Stock Markets

A sharp rally in stocks last week was precipitated by economic data and Federal Reserve announcements that triggered a decline in interest rates. The Dow Jones Industrial Average (DJIA) rose by 5.07% and its Total Stock Market Index by 6.05%. The S&P 500 Index surged by 5.85%, its strongest weekly gain in almost a year. The Nasdaq Stock Market Composite jumped by 6.61% as growth and technology stocks outperformed the market somewhat, although the gains were broad-based. Gains were led by the small-cap Russell 2000 Index, which registered its best weekly gain since October 2022. The NYSE Composite climbed by 5.45%. Investors’ risk perception dipped as indicated by the CBOE Volatility Index (VIX) which pulled back by 29.9%.

Signs of a slowing economy and a statement by the Fed after its policy meeting on Wednesday that was perceived as dovish sent long-term bond yields into a sharp dive. After seven weeks of consecutive hikes in mortgage rates, the 30-year fixed-rate mortgage fell to an average of 7.76% in the week that ended on November 2, down from 7.79^% in the previous week. One year ago, this rate was 6.95%. This development came one day after the Fed said that it would leave its benchmark lending rate at status quo, its highest level in 22 years, as expected. While the Fed rates remained the same, it struck a more balanced tone regarding its upcoming rate decisions outlook that lends credence to the speculation that the policy-making body has completed its rate-hiking cycle.

U.S. Economy

The switch to a dovish outlook by the Fed suggested that the recent rise in long-term Treasury yields had achieved at least some of their intended tightening in financial conditions. The recent upside surprises in economic data also appeared to have satisfied the Fed which tweaked its description of the pace of economic growth from “solid” to “strong.” The closely watched payrolls report released on Friday appears to confirm that the labor market was cooling, which the market hopes to be soon followed by wage pressures. Some 150,000 jobs were added by employers in October, a number which was below expectations and the lowest level since June. September’s strong gain was also revised lower, and the unemployment rate rose to its highest level since January 2022 at 3.9%. \

Average hourly earnings ascended by 0.2%, which was short of expectations, but September’s gain in this regard was adjusted upwards to 0.3%. The 12-month gain fell to its lowest level in over two years at 4.1%, but it remained above the approximately 3% level that policymakers considered compatible with their overall inflation target of 2%. On Monday, the Labor Department released its quarterly employment cost Index which surprised modestly on the upside, reporting an annual increase of 4.3% in wages and benefits. In positive news for both investors and workers, the preliminary estimates of productivity growth in the third quarter were better than expected, indicating a decline in unit labor costs. Productivity gained by 4.7%, its best showing since businesses began to reopen in the third quarter of 2020 during the early stages of the pandemic.

Metals and Mining

While hostilities in the Middle East appear to be generally confined to the Gaza Strip as Israel wages its offensive against Hamas, the static geopolitical environment seems to take its toll on gold the prices of which are stuck at $2,000 per ounce. October’s monthly close was a record high for gold prices, although some investors appear to be somewhat frustrated that this precious metal does not have the momentum to remain at this level. The market remains at around 4% short of its 2020 all-time highs. $2,000 continues to remain a major long-term resistance level for gold, therefore, it is expected that prices may have to consolidate a bit longer at this level, or possibly fall back slightly to gain strength to push upwards to challenge the $2,100 per ounce level.

The spot prices of precious metals continue to move sideways for the week. Gold came from $2,006.37 last week to close this week at $1,992.65 per troy ounce, for a correction of 0.68%. Silver, which ended the week before at $23.12, concluded this week at $23.21 per troy ounce for an increment of 0.39%. Platinum closed the week before at $907.55 and this week at $934.75 per troy ounce for a gain of 3.00%. Palladium came from last week’s close at $1,124.56 to end this week at $1,121.78 per troy ounce for a modest slide of 0.25%. The three-month LME prices of base metals were likewise mixed. Copper ended this week at $8,143.00 per metric ton, higher by 0.54% from last week’s price of $8,099.00. Zinc closed this week at $2,478.00 per metric ton, slightly up by 0.26% from last week’s close at $2,471.50. Aluminum ended this week at $2,478.00 per metric ton, higher by 0.26% from last week’s closing price of $2,220.00. Tin ended the week at $23,962.00 per metric ton, lower by 3.77% from last week’s closing price of $24,902.00.

Energy and Oil

This week, oil prices climbed, taking their cue from interest rates remaining unchanged after the Fed meeting on Wednesday this week. Oil prices fell for three straight days, after which it received some much-needed boost from federal banks due to their inaction regarding interest rates. Both the Federal Reserve and the Bank of England did not hike interest rates this week, causing Brent to jump back to $87 per barrel as investors were encouraged by the possibility that monetary tightening has reached its peak. In the meantime, U.S. oil production also hit an all-time high as crude and condensate production in the country climbed to a record 13.1 million barrels per day (b/d) in August. This volume surpassed the previous 13.0 million b/d record dating way back in November 2019, with EIA reporting a year-on-year surge in production by 955,000 b/d from the lower 48 states.

