Stock Markets

The large-cap benchmarks recorded gains for the week on the back of a late-week rally, and only after the major indexes corrected by more than 10% from the recent peaks. Lagging behind the large caps is the small-cap Russell 2000 Index which closed the week down by almost 20% from its November high, barely avoiding a bear-market scenario. Volatility was at its highest since the introduction of the pandemic, as measured by the Cboe Volatility Index (VIX). There was a strong upward surge among energy stocks due to international oil prices rallying above $90 per barrel. Oil supply worries are impacted in part by the amassing of Russian troops at the border with Ukraine.

Also driving volatility are investor worries that the Federal Reserve may be compelled to raise short-term interest rates expeditiously to try to control a fast-rising inflation rate. Wall Street analysts are apparently focused on plans by the Fed to trim its balance sheet by selling off its holdings of Treasuries and agency mortgage-backed securities, more details of which Powell promised to disclose after the March meeting of the Federal Open Market Committee (FOMC). Currently, the Fed’s balance sheet amounts to $8.9 trillion which is larger than necessary, and therefore must be substantially reduced.

U.S. Economy

In March, the Fed is likely to raise rates for the first time since 2018 together with putting a halt to its balance sheet expansion. Overall, the economy shows signs of robustness with no recession foreseen. In the economic cycle, we are still in the midst of the current economic expansion. Economic growth will continue to remain above trend levels and corporate balance sheets are well-positioned to support an earnings growth rate in the range of 9% for the year. Credit markets, the traditional indicators of economic distress, are calm and credit spreads remain at low pre-pandemic levels. There is no sign of any likely corporate defaults, signaling a sound economic foundation despite the expected restrictive monetary policies and Fed balance-sheet tightening in the future. The underlying economic foundation is not likely to be derailed by any credit crunch, and the economic cycle may be expected to proceed through 2023, barring unforeseen systemic shocks.

Metals and Mining

If the past week were any indication, a volatile metals market lies in the future for investors. As the Federal Reserve adopted a hawkish stance on Wednesday, gold reacted to a possible rate hike in March. It should be remembered that a rise in interest casts a shadow over metals due to the expected opportunity cost of holding an asset that produces no yields. This early, the markets are pricing in a five-rate-hike for the year and a possible 50-basis point increase in March alone. On these speculations, gold fell roughly 3% since the Fed announcement. But analysts are wary of ruling off precious metals, because gold is traditionally a hedge against inflation, and presently the inflation rate is running at its highest in 40 years. This may provide a reason for profitable positioning in metals, as attested to by the World Gold Council which reported on Thursday that although investor demand for gold appeared dismal, demand still grew by 10% over the past year.

Last week, gold fell week-on-week by 2.39%, from the earlier week’s close at $1,835.38 to last Friday’s $1,791.53 per troy ounce. Silver also lost ground for the week, starting at $24.30 and ending at $22.47 for a decline of 7.53%. Platinum began at $1,033.49 and closed the week at $1,013.50 per troy ounce, down by 1.93%. Palladium bucked the trend for precious metals, ending this week at $2,378.88 and the previous week at $2,111.19 per troy ounce for a gain of 12.68%. Among the base metals, copper lost 4.36% of its value, from the previous week’s close at $9,941.00 to this week’s close at $9,507.50 per metric tonne. Zinc ended the previous week at $3,635.00 and this week at $3,609.50 per metric tonne for a -0.70% dip. Aluminum began the week at $3,040.50 and ended at $3,082.50 per metric tonne for a gain of 1.38%. Lastly, tin ended the week previous at $43,955.00 and this past week at $41,684.00 per metric tonne for a drop of 5.17%.

Energy and Oil

This week, Brent prices surged above $90 per barrel for the first time in the past seven years. The rally was pushed by several bullish factors, foremost among which is the low level of inventories. The low product reserve levels are the primary reason most banks forecast a target of $100 per barrel in the near term. This sentiment is spurred by the fact that US commercial stocks descended for the third time in a row. Next to inventories, a secondary reason is the possible escalation of the Russia-Ukraine confrontation which holds the attention of much of Europe. The scenario fuels speculation of the possible embargo of Russian oil from the market, thus hiking oil prices with another geopolitical premium. Additionally, the simultaneous scarcity of supply remains a concern in the global market, a concern that is confirmed by steep backwardation (this week, the Brent six-month market structure neared $7 per barrel). There is hardly any sign that the OPEC+ will be amenable to raising its production to more than it has committed to under the terms of the agreement. All in all, the outlook for the oil markets is bullish.

