Weekly Market Review – April 3, 2021

Stock Markets

The strong first-quarter performance for equities ended with the holiday-shortened trading week. Markets were closed for trading on Friday in observance of Good Friday. On Thursday, the large-cap S&P 500 index traded above the 4,000-point resistance level for the first time in history. The S&P MidCap 400 Index likewise set a new record for intraday trading. The Nasdaq Composite index, which tracks mostly technology counters, led the advance due to gains in a broad range of hardware and semiconductor stocks and was helped by a rally in Facebook shares. Consumer confidence reached its highest level since the pandemic broke out, and there was an expansion in manufacturing activity for March, recording the fastest growth rate in the last four decades. Lagging the market were the consumer staples and materials sectors within the S&P 500. Also, for the first time since January, growth stocks significantly outperformed value shares.

U.S. Economy

Driving the stock trades in the past week were worries about contagion in the financial markets, particularly regarding hedge funds, being superseded by optimism about the upcoming infrastructure spending. Investors turned their attention to the increase in bond yields and the anticipation of accelerated economic growth. The infrastructure plan unveiled by the administration on Wednesday indicated that spending will be dramatically increased on internet and transportation infrastructure. Research and development projects will also benefit greatly from the spending plan estimated at $2.25 trillion. While experts believe that the proposed spending package is at the low end of the range of estimates, it was clarified that a second package is likely to be announced this month. The additional expenditure targets health care, child care, and education.

- The plan does not yet provide for an increase in taxes on wealthy individuals, although it does include a tax hike for the top corporate tax rate to 28% from the current 21% to offset the cost of the spending bill in the next decade and a half. The measure also provides an increase in the global minimum tax rate from 13% to 21% with a mandate for multinational firms to pay the U.S. tax rate. The proposal likewise ends federal subsidies on fossil-fuel firms.

- The administration indicated its openness regarding how the infrastructure plan is to be funded, to woo bipartisan support for the bill. The chances are low, however, that Republicans will support suggestions for a tax hike. In light of the negotiations that will follow prior to the bill being passed, significant changes may be made to the bill

- An increase in the corporate tax rate may result in a sudden drop in corporate earnings, although this is expected to be a one-time occurrence and eventually will have little impact on investors’ stock valuations. Once discounted, the tax hikes may be accompanied by higher consumer spending and therefore higher revenues for listed corporations, for as long as the economic environment remains positive.

Metals and Mining

The trading week for metals ended on Thursday, April 1, as markets were closed for the Good Friday holiday. On Thursday, gold rose by slightly more than 1% spurred mainly by a retreat in U.S. bond yields. Simultaneously, a negative U.S. jobless report showed that the number of Americans filing new claims for unemployment benefits surged above expectations. This tempered the optimistic outlook of an eventual economic recovery, further enhancing the appeal of the yellow metal as a safe-haven investment particularly in light of the administration’s $2 trillion spending plan that has sparked inflationary concerns. Spot gold prices rose 1.2% to $1,727.86 per ounce at about 1:39 p,m. EDT, while gold futures settled at $1,728.30, 0.7% up. Silver rose to $24.89 per ounce, up 2.1%. Platinum ended at $1,208.42, up by 1.8%, while palladium climbed to $2,651.79, up by 1.3%

Energy and Oil

OPEC+ decided to increase production by more than 2 mb/d in the coming months. There is a projected 350,000-bpd increase each in May and June and a 450,000 bpd in July. Simultaneously, Saudi Arabia announced that it will ease its voluntary 1 mb/d cut, implying that it will likely keep production at current levels. Rather than push prices downward on the prospect of increased supply, investors interpreted the bearish move as an indicator that demand is expected to grow. This pushed prices up as investors felt confident that the rise in demand will be met by added supply without the probability that a surplus will develop.

