Stock Markets

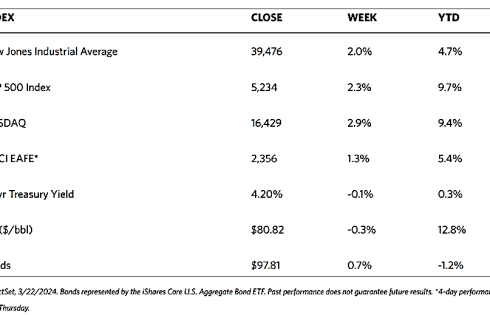

U.S. stock markets across the board have rallied during trading the week. The Dow Jones Industrial Average (DJIA) rose by 1.97% and the Dow Jones Total Stock Market climbed even higher, up by 2.27% for the week. The latter was closely mirrored by the S&P 500 Index which gained by 2.29%, but they were both outperformed by the technology-tracking Nasdaq Stock Market Composite which rose by 2.85%. The NYSE Composite gained by 1.48% and, consistent with the robust performance of the markets, the investor risk perception indicator, the CBOE Volatility Index (VIX), dipped by 9.37% for the week.

The markets welcomed the dovish messaging that the Federal Reserve transmitted by leaving the federal funds rate unchanged at 5.25% to 5.50% during its March FOMC meeting. The Fed also released an updated set of economic projections but underscored that it would maintain its outlook regarding rate cuts this year. Communication services led the gains for the week along with technology shares, accounting for the Nasdaq’s outperformance. Artificial intelligence chipmaker NVIDIA reached a record high on Friday, helped by a late rise that resulted in the stock’s market capitalization rising to almost $2.4 trillion. Also boosting sentiment in the technology sector are reports that Apple might partner with Google parent Alphabet in offering generative artificial intelligence tools. Lagging sectors included health care and real estate. In the coming week, trading is scheduled to end on Thursday in observance of the Good Friday holy day.

U.S. Economy

The inflation readings for January and February were somewhat hotter than expected. Nevertheless, Fed Chair Jerome Powell commented that the Fed sees “inflation coming gradually down to 2% on a sometimes-bumpy path.” Powell seemed not overly concerned about the uptick in the inflation data in January and February, which he attributed to seasonal noise. Other economic data for the week supported hopes that the economy was continuing to expand without reigniting inflation pressures. The more significant economic news was February’s existing home sales which was reported on Thursday, surprising most observers by jumping 9.5%. A gauge of current manufacturing in the Mid-Atlantic region drew back slightly from February’s reading, although it surprised investors by signaling a second straight month of expansion. Prices paid by businesses in the region fell back to their lowest level since May 2020, sending encouraging signals to the market. The announcement by the Fed also helped to drive longer-term Treasury yields lower over the week, and consequently bond prices higher since bond prices and yields move in opposite directions.

Metals and Mining

Despite its slight gain, the price of gold ended the week somewhat heavy as the precious metal encountered some selling pressure after it hit a new record high above $2,220 per ounce. Partly, the bullish sentiment may be attributed to the most recent interest rate expectations announced by the Federal Reserve. While the central bank still sees three rate hikes this year, it is embarking at the same time on a new easing cycle as inflation is expected to remain above its 2% target. Stubborn inflation simultaneous with falling interest rates suggests that real interest rates will be headed lower and put some pressure on the U.S. dollar, thus weakening two major headwinds for gold.

The spot market for precious metals moved sideways for the week and ended mixed. Gold closed the week at $2,165.44 per troy ounce, 0.44% higher than its last weekly close at $2,155.90. Silver ended at $24.67 per troy ounce for the week, down by 2.06% from last week’s closing price of $25.19. Platinum closed the week at $898.35 per troy ounce, a drop of 4.32% from last week’s close at $938.89. Palladium ended the week at $987.93 per troy ounce, which is 8.61% lower than the previous week’s ending price of $1,080.98. The three-month LME prices of the industrial metals were also mixed. Copper gained slightly at 0.71% from last week’s close at $8,887.50 to end this week at $8,950.50 per metric ton. Aluminum rose by 2.22% over last week’s close at $2,251.50 to end this week at $2,301.50 per metric ton. Zinc declines marginally by 0.92% from last week’s closing price of $2,548.00, thus ending this week at $2,524.50 per metric ton. Tin descended by 1.37% from its last weekly close at $28,258.00 for a closing price this week of $27,872.00 per metric ton.

Energy and Oil

Some downward momentum for ICE Brent was created by renewed hopes of a potential ceasefire in Gaza. ICE Brent slid back to $85 per barrel as reports of the U.S. urging Ukraine to halt strikes on Russian refineries presented another opportunity to curb the existing geopolitical risk facing oil. While the current correction weighs on oil prices, outlooks for the rest of the year are getting increasingly bullish as evidenced by the EIA lifting its Brent forecast to $88 per barrel, up $4 per barrel from last month. In other news from the US’s neighbor to the north, the first-ever cargo of Access Western Blend from TMX was bought by Chinese refiner Sinochem as line fill of Canada’s Trans Mountain Expansion pipeline moves ahead. The purchase price was reportedly at a $5 per barrel discount to Brent on a delivered China basis.

