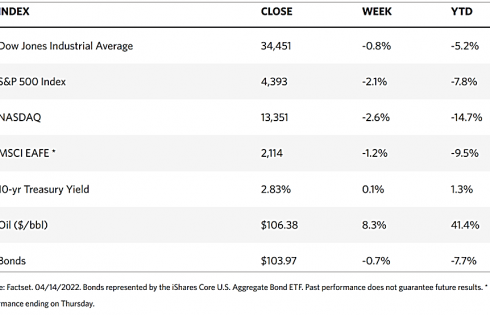

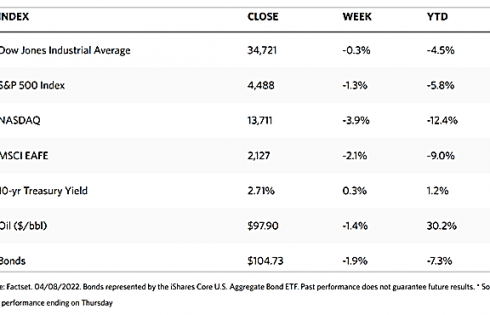

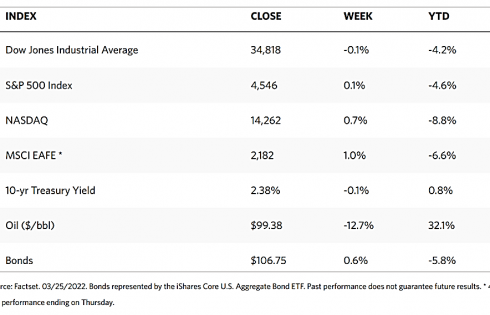

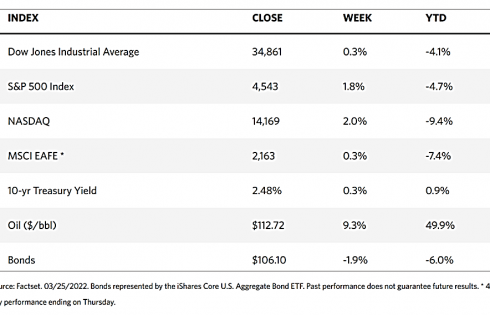

Weekly Market Review – April 16, 2022

Stock Markets

Over the holiday-shortened week, the benchmark indexes closed mixed, with the first corporate earnings reports of 2022 being released. Growth stocks continue to be outperformed by their value counterparts, although the small-caps recovered territory lost during the previous week to large-caps. Within the S&P Index financials fell behind, weighed down by JP Morgan Chase which missed the targets set for it by Wall Street. On the other hand, energy shares outperformed the market during the truncated four-day trading week. Markets were closed on Friday as the world observed Good Friday. Investors’ attention was likely drawn to their holiday plans as the markets saw below-average trading volumes for the entire week.

One factor that may be dragging investor sentiment down is the expectation that earnings growth for most of the larger counters may experience a sharp deceleration. Compared to the preceding quarters, analysts’ projections regarding earnings growth and expected profits for the S&P 500 have been adjusted downward. On average, year-on-year earnings growth figures have been adjusted to mid-single-digit percentages, which measure up to the slowest pace since late 2020. Typically, companies exceed analyst estimates by a slight margin, but this might not materialize for this year’s first quarter.

U.S. Economy

Two important inflation readings for March were announced during the week just ended, namely the U.S. consumer price index or CPI, and the producer price index or PPI. Both indexes showed highs going back decades. The CPI year-over-year reading was 8.5% which is in pace with expectations and at a 40-year high, while the core CPI, which excludes food and energy, was 6.5%, slightly short of the 6.6% forecasted by analysts. On the other hand, the PPI, which indicates the prices paid by domestic producers, registered 11.2% year-over-year, a record high. While these indicators tread highs going back decades, it is possible that early signals that inflation is reaching its peak in the coming weeks. For one, the upward pressure on energy and commodity prices that have largely driven inflation appears to be lessening even though the Ukrainian crisis is still ongoing. Noticeably, the average price of WTI crude oil price in April so far appears to have settled at $99 although the same was $108 in March.

It appears that headline inflation may further moderate in the weeks or months to come, but the other key component of inflation, core inflation, progresses more slowly. The shelter component of inflation, in particular, accounts for approximately a third of the CPI basket. Currently, this component remains stubbornly high since rents and home prices have increased in the U.S. While demand for housing remains steady, housing supply continues to remain low. As mortgage rates rise, however, demand may soften to provide some reprieve in shelter pricing. It may take some time, though, for this effect to become evident in inflation rate figures.