Despite Biden’s declaration that the new infrastructure plan will favor clean energy over fossil fuels, it appears that the plan will also call for higher demand for asphalt, which is likely to prop up demand for heavy crude blends. On the other hand, the demand for oil may likely take a hit from a new round of lockdowns in Europe and the slowdown of the vaccination roll-out. Furthermore, California is poised to add 1.7 GW of energy storage in 2021, which will be sufficient to power 13 million homes. The batteries are expected to help reduce blackouts in the summer.

Natural Gas

During the report week (March 24 to March 31), natural gas spot prices moved upward at most locations. The Henry Hub spot price climbed from $2.45 per million Brutish thermal units (MMBtu) to close the week at $2.49/MMBtu. The April 2021 contract expired Monday at the New York Mercantile Exchange (NYMEX) at $2.586/MMBtu which is $0.07/MMBtu higher than Wednesday the week before. During the same period, the May 2021 contract rose by $0.04/MMBtu to $2.608/MMBtu. The 12-month strip averaging May 20201 through April 2022 futures contract price rose to $2.782/MMBtu, an increase of $0.04/MMBtu. There is a depletion of European gas storage, which could create shocks in the global gas market later in the year.

World Markets

During the holiday-shortened trading week, European shares climbed to a near-record high on continued positive news of a speedy and robust economic recovery. The announcement of a massive U.S. infrastructure spending bill has calmed worries of the probability that lockdowns will prevail in Europe over a longer-than-expected period. The pan-European STOXX Europe 600 Index closed 2% higher for the week. France’s CAC 40 and Italy’s FTSE MIB mirrored Europe 600’s rise, and Germany’s Xetra DAX Index outperformed them by rising about 3%. The FTSE 100 Index of the UK moved sideways with little change.

Core eurozone government bond yields finished higher across the board, They initially rose in tandem with U,S, Treasuries early in anticipation of more U.S. fiscal stimulus and the progress of the vaccination roll-out. Inflation quickened in the eurozone’s 19 countries, registering at 1.3% in March from 0.9% in February. Higher prices of energy and non-processed food prices led to the increase based on official flash estimates. The European Central Bank acknowledges the likelihood of a temporary spike in inflation, after which it will then slow to below the 2% target rate in the long term.

Turning to the Asian stock markets, the Japanese equities began the week’s trading on a high note on the back of bargain hunting by investors after the market declined sharply last week. Investor sentiments also rose due to expectations of the $2.25 trillion infrastructure spending bill announced by the U.S. on Wednesday. The market retraced its gains by midweek, however, due to the release of disappointing economic results and the announcement that Japan’s new coronavirus cases surpassed 10,000 for the first time. A rebound was seen on Thursday, however, prior to the market’s close, in pace with the heavy gains in the Nasdaq index. The benchmark Nikkei 225 Stock Average ended up by 0.7% for the week while the broader TOPIX closed about 1% lower.

Ahead of the long weekend, Chinese stocks ended strong as investors were heartened by the announcement of an additional tax reduction of RMB 550 billion aimed at consolidating the economic recovery. Also among the positive news is the strong March purchasing managers’ index data and the more robust performance of the U.S. and other world markets. From Friday last week to the close on Thursday, the CSI 300 and Shanghai Composite both climbed by 1.4%. Reports of new covid cases remain small at 16 on Wednesday, ten of which were imported and six local. If China’s aim to vaccinate 40% of its population by the end of June is achieved, this may signal a strong recovery in the business and consumer services sector, particularly food and entertainment.

The Week Ahead

The important economic data to be released in the coming week include the trade balance, durable good orders, an inflation update, and the PMI composite.

