Weekly Market Review – August 29, 2020

Stock Markets

Markets finished higher last week, on track for its best August in 34 years, and continuing the rally after the third bear market in two decades. The S&P 500 is up nearly 52% since the bear market bottom on March 23, and is up nearly 8% for the year, posting a new record high of 3,4941. The chairman of the Federal Reserve Board, Jerome Powell, stated last week that the Fed will let inflation run slightly higher than the traditional 2%, meaning rates will stay lower for longer, which is a tailwind for equities. Personal spending rose 1.9% in July, the third month in a row showing growth, indicating that the economic recovery is underway.

US Economy

The health, social and economic effects of COVID-19 continue to be felt, but that hasn’t stopped stocks from marching higher. The S&P 500 closed at another record high last week and is on track to log its best summer performance (June – August) since 1938 and its best August since 1981. The market is wrapping up the summer in a much different position than it was in just a hand full of months ago, reflecting this year’s evolving (and unusual) conditions.

The last three months provided additional evidence that the economy is gradually exiting a deep recession, with data hinting to a sizable bounce in the third quarter. A real-time forecast from the Federal Reserve Bank of Atlanta estimates that third-quarter GDP will grow 26% following a 32% annualized decline in the second quarter. If this proves to be the case, by the end of September the economy will have recovered half of its pandemic-induced losses, leaving real GDP about 5% below its pre-crisis level. Still a lot of ground to cover, but a good first step.

Metals and Mining

After two weeks of losses, gold was poised to end the last week of August up almost 2 percent, reversing a brief slump that saw the metal dip to US$1,917 per ounce on Wednesday (August 26). The yellow metal strengthened as the US dollar pulled back on news that the Fed is taking a dovish stance that is expected to prolong the current low interest rate environment. The other metals were a mixed bag, with silver on track for second week of gains, benefiting from its dual nature as a precious and industrial metal. In a much-anticipated Thursday address, US Federal Reserve Chair Jerome Powell said the central bank will try to achieve an average inflation level of 2 percent over time, meaning it may be higher or lower than that amount at times. In the hours following, gold rose from US$1,917 an ounce to a five-day high of US$1,966.70. He went on to say his firm expects the currency metal to again test the US$2,000 range, possibly moving as high US$2,300. Silver has been trending higher since pulling back in mid-August. The white metal has now added 10 percent to its value since August 11 and is working towards the US$30 per ounce threshold. Even though silver remains shy of its year-to-date high of US$29.14, achieved on August 10, the present price environment is very supportive of pure-play miners, which according to Metals Focus need a price point of at least US$19 an ounce to be economical. Up 53 percent from January, and more than 100 percent since the March slump, silver is expected to show improved resilience as industrial demand strengthens. Platinum lost some ground mid-week, hitting a monthly low of US$905 per ounce. Early in August, the metal had been approaching US$1,000 territory, but retreated. Despite the recent price pressure, analysts are anticipating a rally later in the year. A release from the World Platinum Investment Council touts increased end-use applications for the metal, with the most prominent being an uptick in use as a coating to prevent corrosion or to boost electroconductivity and heat resistance Palladium faced volatility this session, but still held above US$2,000 an ounce. After steadily moving higher in July, the autocatalyst metal has faced headwinds, shedding 7.1 percent month-over-month. Although prices have slumped in August, the metal is well above its January value of US$1,967 per ounce. Palladium was valued at US$2,601 at 12:10 p.m. EDT on Friday.

The base metals managed to squeak out a gain, with the exception of lead. Climbing as high as US$1,984 per tonne mid-week, subsequent pressures weighed the lead price down. Copper posted a strong gain, starting the session at US$6,579.50 per tonne; it pulled back slightly to end the week at US6,602. The red metal is also benefiting from the Fed’s policy shift and renewed optimism that COVID-19 lockdowns will lead to a smaller demand decline that expected. According to an S&P Global report, copper consumption is now expected to fall by 3 to 4 percent year-on-year, less than a 4.6 percent decline in global GDP. Chinese demand, which accounts for half of the metals market, has been robust and will likely prop the market up in the months ahead. Copper was priced at US$6,602 Friday. Zinc felt resistance this week, pulling the metal off its five-day high US$2,462 per tonne. Prices then settled in the US$2,450 range. Zinc has added 38 percent to its value since January, and Friday saw prices sitting at US$2,455. Nickel hit its year-to-date high this week when it rallied from US$14,862 per tonne to US$1,5120. The surge marks the metal’s best showing since November. Since falling to a low of US$11,055 in mid-March, nickel has climbed 36.7 percent. As of Friday, nickel was valued at US$15,120.

