Weekly Market Review – February 5, 2022

Stock Markets

The equity markets continued to be volatile throughout the past week although overall gains were recorded for the second week in a row. Growth and value shares performed similarly while large-caps were outpaced by the medium and small-caps, a breakout of the pattern of value outperformance in place since November. There were 112 companies listed in the S&P 500 Index scheduled to release performance reports, making this one of the busiest weeks of the fourth-quarter earnings reporting season. Several large-capitalized stocks were included, thus driving the movement in broad benchmark indexes. Facebook’s stock price declined by 26% as a result of the announcement of a drop in its daily users and guidance for slower revenue growth. The event alone erased $232 billion off the company’s market capitalization on Thursday, a record-breaking development. On the other hand, a report of better-than-expected earnings for Amazon.com attributed to its Web services business bolstered the indexes back to higher levels on Friday. Among the sectors, energy outperformed the rest, building on their significant lead for the year. U.S. oil prices surged above $90 per barrel, mainly due to agreement among the major oil exporters to commit to a modest production increase despite the rising oil demand.

U.S. Economy

Good news on the economy accompanied last Friday’s release of the most recent monthly employment report. In the month of January, almost half a million (467,000) jobs, much higher than were expected, were added to the employment market. This is an optimistic development in the light of the omicron spread. It is a signal that the underlying labor market remains sufficiently robust to overcome the potential disruption posed by the current and future covid variants. There are signs that the worst of the coronavirus pandemic will end in January, and that public health conditions will continue to ease moving forward. Furthermore, the anticipated rate hike in March is generally accepted as a done deal and investors have discounted this development in the expectation that markets have recalibrated to a more aggressive monetary policy.

Also in January, the hospitality and leisure sectors reported a welcome growth in payrolls. These remained the last sectors to recover as a result of the lockdowns and mobility restrictions. The employment levels in this sector have still not recovered to their pre-pandemic levels, so a continued increase in hiring is expected as the economy continues to rebuild. Average hourly earnings have grown 5.7% on an annual basis, adding a positive note to the growth rate in consumer spending. There is a noticeable jump in the labor-force participation rate that has climbed to a new high post-pandemic amid the largest month-over-month increase in ten years. Posing a challenge is the continued labor shortage, although it is an optimistic sign that workers are eager to return to the labor force, possibly encouraged by the fading covid concerns and the lure of higher wages. Total employment is reported to be 1.7 million below the pre-pandemic level and is clearly on the road to better days ahead.

Metals and Mining

The gold market is presently at a standstill and failing to advance, but at least it maintains its level at $1,800 per ounce. Where it goes from here is uncertain. There are two equal but opposing forces impacting precious metals at present. The first is the escalating inflation which is the highest it has been in years. The second is the expectation that the Federal Reserve will adopt aggressive measures to cool down the overheating economy caused by the rising consumer prices. The workings of these two forces are keeping gold prices on hold. Investor surveys point to the likelihood that gold prices will remain stable at the current level, according to the London Bullion Market Association.

In the past week, spot gold price rose 0.93%, closing the previous week at $1,791.53 and this week at $1,808.28 per troy ounce. Silver began this week at the previous week’s close of $22.47 and ended Friday at $22.52 for a marginal rise of 0.22%. For platinum, the earlier week’s close at $1,013.50 ascended to $1,028.19 by week’s end, for a gain of 1.45%. Among the precious metals, palladium lost 3.57% of its value during the week, beginning at $2,378.88 and ending at $2,294.06 per troy ounce.

For the base metals, copper rose from $9,507.50 per metric tonne to close at $9,841.50, gaining 3.51% for the week. Zinc closed the previous week at $3,609.50 and this week at $3,612.50 per metric tonne for a sideways gain of 0.08%. Aluminum began at $3,082.50 and ended the week at $3,074.00 per metric tonne for a marginal loss of -0.28%. Lastly, tin commenced at the earlier week’s close of $41,684.00 and ended at this week’s close at $43,021.00 for an increase of 3.21%.