Key Topics to Watch

- Markit service PMI (final)

- ISM services index

- Factory orders

- Job openings

- Trade deficit

- FOMS minutes

- Consumer credit

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Producer price index

- Wholesale inventories

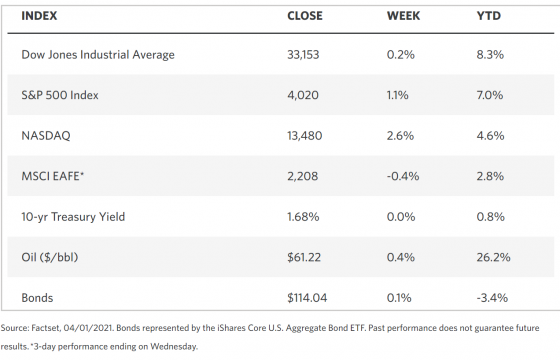

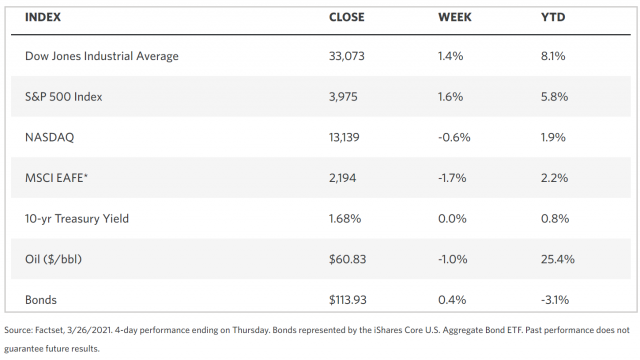

