How BioVaxys Technology Corp. (CSE:BIOV) (OTC:BVAXF) (FR:5LB) Swooped in to Acquire a Promising Biotech Asset with Multi-Billion-Dollar Potential and Over $300M in R&D Already Spent on it for Less Than a Million Dollars.

Imagine finding a hidden treasure in an old attic, a painting thought to be worth a little but actually a masterpiece worth millions. This happened in real life with a painting by Rembrandt, a famous artist, which was first thought to be worth $15,000, only to be sold for almost $14 million—a 93x return![1]

This story is like a hint for smart investors: sometimes, what looks ordinary at first can turn out to be incredibly valuable.

Just like treasure hunters, some smart companies look for hidden gems in businesses that are having a tough time, where they can find what are known as ‘distressed assets’.

They seek to find something special that everyone else missed, buy it for a steep discount, and then repackage or rejuvenate it, turning it into something amazing that makes a huge profit.

You’ve probably already heard of some of these, but didn’t know how successful they actually turned out to be. Here are some more prominent examples:

- Converse – Back in 2003, the historically significant shoemakers filed for bankruptcy, only for shoe giant Nike to swoop in and pay $305 million[2] to resurrect the brand. Nike has made billions in revenue from Converse over the years since, earning +$2.4 billion from the brand in 2023 alone[3].

- Hostess – In 2012, the Twinkies baker announced it was liquidating its assets after a labor dispute. By July 2013, astute businessman Daren Metropoulos and his group pursued and acquired Hostess for $410 million[4] en route to the “sweetest comeback in the history of ever”[5]. Within just two years, the business was rehabilitated and produced a $2 billion gain[6]. By late 2023, the enterprise was sold again for ~$5.6 billion[7].

- Marvel – In 1996, the comic book titan filed for bankruptcy, which sparked a billionaire vs billionaire feud between Ronald Perelman and Carl Icahn, only for action-figure company Toy Biz to swoop in and save the brand, paying $280 million[8]. This masterstroke would go on to attract a sale to Disney for $4 billion in 2009[9]. And of course, Disney would go on to make more than $30 billion in global box office off of movies alone[10].

But in each of these cases, the buyers each still had to put up hundreds of millions of dollars for these valuable assets, to turn them into multi-billion-dollar assets.

What if someone were to find an asset with multi-billion-dollar potential, and snap it up for less than $1 million, and get it over the finish line?

One such example is happening RIGHT NOW in the biotech sector, with all the makings of what could become the BIGGEST asset-rescue deal in the industry’s history.

Enter BioVaxys Technology Corp. (CSE:BIOV) (OTC:BVAXF) (FR:5LB), a junior biotech company that just pulled off a masterful acquisition of a technology platform called DPX™, that has already had over $300M of R&D invested into it, and could potentially become worth billions.

Savvy biotech firm BioVaxys made a move that could change lives and reward investors. They saw a chance with DPX™, a medical tech with huge potential.

While the original creators, despite a strong start, nearly reaching a billion-dollar market cap, and spending hundreds of millions on R&D, didn’t succeed, BioVaxys saw a diamond in the rough.

They didn’t just buy the tech; they got all the research and patents too. Now, BioVaxys is ready to finish what was started, to make DPX™ a name in health care. This deal is more than a purchase—it’s a step toward new treatments for people everywhere.

This move by BioVaxys is big news for anyone looking for smart investment chances. They’ve got a plan to make DPX™ shine, bringing new hope to medicine and possibly big returns for those who see the promise in their bold step.

Top 10 Reasons Why Investors Should Pay Close Attention to BioVaxys Technology Corp. (CSE:BIOV) (OTC:BVAXF) (FR:5LB) :

- Strategic Cost-Efficient Acquisition: At a cost well below its developmental value, BioVaxys acquired DPX™, a technology platform with significant prior investment in research and development, showcasing the company’s ability to identify and capitalize on strategic opportunities.

- Significant R&D Foundation: Over $300M has already been spent on developing DPX™, meaning BioVaxys is building upon a substantial foundation of research.

- Potential for Breakthrough: Based on solid scientific research and supporting clinical data, DPX™ has the potential to revolutionize cancer treatment and vaccine development, representing a breakthrough in medical technology.

- Unmet Medical Needs: With a focus on conditions that currently have few effective treatments, BioVaxys is targeting a critical gap in the healthcare market.