Metals and Mining

Prices showed some recovery during a holiday week. The gold-to-silver ratio has returned to conservative territory while platinum has retraced back closer to the psychological $1000/oz level from its recent lows of $951.50/oz. Gold ended the week at $1,978.25 per troy ounce, up by 1.58% from the previous week’s $1,947.54. Silver also gained by 3.15%, from the earlier $24.77 to the recent close at $25.55 per troy ounce. Platinum settled at $992.89 per troy ounce at week’s end, up by 1.40% from the prior week’s close at $979.16. Palladium lost ground from $2,431.46 to $2,372.95 per troy ounce, down by 2.41%. For the three-month prices of basic metals, closing prices were mixed. Copper moved largely sideways from $10,323.50 to $10,315.00 per metric tonne, shaved by 0.08%. Zinc, which previously closed at $4,254.50, this week ended at $4,412.00 per metric tonne for a gain of 3.70%. Aluminum lost 2.64%, from the previous close of $3,374.50 to this week’s $3,285.50 per metric tonne. Tin began at $43,710.00 and closed at $43,043.00 per metric tonne, down by 1.53%.

Energy and Oil

The rise of COVID cases in China caused an unexpected return to pandemic lockdowns, triggering a large-scale oil demand roadblock, the first in 2022. Some 45 cities succumbed to some form of mobility curtailment, affecting 40% of the country’s economic output. Since the start of the pandemic in early 2020, Chinese refiners have cut refinery runs by 900,000 barrels per day in April. This is equivalent to 6% of domestic demand.

The European Union, on the other hand, continues to consider banning Russian oil imports. This has caused the Brent complex higher compared to other regional benchmarks. ICE Brent front-month futures have ended the week slightly north of $110 per barrel, In the meantime, uncertainties about the demand and supply of oil will continue to keep prices volatile.

Natural Gas

For this report week, April 6 to April 13, natural gas spot prices rose at most locations, with the Henry Hub spot price rising from $6.25 per million British thermal units (MMBtu) at the start of the week to $6.70/MMBtu at the end of the week. International natural gas spot prices decline for the week but continue at elevated levels since February 24, the date Russia invaded Ukraine. In the United States, the prices of gas increased along the Gulf Coast with increasing temperatures. In the West, prices increased with mixed weather along the coast. Prices in the Northeast were mixed during the week but remain elevated. The total supply of natural gas in the U.S. declined slightly this week while consumption went down across most sectors. U.S. LNG exports decreased by four vessels this week compared to last week.

World Markets

Equities in the European markets ascended amid improved sentiment that the European Central Bank did not adopt a more aggressive monetary policy at its weekly meeting. During the holiday-shortened trading week, the pan-European STOXX Europe 600 Index ended 1.09% higher in local currency terms. Italy’s FTSE MIB rose 2.66%, France’s CAC 40 advanced 2.11%, and Germany’s DAX Index inched up 0.62%. The UK’s FTSE 100 dipped by 0.79% on weakness among the energy stocks while the UK pound strengthened vis-à-vis the U.S. dollar. When the pound appreciates against the dollar, the stock index moves down because many of the listed companies are multinationals that earn revenues overseas, thus their earnings soften when converted to pounds. The core eurozone bond yields experienced greater volatility but ended higher in light of speculation around the ECB policy meeting. The UK and peripheral eurozone bond yields followed the direction of the core markets.

Japan’s equities markets gained during the four-day trading week. The Nikkei rose 0.69% while the broader TOPIX Index climbed 0.62%. The country was assured by Bank of Japan (BoJ) Governor Haruhiko Kuroda of the continued recovery of the national economy even in the face of surging commodity prices, although he emphasized the need for the central bank to maintain its massive monetary stimulus to support the still struggling post-pandemic recovery. The ultra-accommodative policy stance of the BoJ, when viewed in contrast to the increasingly hawkish monetary tightening adopted by the central banks of other countries, is the cause of Japan’s currency weakness. The yen is teetering around its lowest levels against the U.S. dollar in the last two decades. It ended Thursday at JPY 125.36 to the dollar from JPY 124.30 at the close of the previous week. The yield on the 10-year Japanese government bond remained unchanged at 0.23%.

