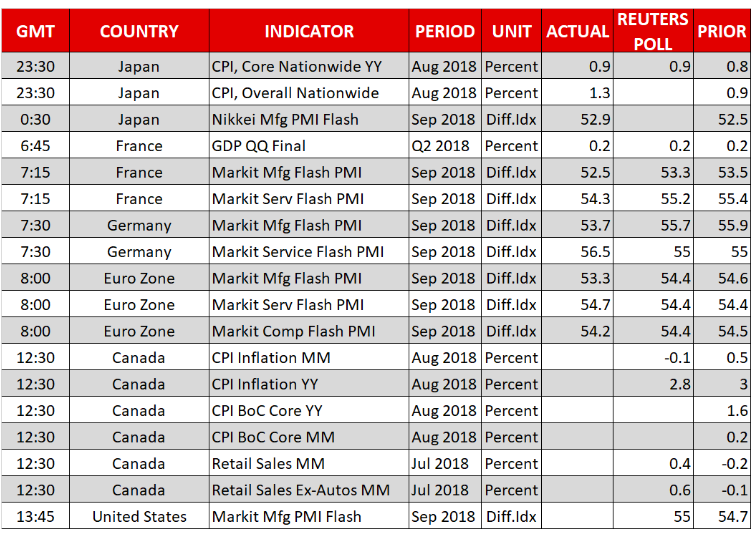

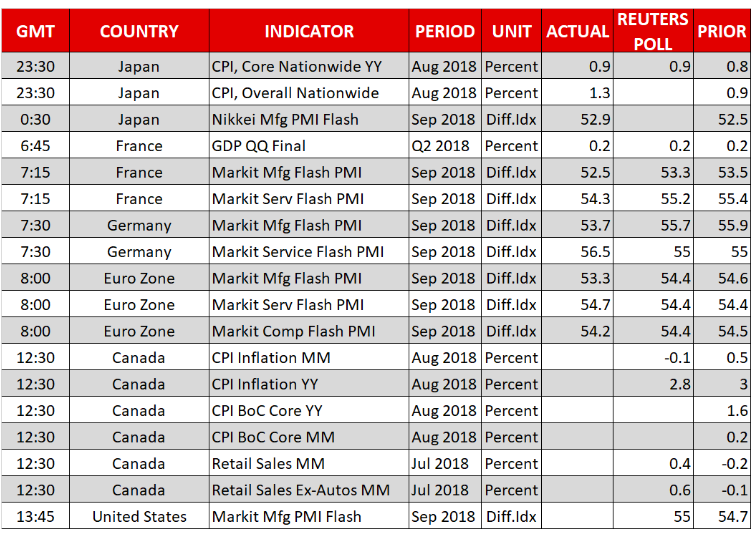

Inflation and retail sales figures out of Canada at 1230 GMT will be the highlight in terms of data releases in the remainder of Friday’s session. Meanwhile, any potential updates regarding the US-China trade skirmish, the NAFTA negotiations, and the Brexit talks are also likely to attract attention.

In Canada, CPI inflation is forecast to have cooled to 2.8% in annual terms during August, from 3.0% in the previous month. The core figure – which excludes volatile items such as energy – will also be in focus, though no forecast is available. As for retail sales, projections point to a 0.4% growth in July on a monthly basis, a rebound following a 0.2% decline previously. The core print, which strips out automobile sales, is also expected to bounce to 0.6%, after falling by 0.1% in June.

Overall, these seem like very decent prints that – if confirmed – could stoke even further market expectations for a BoC rate increase in October. Although inflation is expected to slow, it’s still anticipated to remain far above the midpoint of the BoC’s target of 2% +/- 1%, hence allowing the Bank to proceed with normalizing policy uninterrupted. The market-implied probability for an October hike currently rests at 86% (Canada’s OIS), and in case of strong data prints that push it even higher, the loonie could extend its latest gains.

Besides data, any updates in the US-China trade spat could also prove crucial for market sentiment. Investors breathed a sigh of relief recently that the latest tariffs were not as aggressive as feared, leading to a widespread market rally. That said, it bears mention that neither side has actually shown concrete signs of backing off, suggesting that the recent melt-up in stocks may be more fragile than it seems, with a single alarming headline possible to “ruin the party” at any moment. In other words, have investors run ahead of themselves in discounting a less-aggressive scenario for trade?

Also stock-related, today is “quadruple witching” day in the US, a quarterly event when futures and options on indices and individual stocks expire. Trading volumes are generally higher than usual in such sessions, as investors rush to close, roll over, or rebalance some of their existing positions. This implies that market moves may be abrupt and perhaps larger in magnitude than average, without much in the way of fundamentals behind them.

In energy markets, the weekly Baker Hughes report on active oil rigs in the US is due out at 1700 GMT. Beyond that, a weekend meeting between OPEC and other allies taking place in Algeria may be of interest.

As for the speakers, UK PM Theresa May is anticipated to deliver remarks at 1245 GMT. Her tone regarding the Chequers plan, which was recently rejected by the EU, may be crucial for sterling’s forthcoming direction. If she sticks to her proposals, or appears generally unwilling to surrender some ground, that may spell trouble for the pound as speculation for a continued deadlock in the talks regains steam.