Stock Markets

Stocks continued to seesaw in June, with one week’s gains being reversed the following week. Last week’s decline was caused by a renewed surge in coronavirus cases across the Southwest. Texas and Florida reported a record number of new cases, which led to some rollback of reopening measures. Adding to the anxiety was the announcement that travelers coming into New York, New Jersey and Connecticut from the recent virus hotspots will be subject to a 14-day quarantine. Uncertainty around the path of the virus will continue to be a headwind, but, provided that statewide lockdowns are avoided, a longer-term economic recovery is under way, analysts believe.

US Economy

Last week, an increase in daily new coronavirus cases in the sunbelt states of Texas, Florida and Arizona dampened some of the market optimism for a speedy economic recovery and quick rebound in corporate earnings. In response, to an uptick in COVID-19 outbreaks, the state of Texas dialed back its reopening plans and replaced limits on bars, restaurants and outdoor gatherings. New York, New Jersey and Connecticut, states which had previously led the nation in new cases but have recently seen success in lowering the infection rate from previous high levels in March and April, also reacted to the rise in cases by issuing self-quarantine orders for visitors from emerging hotspots. Stocks slipped 2.9% as anxiety over a second wave of new cases overshadowed recent good economic news on the reopening of the national economy.

To date, the market has rebounded 35% from the March 23 low and is within 11% of the February 19 high. Yet along with this overall upward trend there have been occasional market pullbacks as the economy continues along the bumpy and unprecedented path of reopening and recovery.

Metals and Mining

Gold continued climbing on Friday on its way to a third week of gains. The yellow metal hit a year-to-date high on Wednesday of 1,777.60 per ounce. Concern that miners’ Q2 tallies will be more disappointing than first expected are likely to be a tailwind for the yellow metal in the weeks to come. Despite mostly holding above US$1,700 since passing the threshold in mid-May, analysts at Metals Focus are forecasting a gold price average of only US$1,700 this year. The metals consultancy is also calling for a 9 percent increase in physical gold investment this calendar year, as investors react to weak equities, negative bonds and mounting debt. As reserved as that price forecast may be, Metals Focus did note that gold has the potential to trend higher amid the current uncertainty. Silver edged as high as US$17.99 per ounce this session but was unable to pass the key US$18 level. But the rollover of the June contract is expected to take the white metal past US$18 during the next week. After moving lower since the end of May, platinum soared to US$824 per ounce this week before retreating. Platinum has been plagued by low prices since 2016, falling as low as US$670 in March. Recognizing the opportunity, China has ramped up purchases of the catalyst and jewelry metal, as per a note from the World Platinum Investment Council. Palladium also fell lower this week, starting at US$1,836 per ounce and ending down 3.5 percent. Slower-than-anticipated restarts are preventing the metal’s ability to claw back previously lost gains.

The base metals sector was split during the last full week of June, with two commodities recording modest gains. Copper climbed from US$5,825 per tonne on Monday to US$5,895 a day later. The red metal has now regained its March losses, adding 27 percent to its year-to-date low of US$4,617.50. Positioned favorably in relation to the other base metals, analysts at Canaccord Genuity project that copper demand will remain steady in the long term. Zinc prices fell lower this week, shedding almost 2 percent. The metal remains well off its year-to-date high of US$2,643 per tonne despite being profoundly affected by COVID-19 closures. According to a Reuters report, as much as 5 percent of globally supply may have been impacted due to lockdowns in major producer Peru. Weak demand also prevented nickel from surpassing its Monday value of US$12,625 per tonne. Economic uncertainty continues to weigh on industrial demand, keeping the metal 32 percent off its year-to-date high of US$1,8620. Lead was able to add to its value and finished the session higher. At 11:07 a.m. EDT on Friday, lead was priced at US$1,777.50 per tonne.

