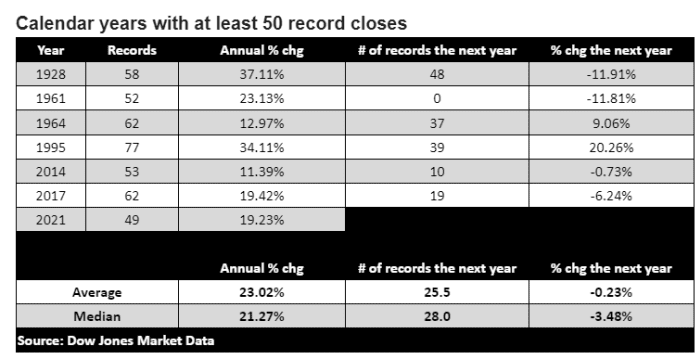

On average, the S&P 500 has delivered an annual gain of 23% in years when there were at least 50 record closes but the year afterward has been weak

The S&P 500 index has produced 50 record closing highs so far this year, amid growing questions about how much farther stocks have to rise in the rebound phase from the COVID-19 pandemic before buckling.

MarketWatch already has noted that stocks have enjoyed a lengthy period without a drawdown of at least 5% from a recent peak.

This current series of records for the broad-market index, however, may raise some questions about the market performance after such a sequence of all-time highs.

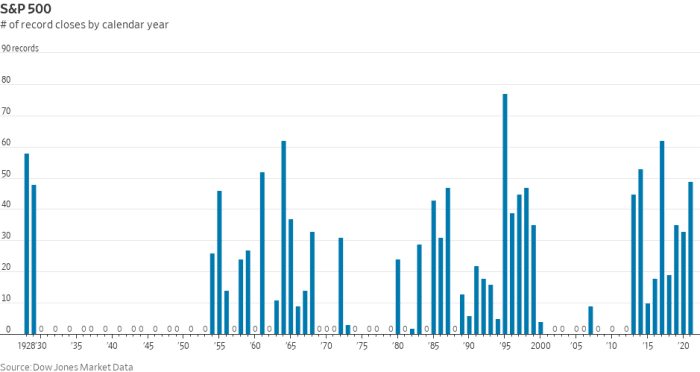

Firstly, it’s worth noting that registering 50 or more record highs for the S&P 500 SPX, -0.14% is a relatively rare occurrence. It has happened only seven times so far, including Tuesday’s, according to Dow Jones Market Data.

However, on average the S&P 500 has delivered an annual gain of 23% in years when there were at least 50 record closes, with a median return of 21.27%.

So far, the S&P 500 is on pace with a year-to-date gain of nearly 20%, as of late-morning Wednesday. The Dow Jones Industrial Average DJIA, 0.10%, meanwhile, was looking at a return of 15.6% so far in 2021, while the Nasdaq Composite Index COMP, -0.04% nearly 17%.

That said, returns for the S&P 500 in the following year after such gains haven’t been great. In fact, they have mostly edged lower, with average declines of 0.23% and a median drop of 3.48%.

To be sure, these are extremely small data sets, so not much can be gleaned about what the S&P 500 will do this year or next. Besides, past performance is no indication of future results.

On top of that, this is a pandemic period, with uncertainties abounding about how and when the economy snaps back from the full effects of COVID-19 and the delta variant of the coronavirus. Concerns about rising inflation and possible monetary policy missteps also will be major contributors to how the market performs and can’t be easily quantified.