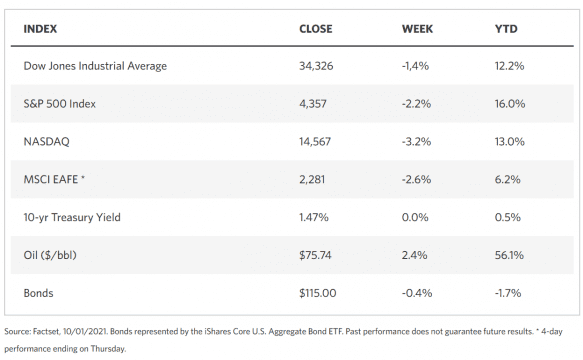

Weekly Market Review – October 2, 2021

Stock Markets

The Nasdaq Composite index and the other large-cap benchmarks have registered their most significant intra-week drop since February, despite Friday’s rally, which recovered some of the week’s losses. This week’s performance concluded what turned out to be the worst monthly declines since the pandemic began, mainly on the back of inflation worries and rising interest rate concerns. Ending the week with only moderate losses are the S&P MidCap 300 and small-cap Russell 2000 indexes. Within the S&P, declines were felt among all the sectors except for energy stocks which slight gained. Value shares fared better than growth stocks, evidenced by the underperformance of the technology-dominant Nasdaq Composite Index.

Stock performance activity is historically weakest during the month of September out of the entire year. This year was no exception, with the S&P declining 4.8%, marking only the second monthly loss for the year and performing at its worst since March 2020. While investors are wary of an upcoming Fed tapering stimulus that may usher in some volatility, it is still premature to consider the likely market pullback to be a significant change in the long-term trend. It is likely that volatility may be prolonged but nevertheless temporary, after which the long-term uptrend will resume.

U.S. Economy

The forecasted economic expansion and ensuing bull market will eventually end in a high-interest rate regime, as have all bull markets. At present, however, the interest rates are still relatively low and will continue to remain so in the near future. The developing inflationary pressures may appear to speed up the rise in interest rates, but this is not likely to happen for at least a year. It will take a protracted cycle of tightening monetary policy before rates accelerate to levels that will make borrowing costs restrictive for consumers and businessmen. Only at this point will economic growth be curtailed and a recession potentially developed, which is a distant possibility.

- Over the past week, political risks intensified over the looming debt limit, potentially leading to a government default. The stopgap spending bill that provided funding for the government until early December has eased some of the tension for the moment, but the markets remain uneasy. The alleviation of a government shutdown last week was nevertheless a most welcome development. It is a sign that both sides of the aisle are keenly aware that the debt ceiling needs to be raised. Federal debt is currently at $28 trillion, and neither political party is eager to be the proponent in increasing the burden of this debt. Therefore, it is likely that the debt ceiling will be considered as a last resort to sustain the government’s operations.

- The yield on the benchmark 10-year U.S. Treasury note surged to its highest in three months at the middle of the past week before receding once more to its previous level. With the stabilization of yields, there was improved buying activity, particularly in bonds with long-term maturities and higher-yielding segments like airports and toll roads. Bond prices recede when yields increase, possibly fueling the buying interest.

Metals and Mining

Investor apathy dominated the whole of the precious metal market, but this is likely to turn in October due to the rising uncertainty and perceived risk in the global financial markets. A developing credit crisis persists in threatening the U.S. government despite the passage of legislation to extend funding until December 3. The debt ceiling will need to be raised, a highly unpopular move that neither party wishes to be identified with in light of the coming 2022 election cycle. Natural gas prices have also ascended to peak levels, increasing inflationary pressures than most central banks will likely respond to with more restrictive policies.

Gold and silver prices remain low, and silver’s intra-week dip below $22 was seen as a buying opportunity. Week-on-week, precious metals came under pressure but gold and silver remained resilient. Gold increased 0.60% from $1,750.42 to $1,760.98 per troy ounce, and silver likewise rose 0.54% from $22.42 to $22.54 per troy ounce. Platinum and palladium slid in value; platinum lost 0.84% to close at $977.11 from $985.36 per troy ounce. Palladium fell by 2.59%, closing at $1,921.82 from the previous week’s $1,972.96 per troy ounce.

Base metals suffered heavier losses than precious metals. Copper spot lost 2.19% from $9,332.50 to $9,128.00 per metric tonne. Zinc underperformed copper with a 4.67% price decline ending at $2.982.50 from $3,128.50 per metric tonne. Aluminum ended 2.01% down, closing the week at $2,857.00 from $2,915.50 per metric tonne. Finally, tin underperformed the rest, falling 7.40% from $36,539.00 per metric tonne to $33.835.00.

Energy and Oil

Speculation is rife for the next OPEC+ meeting next Monday about the group’s decision to increase its crude production and release it into the market. Prices remain approximately $80 per barrel as Brent trades at $78 per barrel and WTI slightly lower at $74.5 per barrel. Some downside for the prices looms as Russia and Kazakhstan ramp up supply, and the first U.S. inventory stocks build-up since July. Simultaneously, extremely high gas prices pushing Asia to switch from gas to oil and the U.S dollar weakening are factors that largely offset the supply increases.

