Weekly Market Review – June 20, 2020

Stock Markets

Stocks rebounded last week on better-than-expected economic data and hopes for fresh stimulus. U.S. retail sales jumped nearly 18% in May, the biggest monthly increase on record, signaling that the economy is improving from depressed levels. That news, coupled with news that the White House may be working on a $1 trillion infrastructure plan, along with the Fed’s announcement that it would expand its support of the credit markets by buying corporate bonds, led to stocks reversing the prior week’s losses. Analysts believe that the combination of job gains in May and the rebound in retail sales can provide some confidence to investors that an economic rebound is under way.

U.S. Economy

The week’s economic data offered mixed signals as to whether the economy will be able to manage a “V shaped” recovery. On Tuesday, the Commerce Department reported of a 17.7% surge in retail sales in May, better than double consensus expectations and the biggest gain in history—albeit one measured against the 23.3% cumulative decline over the previous three months. Labor market data disappointed, however. Weekly jobless claims fell less than expected, and continuing claims remained elevated, at over 20.5 million. A gauge of current manufacturing activity in the mid-Atlantic region surprised dramatically on the upside, indicating considerable expansion instead of continued contraction, but overall industrial production in May rose less than expected.

Metals and Mining

Following five days of volatility, gold was in the green on Friday morning, on track to end the session 1.7 percent higher. With the yellow metal edging above US$1,730 per ounce, analysts are forecasting a steady upward trend as concerns about stimulus and a weak US dollar drive investors to the sector. A Goldman Sachs report released this week projects that the currency metal will hit US$2,000 in the next 12 months as economies struggle with staggered re-openings and disrupted GDPs. The firm expects an inflationary reaction to the COVID-19 response from central banks — but just how much is uncertain. For David Smith, the economic recovery will be more complex, a topic he touched on during his presentation at the digital MoneyShow last week.

The senior analyst at the Morgan Report warned of a period of stagflation similar to the one experienced in the mid-1970s. In this environment, gold is favored to perform positively, according to Smith. Silver continued to trend higher, poised to make its fifth week of gains, despite headwinds mid-session. The white metal has climbed 2.7 percent since late April and is benefiting from safe haven investor attention and growth in industrial demand. Moving towards US$18 an ounce, silver’s steady ascent is right on trend. Platinum displayed strength on Monday, climbing to US$821 per ounce, its highest price since late May, before falling to US$793. As the other precious metals pushed to end the period in the green, palladium was dragged lower. The automotive metal has faced dwindling demand from manufactures. While some of this was offset by a COVID-19-induced production decline, stockpiled material will drag on its value now that projects are ramping up output.

Also on track for a week of positive growth was the base metals sector, which saw gains across most of the assets. Copper added 2.7 percent to its value this week, propelled by reinvigorated industrial demand, mostly in China. Zinc made modest gains over the week. Impacted by some of the same production setbacks that have plagued copper since the pandemic was announced, zinc may benefit from a reduction in supply. That’s because prior to the COVID-19 containment measures, the metal had been on its way to a significant surplus at the pre-closure production levels. With prices 17 percent lower than the same period last year, the output reduction may motivate the metal later on. Nickel was also on its way higher, advanced by positive tailwinds. The momentum has earned the attention of the London Metal Exchange, which changed its speculative position on the metal to bullish on June 12. After shooting from US$12,503 per tonne to US$12,903 early in the period, the metal slid back to US$12,760. Four solid days of gains drove lead from US$1,718 per tonne on Monday to just shy of US$1,800 by week’s end. The base metal is now back in pre-COVID-19 lockdown price territory, but still well off its one year high of US$2,265.

Energy and Oil

Oil prices have shrugged off concerns about rising coronavirus infections, with WTI hitting $40 per barrel in early trading on Friday, a three-month high. “OPEC+ has done a good job turning things around and stronger demand also helps,” said Carsten Fritsch, an analyst at Commerzbank AG. OPEC’s Joint Ministerial Monitoring Committee (JMMC) met and demurred on whether it would extend production cuts again. But Iraq and Kazakhstan presented plans on how they would increase their compliance, a move welcomed by oil markets. “That could be an extra piece of bullish news for the market, which may see the two nations removing some supply,” said Bjornar Tonhaugen from Rystad Energy. Meanwhile the U.S. Treasury Department slapped sanctions on Mexican trading company Libre Abordo SA de CV for buying Venezuelan oil. Saudi Aramco is cutting hundreds of jobs as it hopes to reduce costs. First-quarter profit for Aramco was down 25 percent from a year earlier. And without a doubt, U.S. shale dominance over. U.S. shale production could fall by half over the next year due to the massive drop in the rig count, putting overall American oil production below 8 mb/d within a year’s time. It will take years before production will rebound anywhere close to pre-pandemic levels. Natural gas spot prices fell at most locations this week. The Henry Hub spot price fell from $1.70 per million British thermal units (MMBtu) last week to $1.48/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the July 2020 contract decreased 14¢, from $1.780/MMBtu last week to $1.638/MMBtu this week. The price of the 12-month strip averaging July 2020 through June 2021 futures contracts declined 7¢/MMBtu to $2.361/MMBtu.

