Stock Markets

Stocks finished higher for the third consecutive week on coronavirus-vaccine optimism and positive economic data. U.S. retail sales jumped 7.5% in June, and industrial production increased the most since 1959, both surprising to the upside. Following a two-month rebound, retail sales are almost back to their pre-virus levels, largely helped by the direct support and fiscal transfers from the government to consumers. As the expanded unemployment benefits are due to expire at the end of the month, expectations are that Congress will manage to reach a deal on a new aid package, which is much needed to support the economic recovery.

US Economy

As the economy takes the first tentative steps out of a deep but likely short recession, the destination is clear for many investors. After a precipitous decline in economic activity in the second quarter (the worse since the Great Depression), the economy is set to rebound faster than in previous recessions on the tailwinds of pent-up consumer demand and an unprecedented amount of fiscal and monetary stimulus. Widespread agreement that economic and corporate fundamentals are headed to a more encouraging destination has helped stocks climb 40% from the March low and within 5% of the February high down just 0.5% for the year.

However, the journey to a recovery is likely to be stalled at times by occasional setbacks due to the unpredictable path of the coronavirus pandemic. Despite a fast-initial acceleration, the economy faces headwinds borne out by the dogged virus, which have led to new outbreaks in the Southern and Southwestern regions of the U.S. All told, the trek back to pre-pandemic levels of economic output is likely to be protracted and potholed, with the CBO estimating a nine-year stretch before the economy recovers completely from the pandemic.

Metals and Mining

The gold price held above US$1,800 per ounce this week. Starting the period at US$1,806, the yellow metal briefly slipped to US$1,795 before climbing back above the US$1,800 threshold. Rising COVID-19 cases in gold production hub South Africa, paired with massive upticks in the US, have been price growth catalysts as investors move toward the inflationary hedge and safe haven asset. As of Friday, there were 13.8 million COVID-19 cases globally and 591,000 deaths worldwide related to the virus. Moving as high as US$1,813 on Wednesday, gold has now added more than 20 percent to its value since falling to US$1,498 in March. It is on its way to a sixth week of gains. As the long-term impacts of the pandemic begin to emerge, market watchers are forecasting more stimulus and bailouts, which will ultimately bolster the case for gold. Silver has also been on a steady upward trajectory since mid-June, holding above US$19 per ounce. Now approaching four-year highs, the white metal is also poised to benefit from the mounting financial uncertainty related to COVID-19. As silver and gold moved higher, platinum was challenged and fell lower. Starting the trading week at US$839 per ounce, the metal trended down to a low of US$812. Palladium sat in the US$1,900 per ounce range, surging to US$1,993 on Monday. The metal dropped to US$1,885 hours later before ticking higher in the days to follow. Continued pressure on auto demand is seen weighing on palladium’s ability to reach its early March level of around US$2,400.

As the precious metals held steady, base metals faced headwinds, ending the week lower. Concern that a second wave of COVID-19 will lead to new lockdowns prevented the space from locking in gains. Copper had fallen 2.4 percent by Thursday to reach US$6,385 per tonne, down from the US$6,545 level seen on Monday. Despite that poor showing, the red metal has been a top performer in the base metals sector this year, growing 6 percent on the London Metal Exchange year-to-date. Zinc also started the session at its high, slipping lower over the week. Delayed concentrate shipments this year are expected to put the metal in surplus in 2021. Shedding 1.7 percent from its value, nickel spent the early part of the week climbing higher. Reaching US$13,512 per tonne on Wednesday, the metal slipped 1.9 percent Friday. Despite the fall late in the week, nickel’s H1 performance was surprisingly positive. Nickel’s resilience has prompted Fastmarkets analysts to slightly increase their outlook. Supply chain interruptions in the first half of the year and concerns about future lockdowns have benefited lead prices broadly, despite the metal trending lower this session. Holding in the US$1,800 per tonne range, the metal is now within range of its January highs.