Energy and Oil

The two-month oil rally has stalled, with WTI falling back to $38 per barrel. The resurgence of Covid-19 across the U.S. has halted the market’s positive momentum. In many ways, the rally was already overdone. Texas Governor Greg Abbott ordered bars to shut down on Friday as the spread of the coronavirus continues to accelerate. With several states – and the U.S. as a whole – setting new daily records for positive cases, fuel demand faces enormous downside risk in the weeks ahead. For instance, Texas gasoline demand on June 24 was 17.8 percent lower than on June 17. California regulators approved a new rule requiring more than half of all trucks sold to be zero-emissions by 2035, with incremental targets beginning in 2024. The rule is estimated to lower the state’s greenhouse gas emissions by 17 million metric tons and save truck operators $6 billion on fuel costs. It is also expected to spur manufacturing for electric heavy-duty trucks. Natural gas spot prices rose at most locations this week. The Henry Hub spot price rose from $1.48 per million British thermal units (MMBtu) last week to $1.58/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the July 2020 contract decreased 4¢, from $1.638/MMBtu last week to $1.597/MMBtu this week. The price of the 12-month strip averaging July 2020 through June 2021 futures contracts declined 8¢/MMBtu to $2.286/MMBtu.

World Markets

European shares fell amid trepidation about a resurgence of coronavirus infections that could halt an economic recovery and a flare-up in trade tensions between the U.S. and Europe. The pan-European STOXX Europe 600 Index ended the week 1.89% lower, with major European indexes mixed. Germany’s DAX Index declined 2.09%, while Italy’s FTSE MIB Index slipped 2.33%, and France’s CAC-40 Index slid 1.34%. The UK’s FTSE 100 Index fell 0.87%.

Upbeat economic data provided signs that the coronavirus-induced slump in the eurozone may be bottoming out, reviving hopes of a V-shaped recovery. The flash IHS Markit Eurozone Composite Purchasing Managers’ Index (PMI) surged to 47.5 in June from 31.9 in May, the second-biggest jump in the survey’s history. Although the PMI reached its highest level since February, the data still point to a drop-in business output. German and French business confidence recovered at record rates in June and more than expected by most economists, although they were still well below pre-pandemic levels, two national surveys showed.

However, European Central Bank Chief Economist Philip Lane warned in a speech that any substantial improvement in near-term indicators would “not necessarily be a good guide to the speed and robustness of the recovery.” He added that it might take a sustained period of improving economic and public health conditions before confidence is fully restored.

China’s large-cap CSI 300 Index and benchmark Shanghai Composite Index rose 1.0% and 0.4%, respectively, in a week containing few major economic readings. On Thursday, China’s government said that it would increase the number of sectors open to foreign investment starting July 23, mostly via shorter “negative lists.” The move was viewed as part of Beijing’s efforts to bolster overseas investment to support an economy battered by the coronavirus pandemic. Previously, the number of sectors listed as off-limits to foreign investors was lowered to 33 from 40.

The Week Ahead

U.S. financial markets will be closed Friday for Independence Day. Important economic data being released include pending home sales on Monday, consumer confidence on Tuesday, and the June jobs report on Thursday.

Key Topics to Watch

- Pending home sales index

- Case-Shiller home price index

- Chicago PMI

- Consumer confidence index

- ADP employment report

- Markit manufacturing index

- ISM manufacturing index

- Construction spending

- FOMC minutes

- Motor vehicle sales

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Trade deficit

- Initial jobless claims

- Continuing jobless claims

- Factory orders

- Independence Day holiday

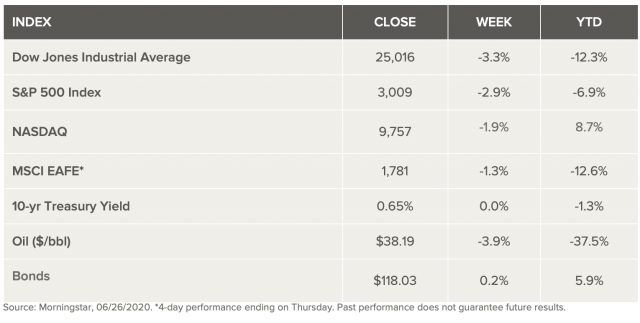

Markets Index Wrap Up