World Markets

Equities in Europe ended the week higher, supported by stimulus efforts and the reopening of key economies. However, a resurgence of COVID-19 cases in the U.S. and China cast doubt on a quick recovery and hindered the advance. The pan-European STOXX Europe 600 Index ended the week 3.31% higher, while Germany’s Xetra DAX Index climbed 3.51%, France’s CAC 40 Index added 3.23%, and Italy’s FTSE MIB Index advanced 3.99%. The UK’s FTSE 100 Index rose 2.93%.

Core eurozone bond yields were mixed on the week. Yields edged up following the Federal Reserve’s move to buy corporate debt, reducing demand for safe-haven assets. However, yields declined later in the week after it emerged that eurozone banks had borrowed a record EUR 1.31 trillion under the European Central Bank’s targeted longer-term refinancing operations (TLTRO). The Fed announcement and TLTRO uptake put downward pressure on peripheral eurozone bond yields, which fell markedly on the week. Meanwhile, the German 10-year bund yield was trading at -0.41% on Friday, up slightly from Monday’s -0.46%. The Italian 10-year yield traded at 1.35% on Friday, compared with Monday’s 1.41%.

China’s domestic large-cap index, the CSI 300 Index, gained 2.4% for the week, outpacing the 1.6% advance in the country’s benchmark Shanghai Composite Index. The gains in Chinese stocks came despite a reported surge in new COVID-19 cases in Beijing over the June 13 weekend, highlighting the risk of a second wave of infections. In response, Beijing returned to tight movement restrictions, though not a complete lockdown, after the new cases were traced to a wholesale food market. Despite fears of another wave, public health experts believe that China will be able to better manage a resurgence in infections given the country’s extensive experience in battling the coronavirus.

The Week Ahead

Important economic data being released include existing home sales on Monday, the preliminary Purchasing Managers’ Index for June on Tuesday, and personal income and spending on Friday.

Key Topics to Watch

- Chicago Fed national activity index

- Existing home sales

- Markit manufacturing index (flash)

- Markit services index (flash)

- New home sales

- FHFA home price index (year-over-year change)

- Initial jobless claims (regular state program, SA)

- Continuing jobless claims

- GDP (revision) Q1

- Durable goods orders

- Core capital goods orders

- Trade in goods (advance report)

- Personal income

- Consumer spending

- Core inflation

- Consumer sentiment index (final)

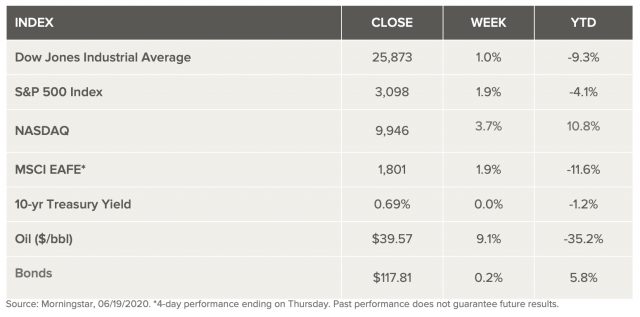

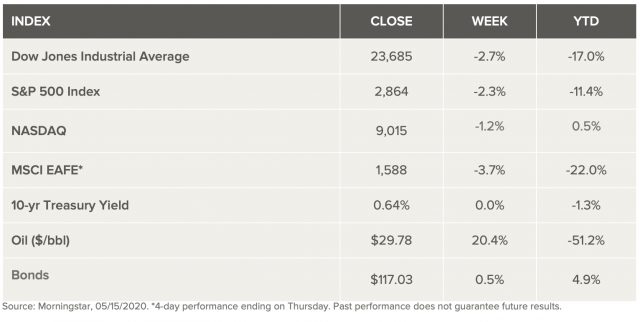

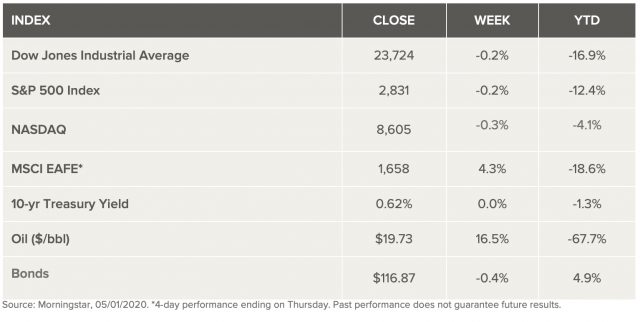

Markets Index Wrap Up