Stock Markets

Equities recovered some of the previous weeks’ losses as most of the major indexes recorded week-on-week gains. The S&P 500 Index gained back some of the value lost the week earlier with energy stocks leading the way. Crude prices reached a seven-year high on Monday in light of the decision by oil exporters not to increase their production levels by more than the modest amount previously agreed upon. In Europe meanwhile, natural gas prices reached record highs. Lagging behind other sectors with modest losses was the small real estate sector. There is a sense of anticipation as investors look forward to the unofficial start of the third-quarter earnings reporting season. Some important bank announcements are expected in the coming week. On the downside, however, investment sentiment was dampened by news that another Chinese property developer may succumb to its debt problems, simultaneous with increasing tensions between China and Taiwan.

U.S. Economy

The week started off on a pessimistic note as President Joe Biden announced that he could not guarantee that the U.S. would not default if the debt ceiling could not be raised. Worries among social media users ensued when Facebook, Instagram, and other related web services went offline due to technical problems. Furthermore, St. Louis Federal Reserve President Jim Bullard commented that he was “concerned that inflation risks are to the upside” due to the spike in oil prices. Before the week ended, however, a temporary deal to raise the debt ceiling until December was reached, alleviating the prospects of default until the year’s end.

- The rise in oil prices to its highest in seven years and the spike in natural gas prices to its 2008 level coincided with the rise in coal prices to record highs. The volatility in energy costs sent Europe and China into an energy crunch, impacting factory outputs and worsening the already long list of supply chain problems. These developments are further holding back the global economic recovery. The impending commodity inflation could not solely be blamed, however, on the energy crunch.

- Among other factors is the pent-up demand that is gradually returning as pandemic restrictions are slowly being eased. Consumption patterns away from services and towards goods are shifting worldwide as an offshoot of the COVID lockdowns, translating to higher energy consumption among the manufacturing companies. Concerning the supply side, production has been constrained by several developments including the output limits from OPEC and its allies, extreme weather events and natural disasters, the transition towards renewables and away from fossil fuels – thereby impacting energy investments – and other geopolitical developments.

- While high energy prices, acting much like a tax on the consumer, has the potential to curtail consumption and, consequently, economic growth. Current developments, however, do not appear to lead to sustained inflationary pressures since the U.S. and global economies are less reliant on oil than they did in the past. The impact on the economy, therefore, remains manageable. The worsening labor shortages may present a problem. The reported 194,000 jobs added in September was the smallest gain this year. The unemployment rate fell more than expected to 4.8%, a new post-pandemic low. This was driven by an unexpected exodus of workers from the labor force, prompting employers to boost pay in an effort to attract workers.

Metals and Mining

The gold market appears to struggle as it fails to hold gains above $1,750 per ounce, following the second month of pessimistic labor-market data. Gold briefly rallied to test the $1,780 resistance level, but quickly retracted. Investors generally remained too focused on the U.S. monetary policy in light of the current inflationary pressures. The Federal Reserve is poised to taper their monthly bond purchase by this year’s end, which continues to weigh on the price of precious metals. The potential global energy crisis looms as the prices of oil and gas rise to record highs, possibly causing inflation to be more of a problem than analysts previously estimated. This fact has uncharacteristically not converted into buying interest for gold and precious metals.

This past week, gold spot price slid from $1,760.98 per troy ounce, its close a week ago, to $1,757.13, dipping slightly by 0.22%. Silver appreciated marginally by 0.62% to close at $22.68 from a week-ago close of $22.54 per troy ounce. Platinum climbed by 5.27% from $977.11 to $1.028.59 per troy ounce. Palladium also gained from $1.921,82 to $2.079.17 per troy ounce, increasing 8.19% week-on-week. The base metals sector did better, with copper prices gaining 2.55% from $9,128 to $9,361 per metric tonne. Zinc gained 5.65%, closing the week at $3.151 from the previous week’s close at $2.982.50 per metric tonne. Aluminum rose by 3.82%, from $2.857 to $2,966 per metric tonne. Tin increased by 6.86% to close at $36,156 from $33,835 per metric tonne.

Energy and Oil

The energy and oil crunch took center stage for the week as pricing fundamentals indicating the likelihood of a prolonged period of high gas and coal prices. The rising electricity generation costs raised concerns across the Atlantic Basin and Asia. At the same time, European gas futures have surged beyond a crude oil equivalent of $200 per barrel, triggering gas-to-oil possibilities wherever they remain available. Gas-to-coal switching economics have likewise boosted coal prices as producers are compelled to produce more despite tightness in the global supply. Brent futures traded around $82.5 per barrel during Friday’s transactions as WTI neared $79 per barrel.