- Market Opportunity: The fields of cancer treatment and vaccine development are high-value markets with growing demand, suggesting a significant opportunity for BioVaxys.

- Expertise and Vision: The acquisition demonstrates BioVaxys’s expertise and vision in recognizing undervalued assets with potential.

- Public Health Impact: If successful, DPX™ could have a global impact on health care, positioning BioVaxys as a leader in the biotech sector against cancer, allergies, and infectious diseases.

- Patent Portfolio: The deal includes a substantial patent library, which could offer competitive advantages and opportunities for additional revenue streams through licensing.

- Revitalizing Potential: BioVaxys aims to revitalize and advance DPX™, indicating a commitment to innovation and value creation.

- Potential Partnerships: BioVaxys’s DPX™ platform could attract partnership opportunities with larger pharmaceutical companies, which can offer additional expertise and resources.

Discover DPX™: The Next Frontier in Immunotherapy

DPX™ stands out in today’s medical world. It’s a special kind of technology that teaches the body to fight cancer and disease, and presents a big chance to help people.

BioVaxys sees how great DPX™ can be. They’re ready to bring it back, like a phoenix rising up. They’re not starting over—there’s already over $300 million of research behind DPX™.

DPX™ is unique because it’s made to train the immune system very carefully. It goes after the real problems causing the disease, not just the symptoms. It could make people’s health better for a long time.

Everyone should now be looking very seriously at BioVaxys, as it begins to breathe new life into DPX™. People who invest money, doctors, and patients want to see what DPX™ can do. With BioVaxys leading, DPX™’s journey is about new starts, big chances, and changing how we treat tough diseases.

Seemingly Endless Possibilities

The DPX™ platform, with its robust and flexible design, could revolutionize future vaccine and therapeutic developments beyond its current applications. Envisioned as a versatile carrier, it has the potential to deliver not only proteins and peptides, but also mRNA, opening avenues for rapid response to emerging infectious diseases.

Furthermore, its adaptability could extend to treatments for chronic immune system conditions, allergies, and autoimmune diseases, harnessing the body’s immune system in precise, targeted ways. This broad potential positions DPX™ as a key player in the next generation of immunotherapies, offering hope for more effective, personalized medical solutions.

