Prolific analyst Dan Ives raised his price target to $1,400, saying the demand trend in China has reversed aggressively in a bullish way

Shares of Tesla Inc. headed toward a fourth-straight gain on Friday, after Wedbush analyst Dan Ives boosted his price target by 27% to match the highest on Wall Street, saying the “EV revolution” is playing out as expected.

The stock TSLA, 0.74% climbed 1.0% in morning trading, after bouncing 8.2% over the past three days.

The stock had tumbled 17.6% from its Nov. 4 record close of $1,229.91 through Monday’s closing low of $1,013.39, as Chief Executive Elon Musk unloaded billions of dollars worth of Tesla stock after polling his Twitter followers whether he should sell 10% of his holdings, to help pay taxes.

Wedbush’s Ives reiterated the outperform rating he’s had on Tesla since April, but raised his stock price target to $1,400 from $1,100. His target is now tied with Jefferies’ Philippe Houchois for the highest of the 41 analysts surveyed by FactSet.

Ives said the “linchpin” of his bull stance on Tesla has been China, which he estimates will represent 40% of the electric vehicle (EV) market leader’s deliveries in 2022.

“While PR/safety headwinds were front and center in China earlier this year, we have seen this demand trend reverse aggressively in a bullish way for Tesla into year-end, with the company now on a ~50k monthly run-rate for China into 2022,” the prolific Ives wrote in a note to clients.

Ives, who has now published no less than six notes on Tesla over the past couple of weeks, has been very bullish on the elective vehicle (EV) industry and Tesla’s role as a “disruptive technology vendor” rather than a traditional auto vendor. He believes investors are continuing to digest the “massive transformation” coming to the auto industry around “EV revolution,” as the “green tidal wave” results in a $5 trillion market opportunity over the next decade with Tesla leading the way.

Ives said that while the semiconductor shortage that has plagued the auto industry this year remains a headwind for Tesla, he believes that is a “transitory issue.” His core focus is on Tesla Model 3 and Model Y demand, which he said is “outstripping supply by roughly 15% as of today.”

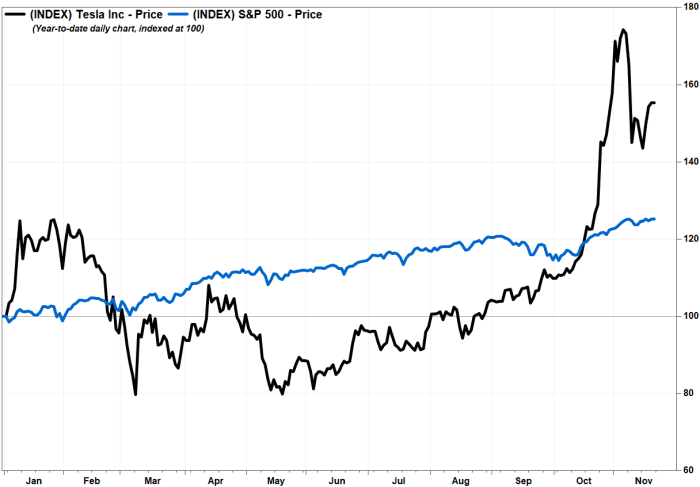

Tesla’s stock has run up 64.4% over the past three months, while the S&P 500 index SPX, 0.13% has gained 6.7%.