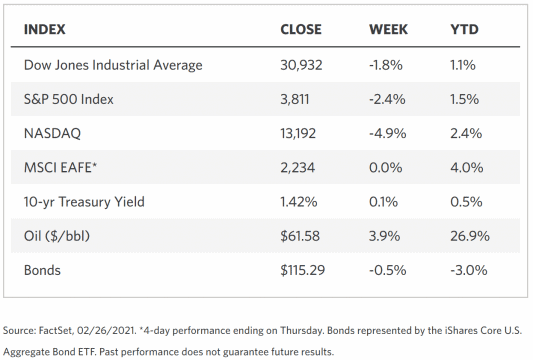

Stock Markets

In the past week, sector leadership shifted to economically sensitive sectors that have lagged due to the pandemic. The catalyst for this shift was the sharp rise in government bond yields that unsettled both equity and fixed-income markets. The acceleration in bond volatility brought it to its highest level since April 2020, affecting other asset classes. In equities, the Nasdaq pulled back 7% from its peak indicating enhanced pressure on technology shares. Growth investments charted their worst month over value investments since the beginning of the millennium. Long-term uncertainties account for the softness in high-growth technology stocks which derive much of their value further into the future. High interest rates have also begun to weigh on valuations.

Overall, last week’s pullback on domestic indexes was due to weakness in the tech sector, since the energy sector comprises 27% of the S&P 500. This does not indicate a long-term breakdown in the sector, because its dominant companies continue to report strong profitability and fast growth. The pressure on rising yields will eventually abate as the market eventually discounts the effect on asset valuation.

U.S. Economy

Projections for continued growth are firming up as the V-shaped recovery continues to hold and pent-up demand is released. The approval of the $1.9 trillion stimulus package is anticipated to coincide with the accelerated roll-out of Covid vaccines and the reopening of the economy, providing a strong boost to economic growth. As a result of these developments, 2021 GDP growth is estimated to exceed 5%, surging to its strongest level in the past 35 years and supporting a rise in interest rates. However, the economy is still recovering from a deep recession, therefore even if the economy returns to its 2019 peak level by the second half of this year, it is unlikely that it will exceed the trend set before the pandemic until sometime in 2022. For this reason, fears of an overheating economy that might reverse Fed policy are somewhat unfounded.

- Due to strong market gains in the past year, equity valuations have already discounted much of the anticipated positive news. The sudden uptick in government-bond yields edged out some of the excess returns in equities and deflated investor expectations of an enhanced risk premium. While the spread still favors equities, it is now at its lowest level in a decade.

- Valuations may likely start to normalize with continued corporate earnings recovery. With only 5% of the S&P listed companies still to report results for fourth-quarter earnings, those that have already reported have trended towards the upside and now show positive growth after year-on-year declines for three consecutive quarters. Estimates for the current year have been revised roughly 4% higher from beginning-of-year forecasts, and there appears to be further room for strong growth given the government’s aggressive spending policy.

- The income and spending report for January that was released last Friday indicate that personal income climbed 10% month-on-month, and despite the increase in consumer spending, personal savings rate also jumped to 20.5% from 13.4%. The increased savings may be regarded as pent-up consumer demand that could eventually drive growth and enhance corporate revenue, should consumer confidence catch up with personal income.

Metals and Mining

In the closing week of February, gold prices remain vulnerable to a strengthening economic outlook in response to the global vaccine distribution. Gold descended to its lowest level in six months, dropping 9.4% year-to-date and 12% since August of last year. Other precious metals saw a correction, contrary to the rising base metals prices. Worries over a possible increase in inflation due to the reopening economy would have triggered buying in gold, but contrary to expectations, Treasury bills appear to be the beneficiary of this recent trend. Gold and precious metals appear further headed for a slump if yields continue to rise. The World Gold Council (WGC) remains optimistic, however, that inflationary pressures may at some point drive prices higher consistent with historical correlations.

Gold was priced at $1,719.46 per ounce as of 11.26 a.m. Friday, while silver sold for $26.67 per ounce as of 11.50 a.m. Earlier in the week, silver appeared to test the $30 resistance level but lost 6.6% by mid-Friday. Eventually, buying interest in silver is expected to pull prices upward since a resurgence in industrial demand is forecasted in the near future. On the other hand, the price of platinum surged to a five-year high during the week although it corrected slightly by the week’s end. Prices dipped from $1,291 to $1,169 per ounce due to investors reconsidering further demand for the automotive metal. Palladium also reached a four-week high to $2,344 on Thursday. However, the metal dove to a two-month low of $2,186 per ounce during Friday’s open. By 11:59 a.m. Friday, platinum was selling at $1,172 while palladium was valued at $2,180 per ounce.