Natural Gas

For the report week from Wednesday, March 13 to Wednesday, March 20, 2024, the Henry Hub spot price climbed by $0.33 from $1.24 per million British thermal units (MMBtu) to $1.57/MMBtu. Concerning Henry Hub futures, the price of the April 2024 NYMEX contract increased by $0.041, from $1.658/MMBtu at the start of the report week to $1.699 by the week’s end. The price of the 12-month strip averaging April 2024 through March 2025 futures contracts increased by $0.021 to $2.709/MMBtu. Regional natural gas spot price changes were mixed for this report week, ranging from an increase of $1.46/MMBtu at Algonquin Citygate to a decrease of $0.28/MMBtu at SoCal Citygate.

International natural gas futures prices increased for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.82 to a weekly average of $9.27/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.70 to a weekly average of $8.84/MMBtu. In the week last year corresponding to this report week (the week from March 15 to March 22, 2023), the prices were $13.24/MMBtu in East Asia and $13.14/MMBtu at the TTF.

World Markets

European stocks rallied this week, with the pan-European STOXX Europe 600 Index ending near a record high after climbing 1.03% in local currency terms. The buy-up was largely due to dovish signals from central banks in the member countries which boosted risk-on sentiment. Germany’s DAX surged by 1.58% while Italy’s FTSE MIB gained 1.30%. Some indexes went against the current, such as France’s CAC 40 Index which declined by 0.17%. On the other hand, the UK’s FTSE 100 shot up by 2.70%. European government bond yields fell on a weak purchasing managers’ survey for Germany and a reduction in Swiss interest rates. Bond yields in the UK also fell, mainly due to the Banks of England (BoE) striking a dovish note at its policy meeting. For a fifth consecutive time, the BoE kept interest rates unchanged at 5.25%, but the market interpreted this time around as a more dovish signal due to the 8-to-1 in favor of the move. Two policymakers who previously called for a hike in borrowing costs reversed their stance in favor of keeping the rate unchanged. In the meantime, the output of goods and services in the eurozone came close to stabilizing in March, as PMI surveys showed, with a first estimate recording only a marginal decline, as noted by S&P Global.

Japan’s stocks registered weekly gains due mainly to yen weakness resulting from the Bank of Japan’s (BoJ’s) unexpected hawkish tilt. The BoJ raised interest rates for the first time since 2007, earlier than was priced in by market participants. Both of Japan’s indexes rallied to record-high levels, with the Nikkei 225 Index gaining 5.6% and the broader TOPIX Index advancing by 5.3%. Positive investor sentiment was further generated by expectations that the U.S. Federal Reserve will cut interest rates in 2024, based on the state of inflationary conditions and the growth prospects of the economy. On fixed-income instruments, the Japanese government bond yields descended after the Bank of Japan (BoJ) took a policy shift that the market had been much anticipating and exited its negative interest rate policy. Following reports from the previous week of major companies agreeing to robust pay increases in annual wage talks, the BoJ announced that it will set a policy rate target of 0 to 0.1%, up from -0.1%. The central bank Governor Kazuo Ueda, however, affirmed that financial conditions would remain accommodative since inflation expectations were still below the 2% target. Consumer price inflation as measured by the consumer price index (CPI) annualized over February rose to a higher-than-anticipated 2.8%, a sharp rise from 2.0% in January.

Chinese equities suffered a sell-off, leading indexes southward due to concerns about the property sector slump offsetting better-than-expected economic data. The Shanghai Composite Index slid by 0.22% while the blue-chip CSI 300 declined by 0.70%. The Hong Kong benchmark Hang Seng Index lost by 1.32%. In the January-February period, property investment in China fell by 9% from a year earlier, which is an improvement over the 24% slump in December. In the first two months of the year, property sales by floor area descended by 20.5% after slumping 23% in December. Beijing’s roll-out of numerous pro-growth measures to arrest China’s yearslong real estate slump accounted for the slower pace of declines in property investment and sales. Most investors, however, chose to remain on the sidelines or approach China’s property sector with caution. Developers continue to struggle with high debt levels and weak homebuyer demand. Other data show that other segments of China’s economy were starting to pick up. Industrial production rose by 7% in January and February year-on-year which is higher than forecasted and up from 6.8% in December. Also in the first two months of 2024, fixed-asset investment grew by 4.2% year-on-year compared to 3% in December amid higher infrastructure growth. Retail sales surged for the same period, largely due to the weeklong Lunar New Year holiday.

The Week Ahead

Consumer confidence, PCE inflation data, and the second revision of the fourth-quarter GDP are among the important economic data expected to be released in the coming week.

Key Topics to Watch

- Atlanta Fed President Raphael Bostic speaks

- Chicago Fed President Austan Goolsbee speaks

- New home sales for February

- Fed Gov. Lisa Cook speaks

- Durable goods orders for February

- Durable goods minus transportation for February

- S&P Case-Shiller home price index (20 cities) for January

- Consumer confidence for March

- Fed Gov. Christopher Waller speaks

- Initial jobless claims for March 23

- Gross Domestic Product (2nd revision) for Fourth Quarter

- Chicago Business Barometer (PMI) for March

- Pending home sales for February

- Consumer sentiment (final) for March

- Advanced U.S. trade balance in goods for February

- Advanced retail inventories for February

- Advanced wholesale inventories for February

- Personal income (nominal) for February

- Personal spending (nominal) for February

- PCE Index for February

- Core PCE Index for February

- PCE (year-over-year)

- Core PCE (year-over-year)

- Fed Chair Jerome Powell speaks

Markets Index Wrap-Up