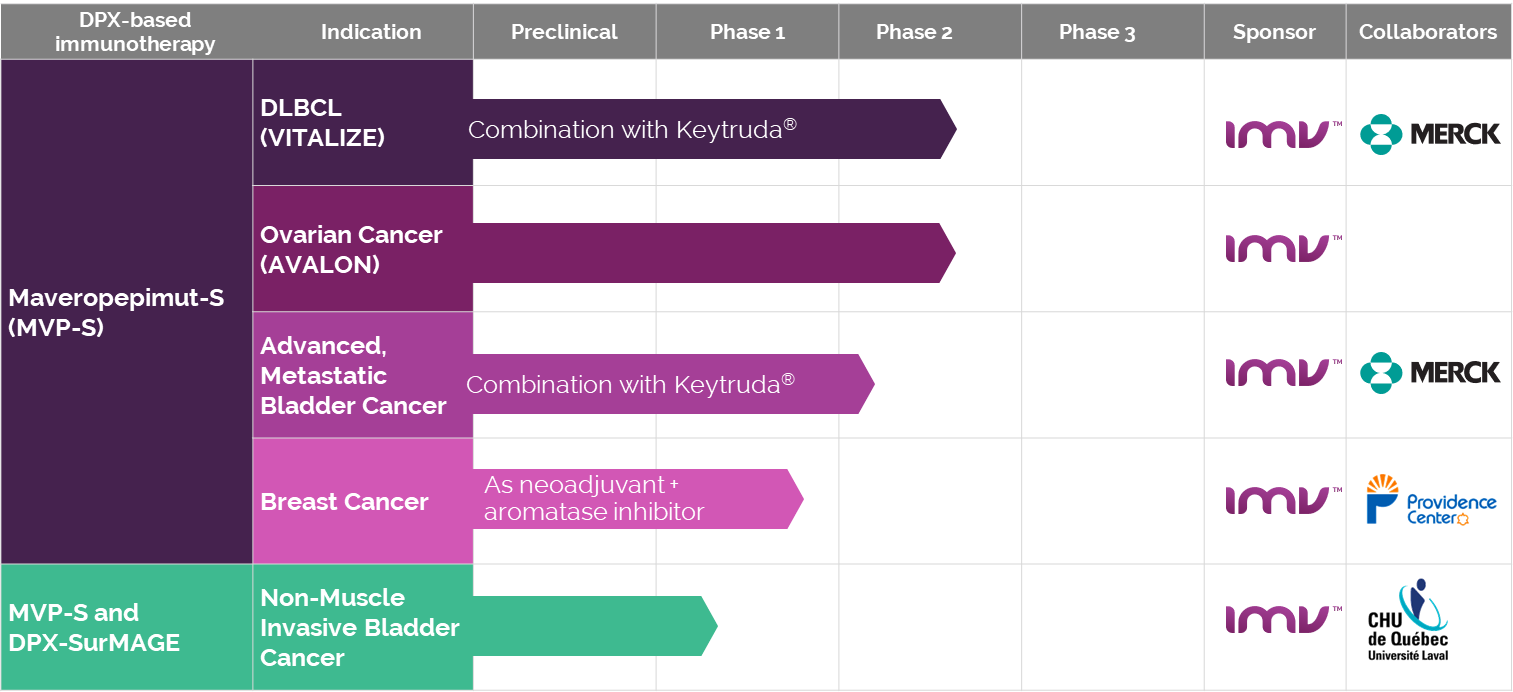

Before its transition, IMV engaged in several clinical studies leveraging the DPX™ platform, aiming to address a range of health issues, from cancer treatments to infectious diseases, showcasing the platform’s versatility and potential in immunotherapy. These studies were pivotal in demonstrating DPX™’s efficacy and safety across various medical applications.

List of IMV’s Clinical Studies:

- DPX™-Survivac™: Targeting ovarian and other cancers

- DPX™-RSV: Focused on Respiratory Syncytial Virus

- DPX™-COVID-19: Vaccine candidate against COVID-19

- Collaborative studies in infectious diseases with renowned institutions

This snapshot (captured from an archive of the IMV website[11]) highlights DPX™’s journey through clinical trials, underscoring its broad applicability in advancing medical science.

Case Study: Lipid Nanoparticle (LNP) Delivery

In a world where breakthroughs can redefine the future, Acuitas Therapeutics emerged as an unsung hero in the fight against COVID-19[12]. Specializing in lipid nanoparticle (LNP) delivery systems, Acuitas played a critical role in the success of mRNA vaccines.

Their technology enabled the safe and effective transport of mRNA into cells, marking a pivotal moment in vaccine development and distribution.

The lipid nanoparticle (LNP) delivery technology, crucial for the success of mRNA vaccines, particularly in the fight against COVID-19, has connections to both Acuitas Therapeutics and Arbutus Biopharma. This situation stems from a complex background of development and licensing agreements in the biotech industry.

Arbutus Biopharma originally developed a range of LNP technologies, which have been instrumental in advancing RNA-based therapies. Acuitas Therapeutics, on the other hand, specializes in the development and application of these LNP delivery systems for mRNA vaccines and therapeutics. There has been some contention and legal disputes between Acuitas and Arbutus over the rights to use certain LNP technologies, especially in the context of COVID-19 vaccines[13].

Acuitas went on to partner with majors such as Pfizer[14] showcasing the power of collaboration, marrying innovative technology with pharmaceutical expertise to deliver a global solution in record time. This strategic alliance not only accelerated the vaccine’s arrival but also spotlighted Acuitas’s technology, setting a new standard in therapeutic delivery.

Now, imagine a similar story unfolding with BioVaxys. With its DPX™ platform, BioVaxys holds the keys to a new realm of possibilities in immunotherapy and vaccine development. Like Acuitas, BioVaxys has the potential to revolutionize healthcare through strategic partnerships and innovation. The DPX™ platform, with its unique delivery mechanism, could become as integral to future treatments as LNP technology has been to mRNA vaccines.

As we look to the future, BioVaxys’s journey could mirror that of Acuitas, transforming the DPX™ platform into a cornerstone of medical innovation. With the right collaborations and continued investment in research, BioVaxys stands on the brink of writing its own success story, potentially surpassing the achievements of Acuitas by broadening the scope of diseases targeted and improving the efficacy of treatments. The story of Acuitas serves not just as inspiration but as a blueprint for what BioVaxys could achieve, highlighting the boundless potential of merging pioneering technology with visionary strategy.