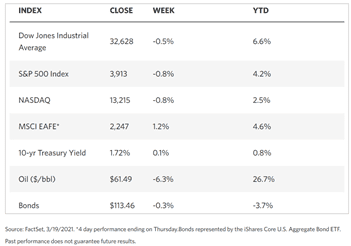

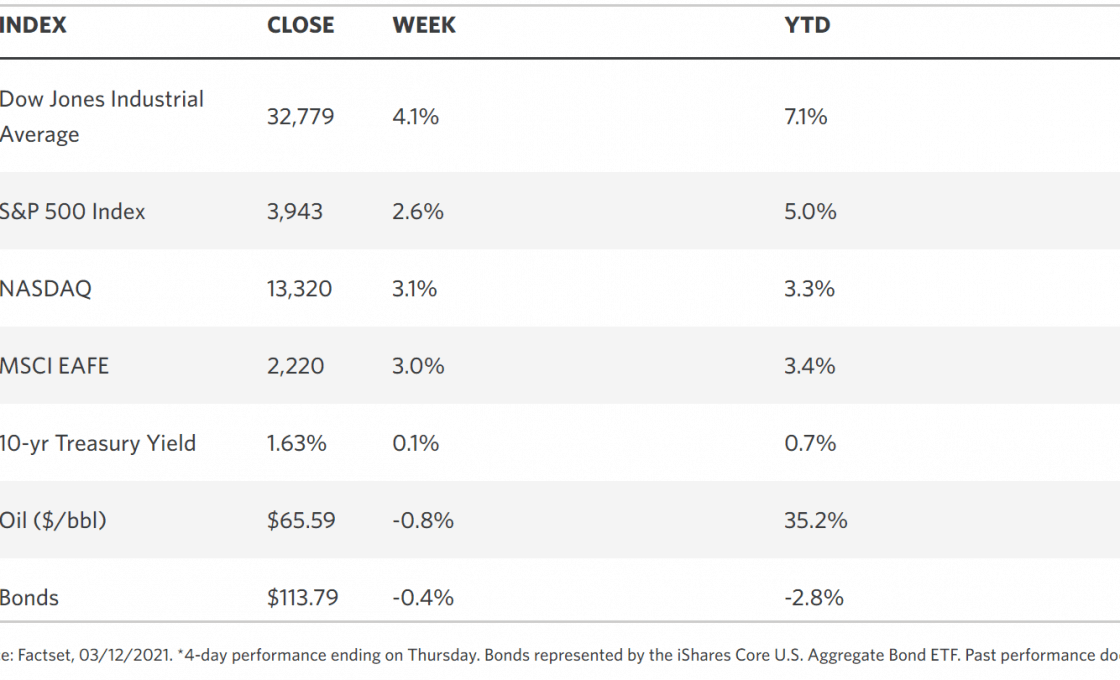

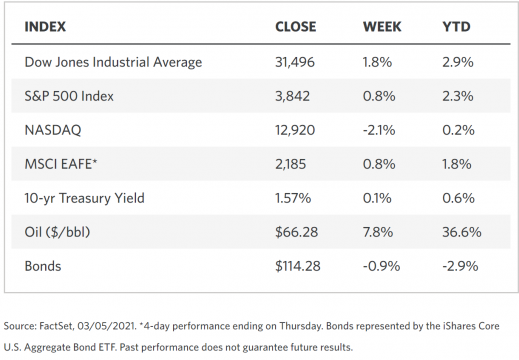

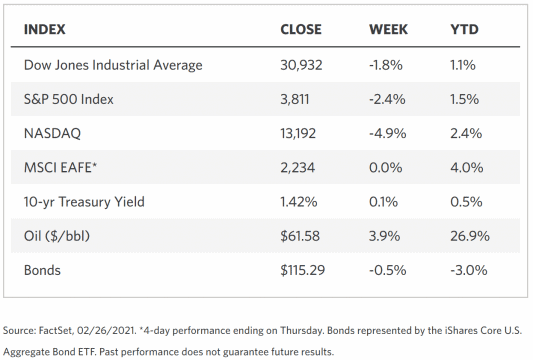

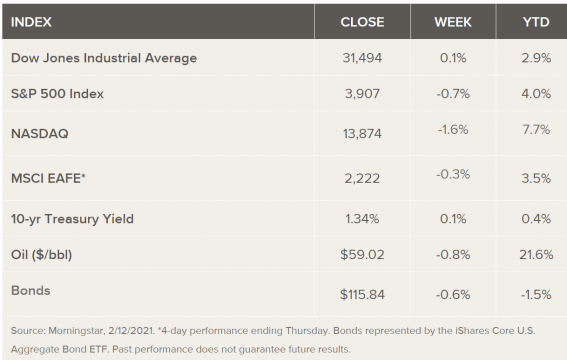

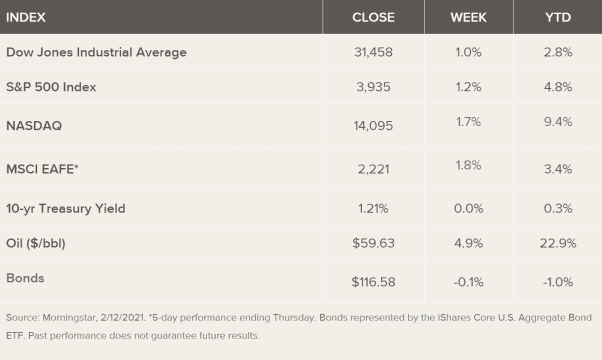

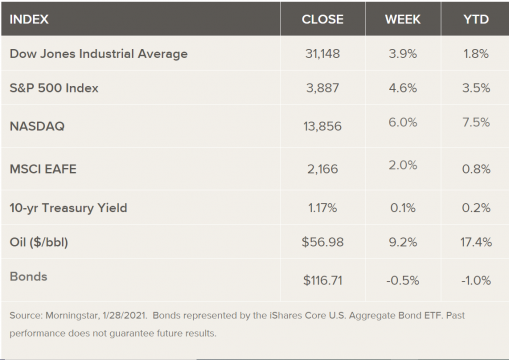

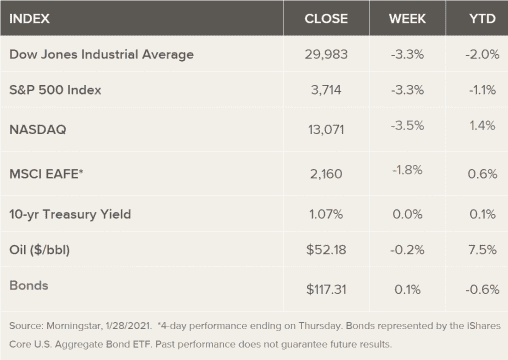

Markets Index Wrap Up