Energy and Oil

Oil prices retreated in the wake of Hurricane Laura, which led to much less destruction than the market had anticipated. That leaves the oil price dynamic little changed from the past two months – WTI and Brent are stuck in familiar territory between $42 and $45. The concentration of energy assets along the Texas and Louisiana coast more or less avoided the worst-case scenario from Hurricane Laura. “The damage is not as bad as anticipated, which is creating more sell pressure along the energy complex,” said Phil Flynn, senior market analyst at Price Futures Group. More than 80 percent of oil output in the Gulf of Mexico and almost 3 million barrels a day of refining capacity had been shut ahead of the storm, most of which should come back online fairly quickly. Laura shut-in some LNG operations, and gas exports are set to fall to about 2.1 bcf, the lowest level since February 2019. Oil exports are expected to drop by nearly 1 mb/d this week. Natural gas spot prices rose at most locations this week. The Henry Hub spot price rose from $2.36 per million British thermal units (MMBtu) last week to $2.51/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the September 2020 contract increased 3¢, from $2.426/MMBtu last week to $2.461/MMBtu this week. The price of the 12-month strip averaging September 2020 through August 2021 futures contracts declined 1¢/MMBtu to $2.851/MMBtu.

World Markets

European shares rose on further economic stimulus in France and Germany, a recommitment by the U.S. and China to their partial trade deal, and signs of progress in the development of treatments for COVID-19. In local currency terms, the pan-European STOXX Europe 600 Index ended the week 1.02% higher, while Germany’s Xetra DAX Index climbed 2.10%, France’s CAC 40 added 2.18%, and Italy’s FTSE MIB rose 0.74%. The UK’s FTSE 100 Index slipped 0.6%.

Despite renewed surges in coronavirus infections, France, Spain, and Italy appeared to reject the need for nationwide lockdowns to curb what could be a second wave of the pandemic. French Prime Minister Jean Castex said the government would do everything to prevent a nationwide lockdown but warned that some regions might need to be isolated after cases quadrupled over the past month. In Italy, Health Minister Roberto Speranza asserted that the government was optimistic about keeping the situation under control, noting that there were fewer hospitalizations and fatalities. In Spain, Prime Minister Pedro Sanchez appeared to rule out a countrywide lockdown, saying the current outbreak was far from the situation in March and that officials were better prepared and had a better understanding of the virus.

Mainland Chinese stock markets rose for the week. The blue-chip CSI 300 Index gained 2.7% and the benchmark Shanghai Composite Index, which gives a significantly larger weighting to state-owned enterprises, added 0.7%. For the year to date, Chinese yuan-denominated A shares have gained about 10% compared with a roughly 8.5% gain for the S&P 500 Index, making them among the best performers in global stock markets.

The yield on China’s sovereign 10-year bond increased for the week amid further evidence of the strengthening economy. Industrial profits in July surged 19.6% over a year earlier in their fastest year-over-year growth since June 2018. However, cumulative profits for the year to date remain in negative territory. Profits at state-owned enterprises significantly lagged those at private and foreign-owned companies.

The Week Ahead

Important economic data being released this week include Construction Spending, Continuing Jobless Claims, and the PMI Composite.

Key Topics to Watch

- IHS Markit manufacturing PMI

- ISM manufacturing index

- Construction spending

- Motor vehicle sales (SAAR)

- ADP employment report

- Factory orders July

- Initial jobless claims

- Initial jobless claims

- Continuing jobless claims

- Continuing jobless claims

- Trade deficit

- Productivity revision

- Unit labor costs revision

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

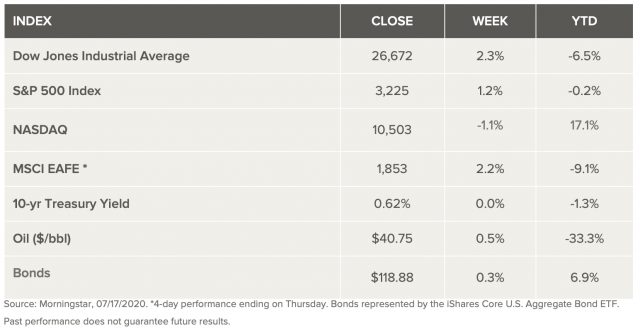

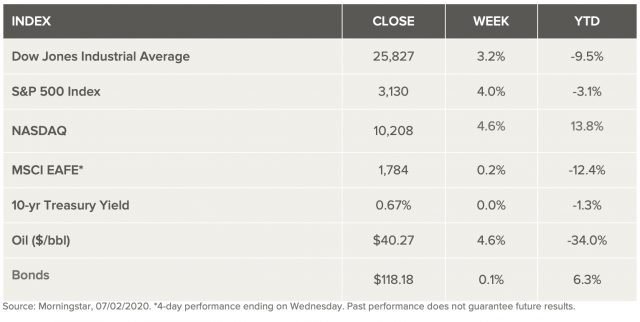

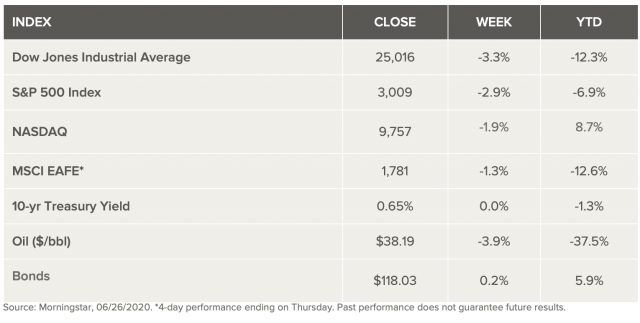

Markets Index Wrap Up