Natural Gas

Spot prices of natural gas fell at most locations for the report week from January 19 to January 26. The Henry Hub spot prices dropped to $4.37 per million British (mmBtu) thermal units at the beginning of the report week, to $4.74/mmBtu by the week’s end. International natural gas prices were mixed through the report week. The prices along the Gulf Coast plunged as liquefied natural gas (LNG) set a new weekly record for accounting for more than half of the total natural gas disposition in South Louisiana. Despite colder weather, prices in the Midwest also dipped, with the Chicago Citygate price sliding $0.39 from $4.65/mmBtu a week ago to $4.26 in the report week just concluded. The total supply of natural gas in the U.S. rose during the week due to increased imports. Total U.S. natural gas consumption increased across all sectors compared to one week earlier. US LNG exports are greater by five vessels this week compared to the week before.

World Markets

Share prices in European stock exchanges fell for the fourth consecutive week due to mounting concerns about interest rate hikes as well as the growing geopolitical tensions between Russia and the West. The pan-European STOXX Europe 600 lost 1.87% over the past week, while major indexes in Italy and Germany suffered similar declines. France’s CAC 40 Index also dropped 1.45%, while the UK’s FTSE 100 Index slid 0.37%. The yields on core eurozone, peripheral eurozone, and UK bonds rose on investor speculation that inflation will continue to rise and the monetary policy will continue to tighten. Regarding coronavirus restrictions, Denmark follows the lead of the UK, Ireland, and the Netherlands in lifting all COVID measures despite infections remaining at near record-high levels across the European continent. Sweden, Norway, and Finland have announced a similar easing of restrictions in the coming weeks.

Japan’s stock markets plummeted over the week as the Nikkei 225 Index lost 2.92% of its value and the broad TOPIX Index gave up 2.61%. Driving the correction was the announcement of the U.S. Federal Reserve to continue tightening its monetary policy. High-growth technology stocks led in the decline. Further weighing on investor sentiments in the decision by Japanese authorities to extend the quasi-states of emergency to more prefectures to address the record-high spread of COVID-19 cases and the omicron variant. The yield on the 10-year Japanese government bond ascended to 0.17% from the previous week’s 0.13%, mirroring U.S. Treasury yields which rose in response to the Fed’s hawkish outlook on interest rates. The exchange rate of the yen to the U.S. dollar weakened to JPY 115.55 from the earlier week’s JPY 113.68.

In China, stocks declined ahead of the weeklong Lunar New Year holiday. Also influencing sentiment was the hawkish tone of the Fed announcement by Jerome Powell, raising anticipation for a faster monetary tightening. The Shanghai Composite Index lost 4.6% during the week’s trading, while the CSI 300 slipped 4.5% as traders factored in as many as five trade hikes in the U.S. for the year. Such a development would impact many Chinese companies’ offshore borrowing plans. The CSI 300 plunged to a 16-month low during the week and has now entered bear market territory. It has descended by more than 20% from its peak in February 2021. Also triggering the market sell-off was a slew of profit warnings by mostly property sector companies. Many China-listed companies are set to release annual results next month, and the earnings announcements have further dampened investor sentiments. Reports on economic indicators showed profits of China’s industrial firms have grown at their slowest rate in more than 18 months due to a drop in demand.

The Week Ahead

In the coming week, among the important economic data to be released are the unit labor costs, hourly earnings, job openings, and job quits.

Key Topics to Watch

- Chicago PMI

- San Francisco Fed President Mary Daly speaks

- Kansas City Fed President Esther George speaks

- Markit manufacturing PMI (final)

- ISM manufacturing index

- Job openings

- Job quits

- Construction spending

- ADP employment report

- Home ownership rate

- Initial jobless claims

- Continuing jobless claims

- Markit services PMI (final)

- ISM services index

- Factory orders

- Core capital equipment orders (revision)

- Nonfarm payrolls (month-to-month)

- Unemployment rate

- Average hourly earnings (month-to-month)

- Labor force participation rate 25-54

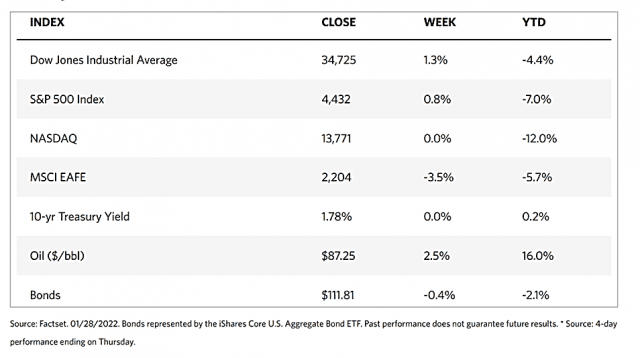

Markets Index Wrap Up