Base metals saw a surge with copper soaring to $9,614 per tonne, its highest level in a decade and 21% higher since the start of 2021. The rising copper price is driven by supply constraints and rising demand. The metal gave back some of its gains to trade at $9,201on Friday morning. Zinc recovered from its two-month low in early February to rise above $2,800 per tonne, Lead also climbed higher from $2,103 to $2,158.50 per tonne. The deep decline in output for both metals in 2020 may have been the catalyst for their recent price positivity. The world mine production of zinc declined by 5.9% year-on-year to 12.14 million tonnes, while global lead mine output fell by 5% to 4.48 million tonnes. Nickel also traded higher due to production shortfalls. On the last trading day, Zinc was priced at $2,894.50, lead at $2,158.50, and Nickel at $19.568 per tonne.

Energy and Oil

The recent rise in oil prices took a respite as consolidation set in after rent traded only slightly higher than $67 on Thursday. Talk of the possibility that prices may reach $100 has been circulating among banks, although OPEC+ still has the option of raising production levels and potentially lower prices. Few analysts, though, will likely stake a bearish position. Since the onset of volatility in the Texas energy markets, the open interest on $100 strike December 2022 has surged higher. For traders, $100 oil is still a risky proposition, but interest has risen in the likelihood of triple-digit oil prices now than there had been in previous years.

OPEC+ is expected to consider a modest increase in oil production during next month’s meeting. The most likely estimate is an increase of 500,000 bpd starting April. Coinciding with that increase is the expiration of a voluntary 1 mb/d cut by Saudi Arabia. It is also expected that US shale production will no longer be a threat to OPEC and OPEC+.

Overseas, China’s prospective shale boom has failed to take off despite the country’s rich natural resources and best efforts. Recent analysis shows that the progress made by China so far in advancing its shale revolution is likely to be obsolete by 2025. The reasons cited were failure to attract more investors and the country’s complex geology. This year, China’s oil imports are expected to slow by the second quarter due to higher prices and refinery maintenance.

The cancellation of the Keystone XL Pipeline means that more oil will be moved by rail, further exacerbating Canada’s oil=by-rail shipments which have already tripled since July. Without Keystone XL, transport of oil by rail will rise throughout the 2020s for heavy Canadian crude to be transported to Gulf Coast refiners.

Natural Gas

Natural gas spot prices dipped as temperature returned to normal or above normal across most of the lower 48 states. This brought most demand for heating and electricity down from record-setting levels. The Henry Hub spot price declined from $23.61 per million British thermal units (MMBtu) on February 17 to $2.75/MMBtu on February 24.

Regarding futures at the New York Mercantile Exchange (NYMEX), the March 2021 contract expired on February 24 at $2.854/MMBtu, down $0.37 for the week. The April 2021 contract price decreased by $0.24/MMBtu to $2.795/MMBtu. The price of the 12-month strip averaging April 2021 through March 2022 futures contracts dropped to $2.964/MMBtu, a decline of $0.18/MMBtu.

The production of natural gas fell by half in Texas during the freeze. Natural gas-supply shortages have been blamed in part by executives of energy corporations operating in Texas. In the long term, global LNG demand is expected to double by the year 2040. 75% of the forecasted growth in demand will likely be concentrated in Asia.

World Markets

The European bourses fell in sync with global markets, and volatility increased during the week on fears that rising inflation due to economic recovery may force Central Banks to preemptively adopt contractionary measures. The STOXX Europe 600 Index fell 2.38% for the week. The Major Continental stock indexes likewise slid. The UK’s FTSE 100 Index descended in response to a stronger British pound as the currency reached its highest level in nearly three years, peaking at $1.42 per pound before correcting. Investors were encouraged by the rapid rollout of COVID vaccines which raised hopes for a recovery. They also factored in a possible interest rate increase over the next two to three years. Peripheral eurozone government bond yields rose in step with U.S. Treasury yields. A plan for the gradual and irreversible lifting of lockdown restrictions was also announced by UK Prime Minister Boris Johnson, to take place within the period March 8 to June 21.

In Asian markets, Japan’s Nikkei 225 Stock Average slid by 3.5% or 1,052 points to close at 28,966.01. This benchmark remains 5.5% higher year-to-date. The broader equity indices similarly registered sharp losses, with the large-cap TOPIX Index and the TOPIX Small Index mirroring the Nikkei. Prices were generally down due to the shortened holiday trading week. The ye weakened against the dollar to close at JPY106. Chinese equities likewise lost ground, with the Shanghai Composite Index declining 5.1% while the large-cap CSI 300 Index losing 7.7%, the bourse’s worst weekly performance since October 12, 2018. Highflying counters in semiconductors, electric vehicles, and automaking succumbed to profit-taking; the same was seen for recent initial public offerings (IPOs). With the resurgence of travel and relaxation of quarantine restrictions, buying interest was focused on shares of Macau gaming companies and airline companies.

The Week Ahead

Among the important reports to be released next week are the PMI composite, jobs data, and consumer credit levels.

Key Topics to Watch

- Market manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Motor vehicle sales (SAAR)

- ADP employment report

- Markit services PMI (final)

- ISM services index

- Initial jobless claims (regular state program)

- Productivity revision

- Unit labor costs revision

- Factory orders

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Trade deficit

- Consumer credit

Markets Index Wrap Up