Energy and Oil

A severe winter storm that is moving across the U.S. has added another risk factor to the oil market. The storm has reached the Permian Basin and sparked concerns that potential supply disruptions may occur in the largest American shale source. Additionally, the OPEC+ commitments in its production increases into March 2022 have remained unchanged, signifying the inability or unwillingness of the group to meet rising demand. The Russian-Ukraine geopolitics add another dimension to the situation, prompting strong speculations that the $100 per barrel mark will soon be breached. Oil prices have been rising, bringing Friday’s Brent trading to $93 per barrel and the US benchmark WTI trending above $92 per barrel. In a 16-minute meeting, the OPEC+ signified that it would extend its 400,000 barrel per day increases into March 2022. The move ignores talks about continuous underperformance of production targets and depleting spare capacity.

Natural Gas

At most locations for the report week January 26 to February 2, natural gas sport prices rose. The Henry Hub spot price increased from $4.37 per million British thermal units at the beginning of the week to $6.44/mmBtu by the week’s end. International natural gas prices were mixed during the week. Along the Gulf Coast, prices rose ahead of forecasts of freezing temperatures. In the Midwest, prices increased in line with those at the Henry Hub, while in the West, prices climbed in response to cooler temperatures increased consumption, and reduced supply. The U.S. natural gas supply was relatively flat this week, although U.S. natural gas consumption fell across all sectors. U.S. LNG exports fell by three vessels this week compared to last week’s exports.

World Markets

European equities fell after Christine Lagarde, President of the European Central Bank (ECB) issued comments that implied the likelihood of a possible rate increase this year. The pan-European STOXX Europe 600 Index closed the week down 0.73% while major indexes likewise slid lower. Although Italy’s FTSE MIB Index posted modest gains, France’s CAC 40 Index descended 0.21% and Germany’s Xetra DAX Index dropped 1.43%. The UK’s FTSE 100 Index saw a 0.67% gain. The core eurozone bond yields climbed on worries about inflationary pressures and the potential of a change in the accommodative policies of the ECB. Peripheral eurozone bond yields aligned with the core yields. Gilt yields moved higher on the back of an increase in interest rates by the Bank of England (BoE), the second such increase since December.

In Japan, the stock markets rose for the week on optimism that the government could present a policy by next week on potentially easing the ban on the entry of foreign nonresidents into the country. The Nikkei 225 Index rose 2.70% while the broader TOPIX Index gained 2.86%. The rally occurred late in the week, led by stocks that were likely to benefit from an economic reopening as a result of the lifting of the ban. The report failed, however, to detail what measures will be eased. With regards to monetary policy, the Bank of Japan (BoJ) reassured the markets that there were no plans to modify the current accommodative policy, boosting broad sentiments. Despite consumer prices remaining low, other major central banks are under inflationary pressure to raise interest rates and tighten monetary policy. This is fueling speculation that the BoJ will eventually be forced to follow suit. The yield on the 10-year Japanese government bond rose to 0.20% this week from 0.17% at the end of the preceding week. This is the highest level since the BoJ began its negative interest rate policy in January 2016. The exchange rate of the yen to the U.S. dollar strengthened to JPY 114.91 from the previous week’s JPY 115.26.

China’s financial markets remained close for the weeklong Lunar New Year celebration. In economic news, a moderation in factory production and services was indicated by government purchasing managers’ surveys for January. There was a decline in the official manufacturing Purchasing Managers’ Index (PMI) from December’s 50.3 reading to 50.1, while the nonmanufacturing rating, which measures construction and services sectors activity, dipped from 52.7 to 51.1. Expansion is separated from contraction at the 50.0 mark. Smaller private firms struggled last month in China’s manufacturing sector, as evidenced by the Caixin/Markit Manufacturing PMI for January which fell to its lowest level since February 2020. In addition, there was more evidence of falling sales in China’s property sector, which continues to suffer from its cash crunch that began last year.

