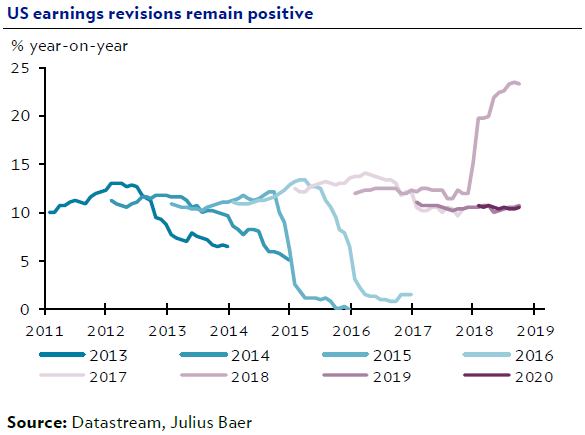

After week three of the US earnings season, around 250 S&P 500 Index companies have reported Q3 results, representing roughly 60% of total index earnings. Consensus earnings growth expectations now stand at +23% against the same period last year, up from +20% at the beginning of the earnings season. The upside revisions are broad-based, led by technology, healthcare and communication services. Real estate and utilities are the only sec-tors where consensus expectations have been revised to the downside. In contrast to market perception, management guidance has also surprised to the upside. In total, 69% (long-term average 54%) of the companies have beaten earnings expectations, and 55% (average 55%) have beaten sales expectations.

Despite strong earnings, equity markets have been sharply lower. Factors weighing on the market are mainly sentiment driven and include peak earnings concerns and the tightening monetary policy. In the view of analysts at Julius Baer, “peak earnings are not a reason for concern as long as earnings continue to grow.” Furthermore, when rates rise from low levels, this has historically supported equity valuations.