Stock Markets

Markets continued to exhibit unusual volatility over the past week but showed some resiliency due to the positive impact of optimistic economic news on otherwise dire geopolitical events. The Russian invasion of Ukraine is having a greater effect on certain areas of the market, particularly interest rates, inflation, and commodity prices. Overall, stocks ended lower for the week. The S&P 500 Index was weighed down by the technology, consumer services, financial, and consumer discretionary sectors, while other segments gained ground. Not surprisingly, the energy sector outperformed as international oil prices surged, trading at almost USD 120 per barrel on Thursday. It was only when news of a possible Iran nuclear deal emerged that oil prices corrected slightly. Although trading volumes were not pronounced, the Cboe Volatility Index (VIX) reached its highest level in more than a year.

Several developments related to the Ukraine crisis affected stock trading as the week progressed. First, the U.S., the U.K., and the European Union agreed to exclude several Russian lenders from the SWIFT (Society for Worldwide Interbank Financial Telecommunication) international banking network. Second, Western powers imposed more sanctions against Russia. The MSCI announced on Wednesday that Russian securities will be removed from its indices, even as the U.S. authorities put further restrictions on Russian imports. President Joe Biden on Thursday announced additional penalties focused on Russian oligarchs closely associated with President Vladimir Putin. Third, news on Thursday evening that Europe’s largest nuclear power station had been attacked pushed futures prices lower, although stocks appeared to stabilize when it was announced that no radiation had been released. Fourth, the ruble plunged to an all-time low despite the Russian Central Bank’s move to raise the policy rate from 9.5% to 20%. Market declines were cushioned, however, when Ukraine and Russia announced they would enter into another second round of negotiations.

U.S. Economy

In light of the recent geopolitical developments, it is expected that the economy will not remain insulated and that some negative impacts will be sustained. Commodity-price shocks and some monetary policy tightening are almost certain to threaten the continued U.S. bull market, but it is unlikely that these threats will end the continued economic expansion altogether. The economy continues to deal with adverse developments from a position of strength, and despite the greater volatility ahead, stable underlying fundamentals will continue to provide the markets more resilience. So far, in 2022, interest rates have risen in tandem with a stubbornly elevated inflation and, therefore, a series of Fed rate hikes remains certain. There has, however, been a series of interest rate pullbacks in recent days due to a flight to safe-haven assets in response to the Ukrainian crisis. The purchase of U.S. Treasury bonds has therefore increased, pushing bond prices higher and bond yields lower. Some analysts anticipate a possible Fed-induced recession, but this is not likely as the markets have already priced in much of the pessimism and the broader bull market shows continued strength.

Metals and Mining

As Russia’s war on Ukraine enters its second week, a flight to safety by investors is only to be expected. Safe-haven investments currently consist of the U.S. dollar and precious metals, gold in particular. The war is wreaking a devastating impact on the two contending nations. A humanitarian crisis is developing as more than one million Ukrainian refugees have fled to adjacent European nations. Russia is also facing an economic crisis as other countries sever ties with the aggressor nation, further crippling its businesses. Oil supply disruptions have pushed crude prices to their highest level in 14 years and intensifying global inflationary pressures. The risk uncertainty in most financial markets is driving investors to seek safe assets where they could park their wealth until the crisis is resolved. Gold and precious metals are reaping the benefits of this flight to safety, with analysts speculating that the yellow metals will soon penetrate the $2,000 per ounce level.

Gold ended the week 4.31% higher than the week previous, surging from $1,889.34 to $1,970.70 per troy ounce. Silver ended the week at $25.70 per troy ounce, up by 5.89% from the previous week’s $24.27. Platinum rose from $1,059.35 the week earlier to this week’s $1,128.07 per troy ounce for a gain of 6.49%. Palladium gained an impressive 27.14% price increase, from the initial $2,368.72 to $3,011.50 per troy ounce. The 3mo base metal prices have also registered impressive gains. Copper, which closed a week earlier at $9,873.00, ended this week at $10,674.00 per metric tonne, rising by 8.11%. Zinc realized a surge of 11.86%, starting at $3,621.50 and ending at $4,051.00 per metric tonne for this week. Aluminum ended one week ago at $3,357.50 but closed this week at $3,849.00 per metric tonne for a gain of 14.64%. Finally, tin surged from $44,470.00 to end the week at $47,540.00 per metric tonne for an increase of 6.90%.

Energy and Oil

The Russian invasion of Ukraine set off the most volatile oil trading in recent memory. Wild trading not seen in 33 years, since Saddam Hussein attacked Kuwait, dominated over the past week. The prospects that Russia’s oil supply will likely be banned in international markets have sent crude prices northward of $100 per barrel to its highest level since 2008. On Thursday, WTI touched $116 per barrel while ICE Brent came within striking distance of $120 per barrel. U.S. President Joe Biden announced a fresh round of sanctions targeted at Russia’s refining sector, banning the export of specific refining technologies to Russia and its ally Belarus and hampering efforts by these two countries to modernize their downstream assets. Rumors of an imminent nuclear deal with Iran have somewhat tempered the wild swings, but the supply uncertainties are far from resolved, and speculative trading could be expected to continue for some time. The wild price fluctuations may find further impetus from the renewed riots and force majeure developments in Libya which may trigger another civil war. These geopolitical threats may very well send oil prices above the $120 per barrel mark in the weeks to come.