The Week Ahead

For the week ahead, expect consumer credit, inflation, and jobless claims to be among the important economic data to be released.

Key Topics to Watch

- Consumer credit

- NFIB small-business index

- International trade

- Real household debt (year-over-year)

- Wholesale inventories (revision)

- Gov Michelle Bowman speaks

- Cleveland Fed President Loretta Mester speaks

- Initial jobless claims

- Continuing jobless claims

- Consumer price index (month-to-month)

- Core CPI (month-to-month)

- Consumer price index (year-to-year)

- Core CPI (year-to-year)

- Federal budget

- Richmond Fed President Tom Barkin speaks

- UMich consumer sentiment index (preliminary)

- UMich 5-year-inflation expectations (preliminary)

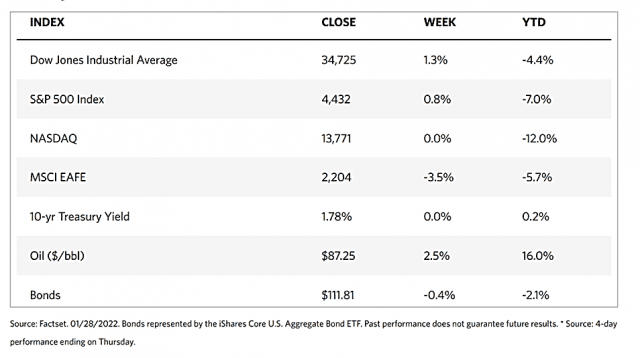

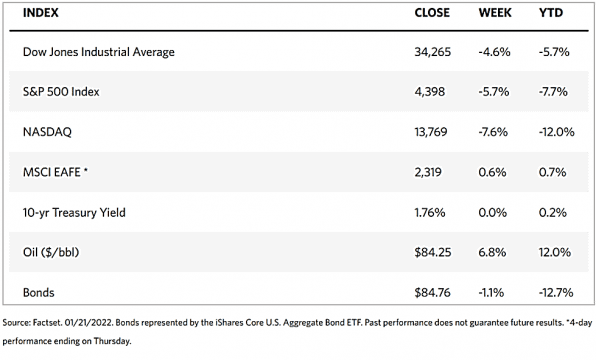

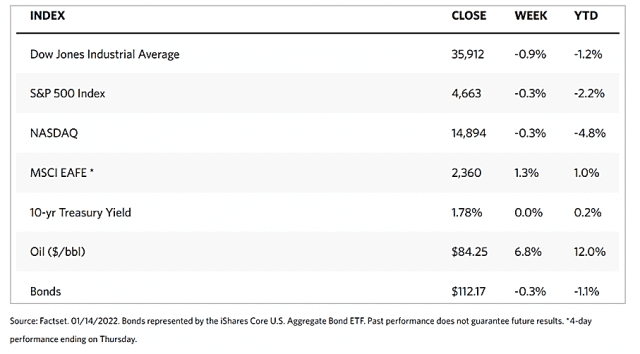

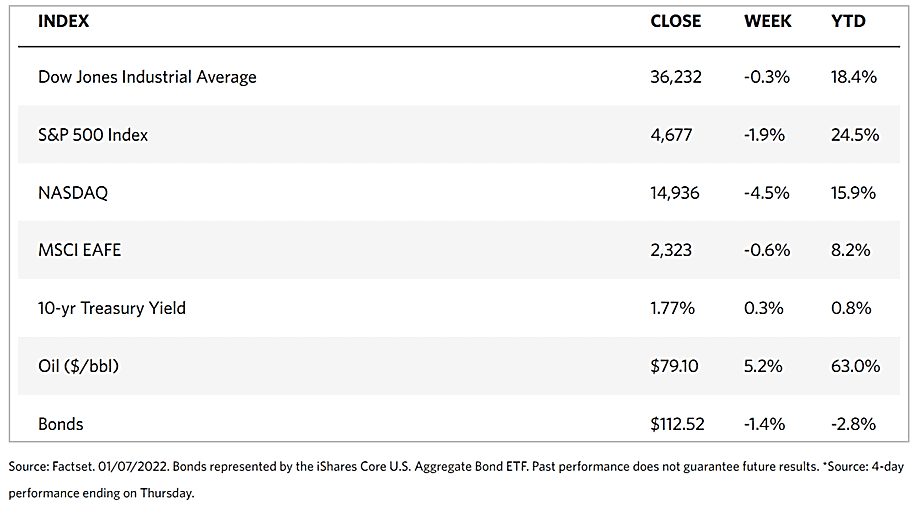

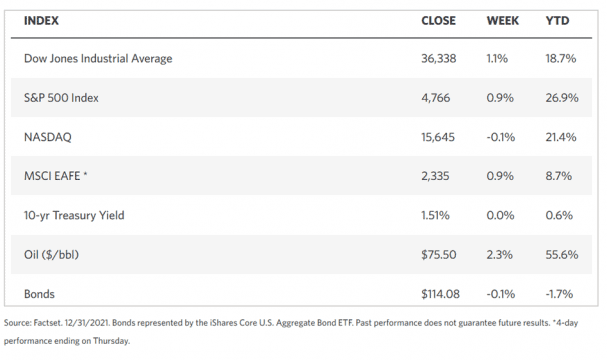

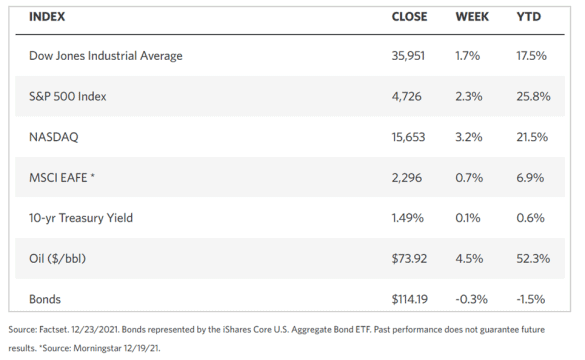

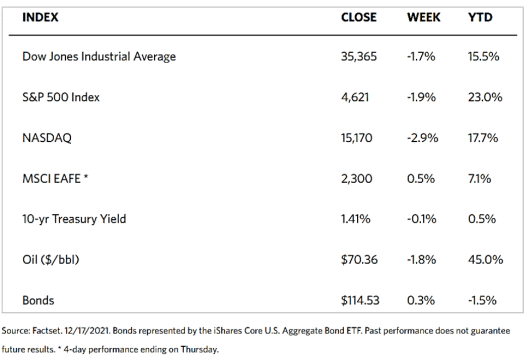

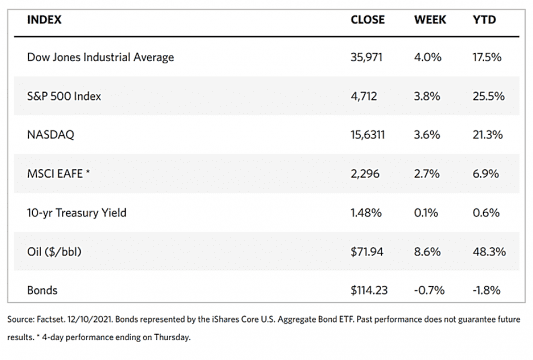

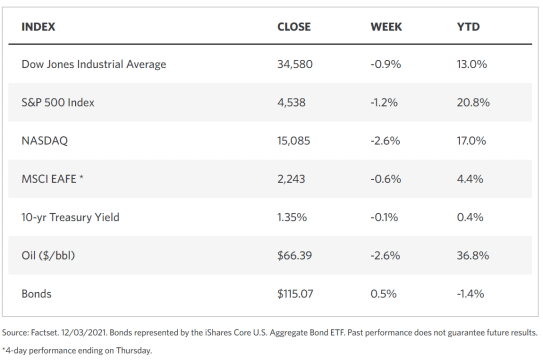

Markets Index Wrap Up