Natural Gas

The U.S. supply of natural gas rose for this report week (September 22 to September 29) due to increasing imports from Canada. The average total supply of natural gas rose by 0.5% from the previous week, while dry natural gas production decreased by 0.1% during the same period. The decline was more than offset by the 12.2% increase in average net imports from its neighbor to the north. Meanwhile, U.S. consumption declined for the second consecutive week due to reduced fuel use in the electric power sector. This week, U.S. natural gas consumption fell by 5.7%. The consumption of natural gas for power generation slowed by 13.1% due to weather temperatures being cooler than normal.

In the meantime, spot prices for liquid natural gas continue to surge as China’s demand for power meets a tight supply. LNG prices reach $34.5 per million British thermal units (MMBtu) in Asia, an all-time record high. Natural gas spot prices increased at most locations during the report week. The Henry Hub spot price climbed from $4.83/MMBtu to $5.63/MMBtu. The October 2021 NYMEX contract expired on Tuesday at $5.841/MMBtu, up by $1.04/MMBtu from the week previous. The November 2021 NYMEX contract price ascended to $5.477/MMBtu for an increase of $0.62/MMBtu. The price of the 12-month strip averaging November 2021 through October 2022 futures contracts increased by $0.34/MMBtu to $4.507/MMBtu.

World Markets

European equities plummeted due to investor fears that the economy was entering a low growth and high inflation phase. The pan-European STOXX Europe 600 Index closed the week 2.24% below last week’s close. Major markets in the region also chalked up losses for the week. Italy’s FTSE MIB Index slid 1.36%, France’s CAC 40 Index fell 1.82%, and Germany’s Xetra DAX underperformed the rest, closing lower by 2.42%. UK’s FTSE 100 Index declined by 1.36%. The core eurozone bond yields climbed in reaction to a sell-off in global developed market bonds. Expectations of a tightening of the U.S. monetary policy were fueled by Federal Reserve pronouncements hinting at forthcoming restrictions. The inflation rate in Germany was announced to reach 4.1%, the highest in 29 years. Peripheral and UK government bonds largely tracked the uptick in core bond yields.

In Japan, the stock market followed the direction of U.S. equities as the latter declined sharply during the week. The Nikkei 225 Index fell 4.89%, with its deepest drops seen occurring on Wednesday and Friday, although it still realizes year-to-date gains. The broader TOPIX Index also lost 5% week-on-week. In the currencies market, the Japanese yen lost value against a stronger-performing U.S. dollar from the beginning of the week to Thursday, regaining some of its value on Friday. By the week’s end, the yen traded at about 111.20 versus the dollar.

China’s holiday-shortened trading week ended mixed. The large-cap CSI 300 Index inched higher even as the Shanghai Composite Index moved lower from their respective closes during the previous week. Markets were closed on Friday for the National Holiday that will last one week starting October 1. Yields on Chinese government bonds remained unchanged from the past week for the broader market. In the currencies market, the renminbi (RMB) gained strength against the U.S. dollar by 0.3% to 6.447 per dollar. Investor sentiment turned optimistic on positive news surrounding the Evergrande Group, China’s heavily indebted property developer. Evergrande announced the sale of 20% of its stake in Shengjing Bank Co. to a state-owned enterprise for U.S.$1.5 billion that would effectively reduce its debt load.

The Week Ahead

Investors may look forward to important economic data such as the unemployment rate, the PMI composite, and the trade deficit expected to be released this week.

Key Topics to Watch

- Factory orders

- Trade deficit

- Markit services PMI (final)