Energy and Oil

The big oil market news of the week was the easing of cuts from OPEC+. The markets largely welcomed the move, especially since it included pledges by laggards to temporarily keep some supply off of the market to compensate for past under-compliance. Meanwhile, bullish EIA data also boosted sentiment. However, by the end of the week, concerns about slowing oil demand weighed on prices, keeping them stuck at around $40. OPEC+ cut really deep in June, and the cohesion was maintained as the group moved to ease production cuts from 9.7 mb/d to 7.7 mb/d in August. However, the headline number is mitigated by the fact that the so-called laggards are supposed to “compensate” for overproducing in recent months. So, the effective production cuts may only decline to 8.1 to 8.3 mb/d in August instead of 7.7 mb/d. Analysts mostly think that there is room for OPEC+ to increase production without leading to a slide in prices. After all, demand apparently outstrips supply at the moment. Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman said the increase will be “barely felt.” Still, significant downside risk remains, largely revolving around the potential hit to demand from the coronavirus and renewed closures. U.S. gasoline demand fell 5 percent last week, the second consecutive week of declines. “Normally this two-week period would have been the peak demand period and we didn’t get it,” said John Kilduff, partner at Again Capital in New York. “The recovery has been unwinding.” Natural gas spot prices fell at most locations this week. The Henry Hub spot price fell from $1.79 per million British thermal units (MMBtu) last week to $1.71/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the August 2020 contract decreased 5¢, from $1.824/MMBtu last week to $1.778/MMBtu this week. The price of the 12-month strip averaging August 2020 through July 2021 futures contracts declined 2¢/MMBtu to $2.421/MMBtu.

World Markets

European shares rose over the week on reports of progress in the development of a coronavirus vaccine. The pan-European STOXX Europe 600 Index ended the week 1.6% higher. The major country indexes also climbed, with Germany’s Xetra DAX up 2.26%, France’s CAC 40 1.99% higher, and Italy’s FTSE MIB ahead by 3.24%. The UK’s FTSE 100 Index added 3%.

European Union (EU) leaders started a two-day summit Friday to discuss the proposed EUR 750 billion EU recovery fund, amid market hopes for a deal by the end of summer. The size of the fund, distribution criteria, and the proportion of grants to loans are the main areas of disagreement. The Netherlands, Sweden, Denmark, and Austria want to link loans to reforms designed to boost productivity and jobs. Italy and Spain, which were hit hard by the coronavirus, seek a simplified reform agenda and distribution of funds via grants.

Chinese stocks slumped in a volatile trading week amid indications of economic weakness, renewed U.S. trade tensions, and profit taking following recent gains. The large-cap CSI 300 Index fell 4.4%, its biggest weekly decline since February, while the country’s benchmark Shanghai Composite Index lost 5.0%. China’s sovereign 10-year bond yield declined by nine basis points to 3.04% on the week through Friday.

China’s economy grew a better-than-expected 3.2% in the second quarter from a year earlier, reversing a historic 6.8% contraction in the first quarter, according to preliminary data from the country’s statistics bureau. On a sequential basis, gross domestic product rebounded by a rate of 11.5% quarter on quarter, following a 10.0% drop in the first quarter. In the release accompanying the data, China’s National Bureau of Statistics warned that “we should be aware that some indicators are still in decline and the losses caused by the epidemic need to be recovered.”

The Week Ahead

The earnings season will take center stage, with about 20% of the S&P 500 companies reporting second-quarter results. Important economic data being released include existing home sales on Wednesday, the leading economic index on Thursday, and July’s preliminary Purchasing Managers’ Index on Friday.

Key Topics to Watch

- Chicago Fed national activity index

- Committee vote on Fed nominations of Judy Shelton, Christopher Waller

- Existing home sales (SAAR)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Continuing jobless claims (federal & state, NSA)

- Leading economic indicators June

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

- New home sales (SAAR)

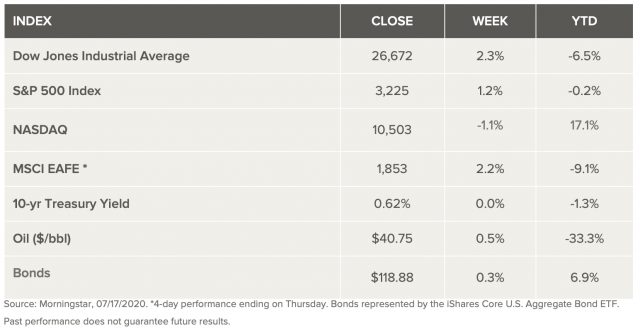

Markets Index Wrap Up