After the gutting of the Department of Health and Human Services, fears mount about the future direction of the FDA—with regulatory experts predicting delays in drug approvals and greater influence of political appointees.

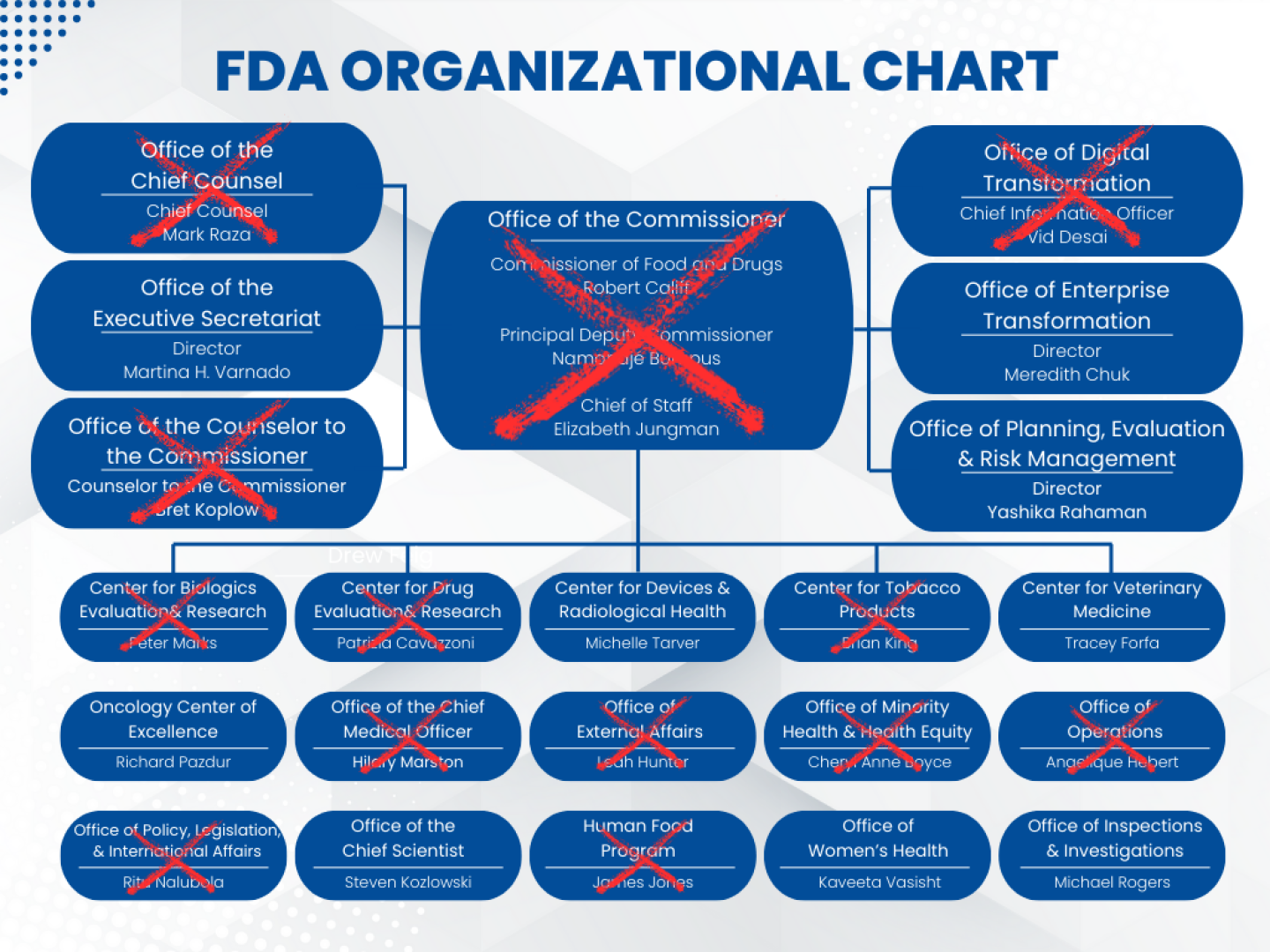

Hordes of HHS employees, including 3,500 FDA staffers and more than half of its senior leadership, are gone, prompting former FDA Commissioner Robert Califf to write on LinkedIn last week: “The FDA as we’ve known it is finished.” This, of course, begs the question: What will the future FDA look like?

“I don’t think the FDA in the future, whether you’re talking about near- or medium- or long-[term], looks very much like the FDA of the past,” Stuart Pape, food and drug chair at Polsinelli Law Firm and former associate chief counsel for foods at the FDA, told BioSpace.

As of March 2024, HHS’ mission was “to enhance the health and well-being of all Americans, by providing for effective health and human services and by fostering sound, sustained advances in the sciences underlying medicine, public health, and social services.”

Certainly, Department of Health and Human Services (HHS) Secretary Robert F. Kennedy Jr. and his team have come in with a different—seemingly more specific—mission.

“The overhaul will implement the new HHS priority of ending America’s epidemic of chronic illness by focusing on safe, wholesome food, clean water, and the elimination of environmental toxins,” according to a March 27 press release from HHS announcing the workforce reduction of 10,000 employees across the department.

The mass layoffs have been unpopular with industry leaders and observers, to say the least.

Chad Landmon, chair of Hatch-Waxman & Biologics at Polsinelli, left room for a possible upside, as the removal of long-standing personnel provides “more of an opportunity to potentially advocate new directions for FDA,” but by and large the sentiment has been hyper-critical.