Natural Gas

For the report week beginning Wednesday, October 26, and ending Wednesday, November 1, 2023, the Henry Hub spot price rose by $0.33 from $2.86 per million British thermal units (MMBtu) to $3.19/MMBtu. Regarding Henry Hub futures prices, the November 2023 NYMEX contract expired Friday at $3.164/MMBtu, higher by $0.15 from the start of the report week. The December 2023 NYMEX contract price increased to $3.494/MMBtu, up by $0.12 from the beginning to the end of the report week. The price of the 12-month strip averaging December 2023 to November 2024 futures contracts climbed by $0.12 to $3.505/MMBtu.\

The international natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.39 to a weekly average of $17.82/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.29 to a weekly average of $15.36/MMBtu. In the week last year corresponding to this report week (the week from October 26 to November 2, 2022), the prices were $28.97/MMBtu and $33.96/MMBtu in East Asia and at the TTF, respectively.

World Markets

European stocks were up this week on expectations that interest rates may have reached their peak and would start to descend. The pan-European STOXX Europe 600 Index rebounded from the losses of the previous week and closed 3.14% higher for this week. Major stock indexes in the region also rallied. Germany’s DAX rose by 3.42%, France’s CAC 40 Index surged by 3.71%, and Italy’s FTSE MIB jumped by 5.08%. The UK’s FTSE 100 Index climbed by 1.73%. As expectations rose that major central banks have completed their monetary policy tightening cycles, European bond yields broadly declined. The yield on the 10-year German sovereign bond slumped to its lowest levels in more than two months. The yield on the UK 10-year government bond also declined, as did the Swiss and French bond yields. The Bank of England (BoE) maintained interest rates at 5.25%, a 15-year high, for the second consecutive meeting. Despite the absence of an increase, the bank warned that rates would have to stay at a restrictive level for

“an extended period of time.”

Japan’s equities market registered gains for the week. The Nikkei 225 Index as well as the broader TOPIX Index both returned 3%. The Bank of Japan (BoJ) tweaked its yield curve control framework to allow yields to rise more freely which has raised inflation forecasts. Nevertheless, monetary policy remained highly accommodative consistent with the BoJ’s stance so far. The dovish stance weighed on the yen, though, which weakened briefly past the JPY 151 to the U.S. dollar level. The Japanese currency continues to remain under pressure due to the interest rate differential between the U.S. and Japan resulting from their divergent policies. In the Outlook for Economic Activity and Prices, BoJ policymakers have increased their consumer price index (CPI) forecast substantially for the next two years, both to 2.8% year-on-year and higher than BoJ’s 2% target. The outlook for price growth depends on assumptions regarding crude oil prices and the government’s economic measures. The bank asserts that underlying CPI inflation is likely to increase gradually toward achieving the price stability target.

Chinese stocks rose on speculation that U.S. interest rates may have reached their peak, thus offsetting the broader concerns about China’s slowing growth. The Shanghai Composite Index inched higher by 0.43% while the blue-chip CSI 300 climbed higher by 0.61%. The Hong Kong benchmark Hang Seng Index advanced by 1.53%. China’s factory activity contracted once more in October. The official manufacturing Purchasing Manager’s Index (PMI) plunged to 49.5 in October which is below 50 which is the border between contraction and expansion. The same indicator registered 50.2 in September, resulting in a descent that signaled a slowing in production growth. The nonmanufacturing PMI descended to a slower-than-expected 50.6 from 51.7 in September, although it remained in expansion territory. The private Caixin/S&P Global survey of manufacturing activity declined to a lower-than-forecasted 49.5 in October from 50.6 in September. The private survey of services activity moved up slightly but lagged the consensus estimate. Further evidence of China’s property dilemma dogged investor concerns regarding this key economic growth driver. New home sales by the country’s top 100 developers fell from September to August, and real estate loans declined in September from the previous year.

The Week Ahead

Among the important economic data scheduled for release in the coming week are consumer credit data for September, wholesale inventories for September, and the Michigan Consumer Sentiment index.

Key Topics to Watch

- Fed Gov. Cook speaks

- Federal Reserve senior loan survey for October

- U.S. trade deficit for September

- Fed Vice Chair for Supervision Barr speaks (Nov. 7)

- Fed Gov. Waller speaks

- Consumer credit for September

- Fed Gov. Cook speaks

- Fed Chair Jerome Powell delivers opening remarks

- Wholesale inventories for September

- Fed Vice Chair for Supervision Barr speaks (Nov. 8)

- Fed Vice Chair Jefferson speaks

- Initial jobless claims (Nov. 4)

- Fed Chair Jerome Powell on panel at IMF

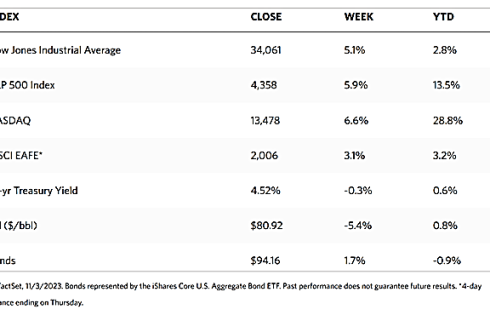

Markets Index Wrap-Up