The news that Roche had acquired Spark for more than a 120% premium to Friday’s closing price had investors speculating the deal was a signal of yet more M&A activity in the space ahead.

Shares of gene-therapy companies surged on Monday morning, buoyed by the news of Roche Holding AG’s acquisition of Spark Therapeutics Inc.

Shares of gene-therapy company bluebird bio inc. BLUE, +14.16% rose 14%, while shares of Intella Therapeutics Inc. NTLA, +6.06% climbed 5%. UniQure N.V. QURE, +34.30% stock jumped 30%.

Shares of CRISPR Therapeutics AG CRSP, +25.20% , which announced fourth-quarter earnings on Monday morning that missed Wall Street expectations, rose 21%. Shares of Sangamo Therapeutics Inc. SGMO, +2.27% rose 0.5%.

The news that Roche RHHBY, -0.36% had acquired Spark ONCE, +120.09% for a 122% premium to Friday’s closing price had investors speculating the deal was a signal of yet more M&A activity in the space ahead. The acquisition deal comes after Novartis NVS, +0.35% agreed last year to pay $8.7 billion for gene-therapy company AveXis.

“We expect the confirmed news that Roche is acquiring Spark Therapeutics at a significant premium to have a positive impact on investor sentiment towards not only gene therapy names, but the overall sector as well,” analysts at Janney Montgomery Scott wrote in a note to investors.

Jefferies analysts also weighed in on the gene-therapy space, writing in a note: “Given advancements in manufacturing, de-risking on dosing safety and efficacy, fast development times for rare disease, and favorable regulatory environment, the space is appealing and differentiated as a growth investment.”

The iShares Nasdaq Biotechnology exchange-traded fund IBB, +2.03% gained 2% on Monday morning.

Basel-based Roche announced Monday that it had agreed to acquire Spark for $114.50 per share, sending Spark shares up 120%. Under the terms of the deal, Roche will file a tender offer to acquire all outstanding shares of Spark common stock, while Spark will file a statement with the board unanimously recommending its shareholders tender their shares to Roche.

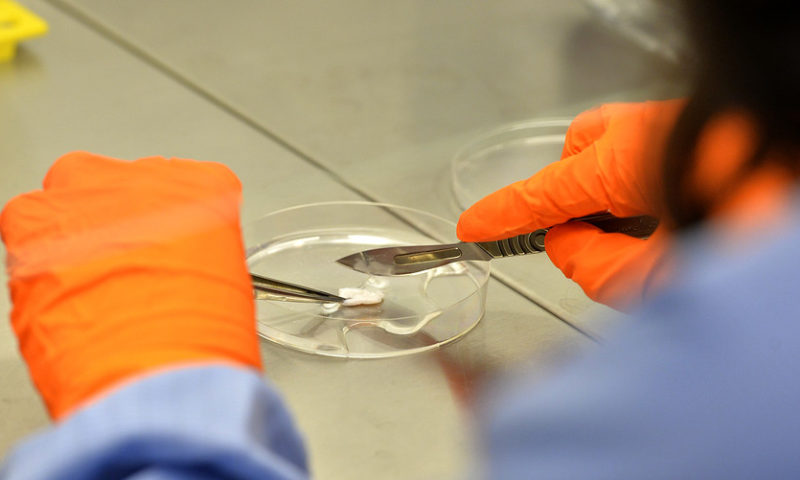

Spark’s lead drug candidate is SPK-8011, a gene therapy for the treatment of the inherited blood disorder hemophilia A. The company also has a partnership with Pfizer Inc. PFE, +0.28% to develop a treatment for hemophilia B. Spark’s drug Luxterna was approved in 2017 for the treatment of an inherited retinal disease that can cause blindness — the first gene therapy for an inherited disease to obtain U.S. Food and Drug Administration approval.