“Bluntly, the most productive action would be to hire back a lot of staff,” Genevieve Kanter, an associate professor of public policy at the University of Southern California Price School of Public Policy, told BioSpace in an email.

In a LinkedIn message last week, Ovid Therapeutics CEO Jeremy Levin called the cuts a “classical ‘decapitation strike’” that “threatens to paralyze regulatory oversight, delay drug and food safety decisions, erode public trust, and expose the nation to health and security risks.”

And this week, biotech executives, patient advocates and investors wrote a letter to Health, Education, Labor, and Pensions (HELP) Committee Chair Sen. Bill Cassidy (R-LA), imploring him to take action to ensure the FDA can continue its core mission.

“Most small companies don’t engage the agency frequently enough to know yet how their drug candidates or their research timelines will be affected by recent changes at the FDA; while some problems crop up quickly, others will take months or even years to emerge,” according to the letter, which was posted by the advocacy group No Patient Left Behind (NPLB).

Review Delays and Political Pressure

Kennedy’s office has sought to reassure stakeholders—including pharma and the American public—that FDA review of new drugs will not be affected, as the mass layoffs did not include reviewers.

However, according to Kanter, it’s not that simple. “The idea that FDA reviews won’t be adversely affected after such a draconian staffing cut is like firing all the staff at a clinic and saying that patient care won’t be affected because we haven’t fired the doctors,” she said.

Already this month, the FDA has missed the April 1 PDUFA deadline to grant full approval of Novavax’s COVID-19 vaccine. Elsewhere, the NPLB letter referred to a dispute resolution process for an unnamed Massachusetts-based company that was canceled because the FDA counterpart was not sure there would be enough staff available to handle the matter. And an unnamed California biotech is turning to European regulators to run a clinical trial due to concerns about the FDA’s ability to meet timelines, per the letter.

Pape predicted that there will be “a reduction in the number of review divisions” across HHS. This structure has been tried before, he said, but “the reason they have the current structures, those [past structures] were found not to work very well.”

There could be monetary impacts for the FDA as well. “There remains an open question about the impact of [the cuts] on the user fee funded programs,” such as the Prescription Drug User Fee Act (PDUFA), from which the agency draws nearly half of its yearly budget, and which contains a caveat that Congress must fund the FDA to a level determined by a specific formula.

According to FDA insiders, the recent cuts have put the agency in “extraordinary danger of being out of compliance” with a mechanism that, if triggered, could result in the loss of those PDUFA funds, Alexander Gaffney, regulatory policy and intelligence leader at AgencyIQ, told BioSpace.

As for how the depletion of senior FDA leadership will affect the agency, Kanter pointed to the loss of institutional knowledge as a potential stumbling block going forward. “Unfortunately, there will be a lot of mistakes and reinventing the wheel.”

It could also be a wheel steered by a heavier hand, according to Landmon. “I think we’re going to see greater control of HHS over FDA as well,” he said.

Landmon noted the policy positions that have “largely been let go,” and said, “I think part of this is an effort to get greater HHS control over FDA.”

Pape agreed and added that we could see “also potentially greater control by political appointees of decisions that historically have been made on the basis of medicine and science and not politics.”

Concern about this shift was also evident in a statement made last week by recently ousted Center for Biologics Evaluation and Research (CBER) director Peter Marks to the Associated Press. When explaining his rationale for not giving Kennedy’s team editing access to reports submitted to the government’s Vaccine Adverse Event Reporting System, Marks said: “Why wouldn’t we? Because frankly we don’t trust these m——-f———. They’d write over it or erase the whole database.”

Pape also pointed to the missed Novavax PDUFA deadline as an example of “potential political involvement.” According to Politico, Sara Brenner, the FDA’s recently appointed principal deputy commissioner—and former senior policy adviser for health and biomedical innovation during the first Trump administration—directly intervened on the review of this product.

Pape said this dynamic is a departure from normal FDA operations. “That’s a whole other world.”

Loss and Opportunity

When it comes to the recent reorganization—with the exception of the 20% of HHS staff whom Kennedy said may have been incorrectly fired—Landmon doesn’t see the Secretary “walk[ing] anything back.”

Instead, he highlighted two important variables: First, will these roles be backfilled or left empty? And second, if they are filled, who will step in—especially for those senior leadership roles.

Right now, many key FDA divisions have temporary leaders. On April 2, Scott Steele, a senior CBER adviser, was named as acting director of the division. Meanwhile, Jacqueline Corrigan-Curay—a veteran of the Center for Drug Evaluation and Research—is its interim head.

Ultimately, the overall impact on the FDA is also tied to the fate of the Centers for Disease Control and Prevention (CDC) and the National Institutes of Health (NIH), Pape said, both of which have also suffered considerable cuts in the past month. The loss of senior leadership like Marks and multiple CDER drug division heads, in addition to a reduction in funding of NIH grants, serve to unravel this partnership, he added.

“You have to look at NIH and CDC along with FDA in the same breath,” he said, “because there’s a reason why, historically, the United States has been the center in the world in terms of new scientific and medical discovery and converting those discoveries into therapeutic products, and I think now what we have done is unlink those things in ways that have the potential to have profound negative effects.”

The Trump administration has been criticized for a lack of transparency and clarity regarding its actions taken throughout the HHS.

“The biggest immediate impact [of the senior FDA leadership cuts] for the public will be loss of transparency and public engagement,” Kanter said. “There’s less public comment, so less knowledge about how FDA is thinking about a regulatory issue and even whether it’s thinking about it at all.”