Quick Recap: Why BioVaxys Technology Corp. (CSE:BIOV) (OTC:BVAXF) (FR:5LB) Should Be On Your Radar:

- Smart Buy: BioVaxys secured DPX™ for much less than its research value, showing their knack for spotting and seizing smart opportunities.

- Established Research: BioVaxys builds on the extensive $300M+ research groundwork already laid for DPX™.

- Innovation Potential: DPX™ stands on the brink of changing cancer and vaccine science based on robust research.

- Healthcare Gap: BioVaxys targets crucial healthcare needs that are currently underserved.

- Lucrative Markets: The company enters the high-value arenas of cancer and vaccine markets, poised for growth.

- Strategic Insight: The acquisition underscores BioVaxys’s strategic acumen in identifying high-potential assets.

- Health Impact: Success with DPX™ could place BioVaxys at the forefront of global healthcare solutions.

- Patent Strength: A strong patent collection from the deal may provide a competitive edge and new revenue paths.

- Renewed Momentum: BioVaxys is set to propel DPX™ forward, emphasizing their commitment to unlocking hidden value.

- Collaborative Prospects: The DPX™ platform’s potential may draw collaborations with pharma giants, bringing in more expertise and capital.

BEFORE YOU GO!

BioVaxys Technology Corp. (CSE:BIOV) (OTC:BVAXF) (FR:5LB) isn’t just another player in the biotech sector; it’s a pioneer poised to redefine the future of immunotherapy and vaccine development. With its innovative Haptenix© platform behind development of ovarian cancer vaccine candidate BVX-0918, and the addition of

DPX™ platform technology, BioVaxys stands at the forefront of addressing some of the most pressing medical challenges of our time, including cancer, allergies and infectious diseases like COVID-19 and RSV.

The company’s approach, leveraging the power of the immune system through targeted delivery mechanisms, is not only ground breaking but also offers the potential for scalable and effective solutions. As the world continues to grapple with health crises, the work of BioVaxys could prove instrumental in shaping the next generation of medical treatments.

Stay informed about all the latest advancements and updates from BioVaxys Technology Corp. by clicking here.

USA News Group

Editorial Staff

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for BioVaxys Technology Corp. advertising and digital media from the company directly. There may be 3rd parties who may have shares of BioVaxys Technology Corp., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of BioVaxys Technology Corp. which were purchased in the open market, and reserve the right to buy and sell, and will buy and sell shares BioVaxys Technology Corp. at any time without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, we currently own shares of BioVaxys Technology Corp. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://www.cnn.com/style/rembrandt-auction-adoration-kings-sothebys-gbr-scli-intl

[2] https://www.wsj.com/articles/SB105778918424757500

[3] https://www.statista.com/statistics/241850/sales-of-nikes-non-nike-brands-2006-2010/

[4] https://www.prnewswire.com/news-releases/hostess-brands-selects-apollo-global-management-and-metropoulos–co-as-winning-bidder-for-majority-of-snack-cake-business-including-twinkiesr-197536231.html

[5] https://www.bakingbusiness.com/articles/60082-hostess-saga-truly-the-sweetest-comeback-in-the-history-of-ever

[6] https://www.forbes.com/sites/stevenbertoni/2015/04/15/twinkie-billion-dollar-comeback-hostess-metropoulos-apollo-jhawar/?sh=77d013767235

[7] https://www.prnewswire.com/news-releases/the-j-m-smucker-co-to-acquire-hostess-brands-to-accelerate-focus-on-convenient-consumer-occasions-301923243.html

[8] https://money.cnn.com/1998/06/29/companies/marvel/

[9] https://www.nytimes.com/2009/09/01/business/media/01disney.html

[10] https://www.cnbc.com/2023/11/14/how-disney-can-save-marvel-cinematic-universe.html

[11] https://web.archive.org/web/20230207172926/https://www.imv-inc.com/product-pipeline

[12] https://www.forbes.com/sites/nathanvardi/2021/08/17/covids-forgotten-hero-the-untold-story-of-the-scientist-whose-breakthrough-made-the-vaccines-possible/?sh=3949ee38354f

[13] https://investor.arbutusbio.com/news-releases/news-release-details/arbutus-settles-litigation-terminating-acuitas-rights-lnp-0

[14] https://www.pfizer.com/news/press-release/press-release-detail/pfizer-enters-agreement-acuitas-therapeutics-lipid