- ISM services index

- ADP employment

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Consumer credit

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

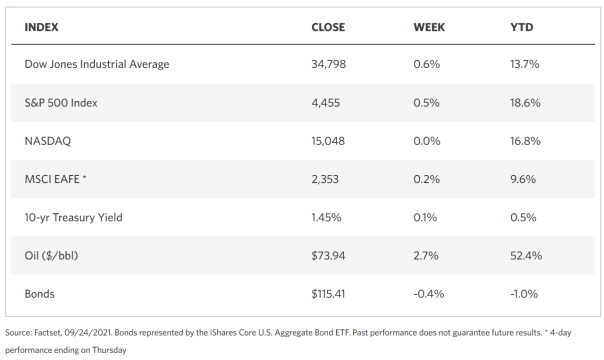

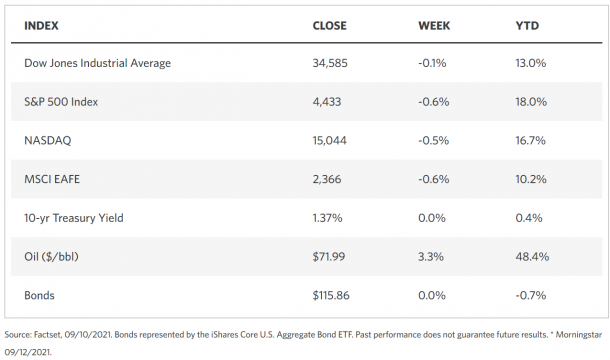

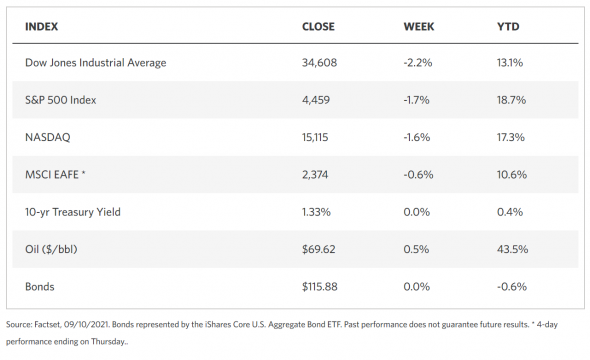

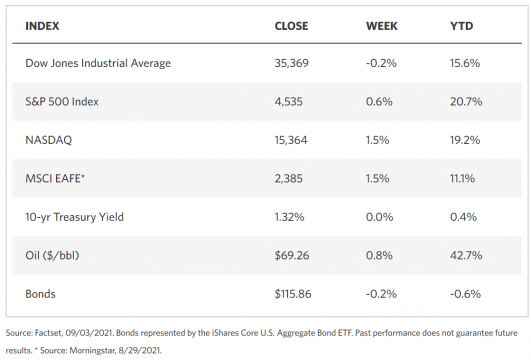

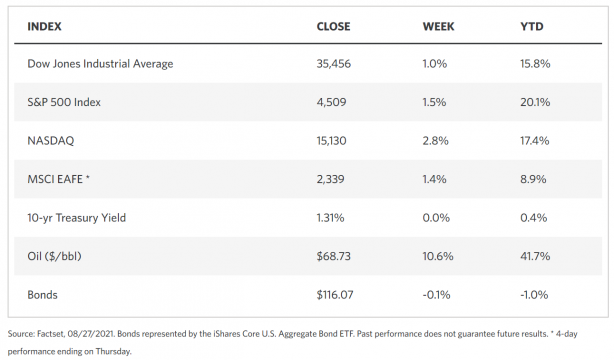

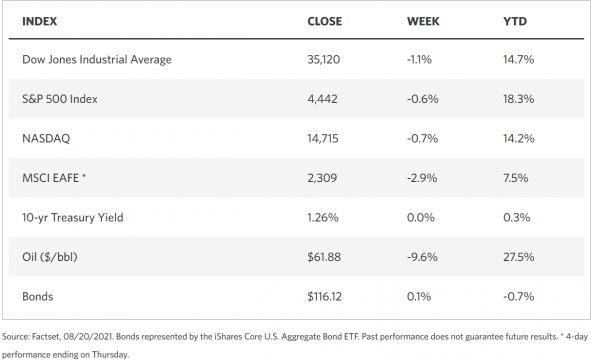

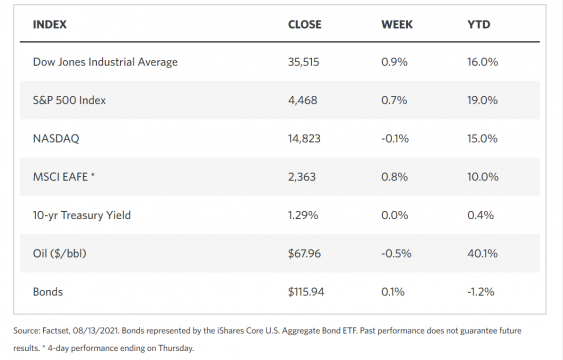

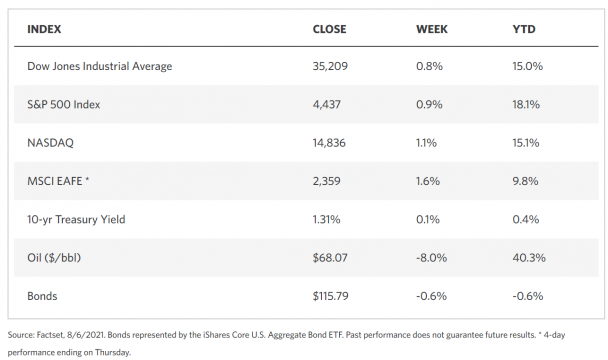

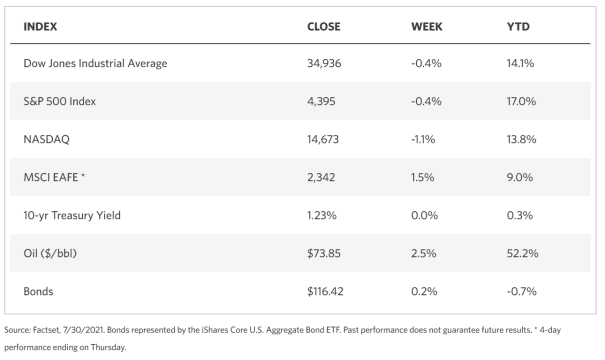

Markets Index Wrap Up