Another sharp drop in Russian ruble can potentially push bitcoin’s price higher like it did on Monday, one analyst writes.

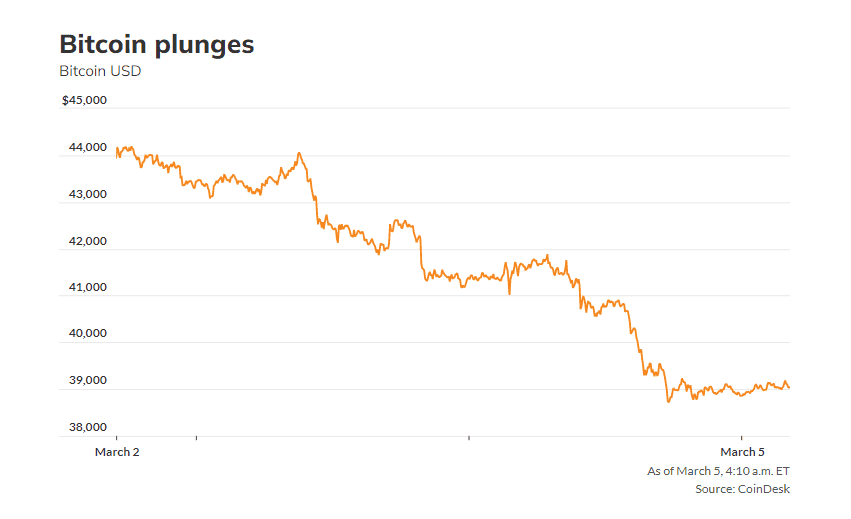

Bitcoin extended its losses on Friday, falling below $40,000 with investors concerned about the worsening war between Russia and Ukraine, after Russian troops seized Ukraine’s largest nuclear power plant.

The cryptocurrency BTCUSD, -0.96% was trading Friday afternoon New York time at around $39,844 or down 5.4% over the past 24 hours, according to CoinDesk data.

Russian troops occupied Ukraine’s largest nuclear power plant on Friday, after a fire ignited by its attack was extinguished. The U.N. and Ukrainian officials said no radiation was released, Associated Press reported.

Bitcoin prices have shown a relatively high correlation with growth stocks for the past few months. U.S. stock indexes were down sharply Friday afternoon. The Dow Jones Industrial Average DJIA, -0.53% dropped 1.1%, the S&P 500 index SPX, -0.79% lost 1.3%, while the Nasdaq Composite Index COMP, -1.66% declined about 2%.

Investors were also watching if the U.S. and its allies would levy any new sanction measures against Russia. “We should pay close attention to whether the Russian Ruble can stop the fall against other major currencies amid intensifying financial sanctions on Russia, since another drop can potentially push the price of bitcoin higher like it did on Monday,” Yuya Hasegawa, analyst at crypto exchange bitbank wrote in Friday notes.

David Duong, head of institutional research at Coinbase COIN, -6.90% wrote in Thursday notes that the crypto markets “will need to see a period of stabilization in the next two or three months before a more sustainable recovery can get under way,” as U.S. monetary policy is now entangled with geopolitical factors.

“Prior to the invasion, we thought a recovery could come sooner, but we think investors now need to have more clarity over the timing of peak inflation and the Fed hiking cycle before they may be willing to deploy more capital here,” Duong wrote.

“Sanctions on the Russian central bank have drained the global system of ~US$300 billion in reserve liquidity, which has the potential to hurt risk assets in the weeks ahead,” according to Duong.

Federal Reserve Chairman Jerome Powell on Wednesday said the central bank intends to raise its policy interest rate by a quarter-percentage point following the end of its March 15-16 meeting.