Natural Gas

With the ongoing disruptions over the report week beginning February 23 and ending March 2, the spot price movements of natural gas were mixed. The Henry Hub spot price increased to $4.65 per million British thermal units (MMBtu) at the end of the week, from $4.57/MMBtu where it ended the week prior. International natural gas spot prices surged during the week. At the Title Transfer Facility (TTF) in the Netherlands, which is Europe’s most liquid natural gas spot market, the day ahead prices rose $15.34 to a weekly average of $41.06/MMBtu in light of the Russian-Ukraine hostilities that has caused uncertainty in the European natural gas markets.

In the meantime, prices on the Gulf Coast were slightly elevated due to cooler temperatures. In the Midwest, prices fell slightly with warmer temperatures, as they did in the West. In the Northeast, prices increased due to higher natural gas consumption. The U.S. natural gas supply decreased from all sources this week, coinciding with an increase in U.S. natural gas demand in every consuming sector. U.S. LNG exports increased by six vessels this week compared to the week previous.

World Markets

In Europe, shares plummeted as investors were caught in the uncertain implications of the ongoing Russian invasion into Ukraine. The pan-European STOXX Europe 600 Index lost 7% of its value in local currency terms even as the major indexes fell sharply. Italy’s FTSE MIB Index plunged by more than 12% while Germany’s DAX Index and France’s CAC 40 Index declined by more than 10%. The UK’s FTSE 100 Index lost 6.7%. Core eurozone bond yields likewise fell overall as volatile trading prevailed over the week. They contracted sharply when Russia and Ukraine failed to successfully pursue ceasefire talks and the hostilities intensified. Peripheral eurozone and UK gilt yields broadly followed the trend set by core markets. The EU, the UK, and the US agreed to impose sanctions on Russia for its intrusion into Ukraine. Russian access to their capital markets and financial systems was curtailed, and some Russian banks were excluded from the SWIFT payments messaging system. The EU shut down its airspace to Russia, tightened export controls on high-end technology, and adopted measures to freeze the financial assets of several prominent Russians among whom are Russian President Vladimir Putin and Foreign Minister Sergei Lavrov.

In Japan, equities registered losses also in reaction o the geopolitical and economic uncertainty emanating from Europe due to the Russian-Ukrainian conflict, not a minor part of which is the escalating global oil prices. The Nikkei 225 Index fell 1.85% while the broader TOPIX Index lost 1.67%. Also weighing in on investor sentiment is the possibility of aggressive monetary policy tightening by the U.S. Federal Reserve. As a consequence of the heightened risk, safe-haven demand pushed the yield on the 10-year Japanese government bond to decrease to 0.15% from 0.20% at the close of the week previous. The yen remained relatively unchanged at JPY 115.6 versus the USD despite the heightened intraweek trading volatility. Japan imposed more sanctions against Russia in coordination with the other Western nations, including freezing the assets of Russian oligarchs and blocking seven Russian banks from the SWIFT international payment system. Japan also intends to tighten exports of semiconductors and other technology products to Russia.

Also, in reaction to the Russia-Ukraine situation and negative economic pronouncements domestically, China’s markets retreated as investors’ risk appetite dampened. The Shanghai Composite Index slid 0.1% while the blue-chip CSI 300 Index lost 1.7%. The tightening sanctions against Russia and anticipation of pessimistic news during the coming weeklong annual meeting of China’s parliament beginning on Saturday diminished trading activity. Expectations are that China will announce that its official GDP target for 2022 will be within the range of 5.0% to 5.5%. This is possibly the first time since 1991 that the country’s annual economic growth target will fall short of 6%. Investors are keen to spot other signs of greater economic stimulus. Short-term interest rates may be cut further by the People’s Bank of China to stave off the likelihood of an economic slowdown. On the other hand, analysts expect a relatively unremarkable parliamentary meeting ahead of the meeting of the Communist Party in the fall. The meeting is held only twice every decade, underscoring the importance of maintaining a politically stable environment leading to the event. The yield on the 10-year Chinese government bond rose 2.861% from the prior week’s 2.806%, a reflection of tight onshore liquidity conditions. The Yuan currency remained unchanged at 6.3190 per USD.

The Week Ahead

In the coming week, important economic data expected to be released include inflation data, the Michigan Sentiment gauge, and jobless claims.

Key Topics to Watch

- Consumer credit

- NFIB small business index

- Foreign trade deficit

- Wholesale inventories (revision)

- Job openings

- Quits

- Initial jobless claims

- Continuing jobless claims

- Consumer price index

- Core CPI

- CPI (year over year)

- Core CPI (year over year)

- Real domestic nonfinancial debt (SAAR)

- Real household wealth (SAAR)

- Federal budget deficit

- UMich consumer sentiment index (preliminary)

- Five-year inflation expectations (preliminary)

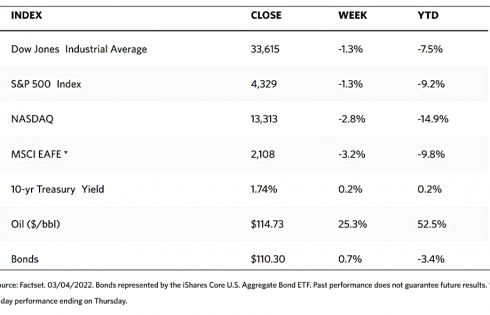

Markets Index Wrap Up