The Chinese stock markets pulled back during the four-day trading week in reaction to the fresh coronavirus surge in Shanghai, further fueling concerns that supply chains are likely to be disrupted once more. The broad capitalization-weighted Shanghai Composite Index slid 0.8%, while the blue-chip CSI 300 Index which tracks the largest listed companies in Shanghai and Shenzhen declined by 0.92%. More than 27,000 coronavirus cases were reported in Shanghai on Thursday. This sets the record as the worst outbreak in the city since the Wuhan episode first came to light in 2019. Since March 28, the city’s 26 million residents have been under lockdown. China’s manufacturing sector is gripped by supply chain paralysis as more and more Chinese cities reimposed pandemic restrictions to eradicate the virus. Among the companies that suspended production are Tesla, Volkswagen, Bosch, and domestic auto manufacturers Nio and SAIC Motors. Also suspending production in eastern China are more than 30 Taiwanese companies, many of which are electronics parts manufacturers.

The Week Ahead

Important economic data expected to be released in the coming week include Housing Starts, Initial and Continuing job claims, and the Markit PMI Index for manufacturing and services.

Key Topics to Watch

- NAHB home builders’ index

- Building permits (SAAR)

- Housing starts (SAAR)

- Existing home sales (SAAR)

- Federal Reserve releases Beige Book

- Initial jobless claims

- Continuing jobless claims

- Leading economic indicators

- S&P (Markit) manufacturing PMI (flash)

- S&P (Markit services PMI (flash)

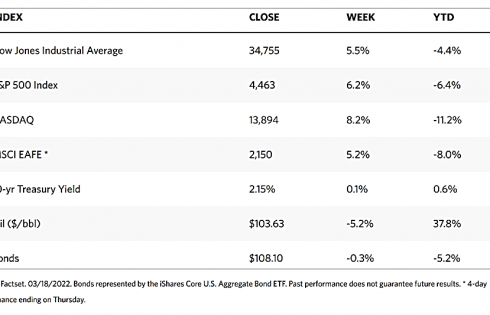

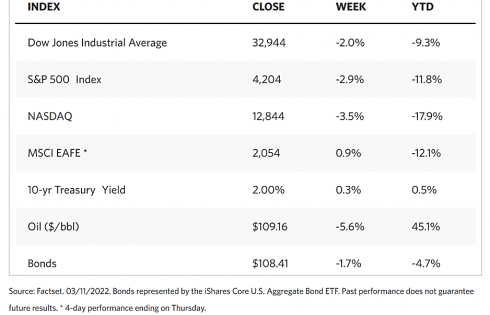

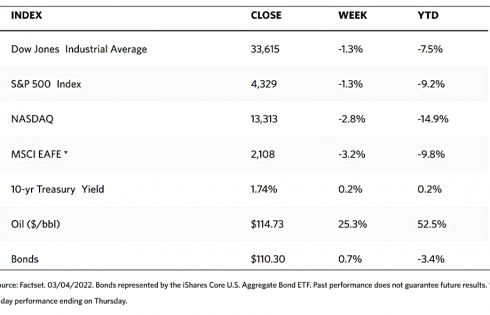

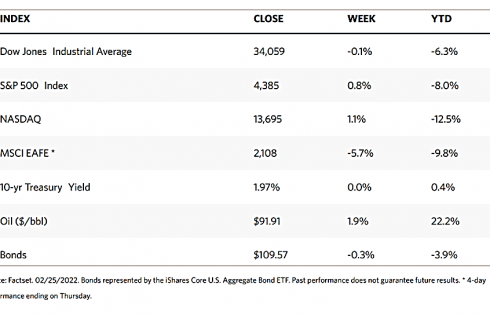

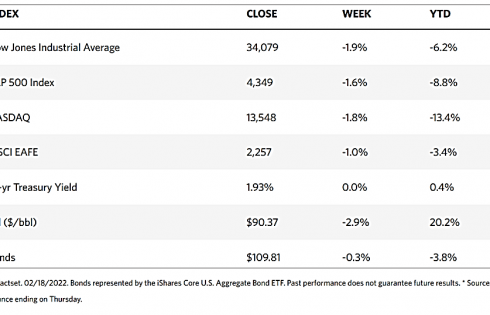

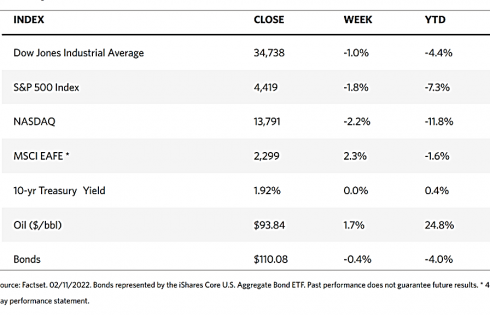

Markets Index Wrap Up