Natural Gas

For the sixth straight consecutive week, international natural gas prices rose together with the entire energy industry. At the Title Transfer Facility (TTF) in the Netherlands, Europe’s most liquid natural gas spot market, the average day-ahead price for the report week was $32.38 per million British thermal units (MMBtu). This is the highest weekly average recorded since September 2007, a gain of $7.05/MMBtu from the previous week’s average of $25.23/MMBtu. Last year’s corresponding weekly average (October 7, 2020) prices were $5.06/MMBtu and $4.39/MMBtu in East Asia and at TTF, respectively.

Natural gas spot prices increased during the report week from September 20 to October 6. The Henry Hub spot price ended at $5.95/MMBtu from $5.63/MMBtu at the beginning of the week. The price of the November 2021 New York Mercantile Exchange (NYMEX) contract rose by $0.20 to $5.675/MMBtu from $5.477/MMBtu week-on-week, after reaching a high of $6.312/MMBtu on Tuesday. The price for the 12-month strip averaging November 2021 through October 2022 futures contract rose by $0.16 to $4.665/MMBtu. The U.S. supply of natural gas was unchanged for the report week, but its natural gas consumption increased week-over-week due to a substantial increase in power generation. The U.S. LNG exports likewise increased over the report week.

World Markets

Shares in the European market were volatile for the week but, in the end, closed higher. The pan-European STOXX Europe 600 Index gained 0.97% with the financial sector outperforming the rest of the market. The anticipation of a higher interest-rate monetary policy and steepening yield curve may have fueled the buying interest as both would help to boost the banks’ net interest margins. Germany’s Xetra DAX Index rose by 0.33%, France’s CAC40 Index climbed 0.65%, and Italy’s FTSE MIB Index rose by 1.70%. The UK’s FTSE 100 Index gained 0.97%. The core eurozone bond yields went higher on inflationary worries as a result of the increase in the prices of natural gas. They further increased in tandem with U.S. Treasury yields after the U.S. Senate agreed to raise the U.S. debt ceiling until December to prevent a government default. The peripheral eurozone bond yields and UK gilt yields followed the core markets. The gilt yields gained upward momentum after the new Chief Economist of the Bank of England, Huw Pill, expressed concerns that the high inflation may become more persistent than earlier expected.

In Japan, responding to concerns of global inflation, oil prices, and a possible bubble burst in the Chinese property market, equities fell for the third week in succession. The Nikkei 225 Index fell 2.51% while the broader TOPIX Index likewise lost 1.23%. Investors’ concerns also drove share price declines in light of the prospective policies of the newly inaugurate Japanese Prime Minister, Fumio Kishida. The new prime minister had previously announced that he would support a capital gains tax increase, primarily perceived as a step backward from Japan’s efforts to become more shareholder-friendly. The yield on the 10-year Japanese government bond tracked U.S. Treasury yields, rising to a multi-month high of 0.08% from 0.05% week-on-week. The yen devalued against the U.S. dollar, to JPY 111.88 from JPY 111.08 the week earlier, due to the sudden increase in Treasury yields.

Following the Golden Week holidays, Chinese equities surged Friday. The CSI 300 Index rose 1.31% and the Shanghai Composite Index gained 0.67%. Investors appeared to discount the government’s regulatory crackdown, property sector uncertainties, and the nationwide energy crunch and looked instead at the optimistic economic data. Friday’s data release drew attention to the Caixin/Markit services Purchasing Managers’ Index which increased to 53.4 from August’s 46.7, the lowest level during the worst of the 2020 pandemic. The 50-point mark demarcates the monthly growth from contraction. During the Golden Week, tourism revenues plunged 5% year-on-year, indicating a weak outlook for the October retail sales. In response to China’s power shortages, Beijing ordered on Friday an immediate increase in coal output. The bid to mitigate the nationwide power crunch is expected to help alleviate production problems in industries in several regions of the Chinese economy, the second-largest in the world.

The Week Ahead

The PPI, unemployment rate, and retail sales growth are among the important economic data expected to be released in the coming week.

Key Topics to Watch

- NFIB small-business index

- Job openings

- Consumer price index

- Core CPI

- FOMC minutes

- Initial jobless claims (regular state program)

- Producer price index

- Retail sales

- Retail sales ex-autos

- Import price index

- Empire state index

- Consumer sentiment index

- Business inventories

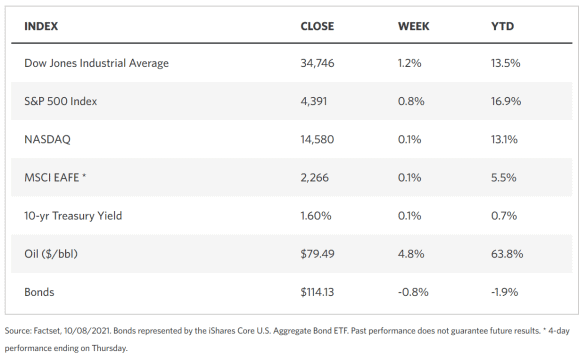

Markets Index Wrap Up