Stock Markets

All stock indexes were modestly up during the week. According to the WSJ Markets report, the Dow Jones Industrial Average (DJIA) gained by 0.34%, and the Total Stock Market Index likewise by 0.50%. The Nasdaq Stock Market Composite took a breather with a gain of only 0.14%, while the NYSE Composite Index did slightly better with a gain of 1.01%. The broad-based S&P 500 Index climbed by 0.39%; nevertheless, this is the week the S&P 500 moved into bull market territory. The index moved up by more than 20% off its mid-October lows. Market gains also broadened this week, with small caps outperforming large caps and value shares outperforming growth shares.

Some of the market enthusiasm may have gained momentum from several prominent investment conferences and events that took place during the week. The events, which appear to have driven investor sentiment, included the Paris Air Show and the conference on energy and consumer stocks. Also making headlines was Apple’s annual developer’s conference, where the world’s most valuable public company launched a virtual reality headset, its first major new product in years. The headset was pricey at $3.500, causing some investors to react negatively, but the stock recovered some of its losses towards the week’s end.

U.S. Economy

The economic calendar was relatively light this week, at least giving some support to investors’ hopes that a recession will be avoided. The Labor Department reported on Thursday that the weekly jobless claims rose to 261,000, well above expectations and the highest level since October 2021. Continuing claims dropped unexpectedly, descending to their lowest level in almost four months. Earlier in the week, data released showed an unexpectedly large contraction in the services sector, but evidence of a continuing decline in services prices was the silver lining for investors. Services prices remained “sticky” relative to moderating prices for goods, food, and energy. The gauge of prices paid for services released by the Institute for Supply Management (ISM) moderated to its lowest level since May 2020. The ISM’s gauge of overall activity in the services sector fell to 50.3 which is indicative of stalled growth (levels over 50 indicate expansion).

The main economic highlight for the week was the surprise rate hike by the Bank of Canada (BoC). It is significant because the BoC was the first major central bank to pause its hiking cycle back in January. This week it raised its policy rate by a quarter point to its highest point since 2001, at 4.75%. The shift was due to a resilient economy, a still-tight labor market, and a rebound in the interest-rate-sensitive housing sector. All these indicators can prevent inflation from returning to the 2% target. The BoC and other central banks are keen on ensuring that monetary policy is sufficiently restrictive. Their goal is to achieve a degree of economic slowdown to stave off a return to runaway inflation.

Metals and Mining

Gold continues to hold onto its current support level within a solid, bullish trend line. This, despite everything that has been thrown at the market such as the U.S. dollar holding above 100 points and the S&P breaking into bull market territory, both of which would have normally caused gold prices to plunge. Some analysts opined that at the current market conditions, gold prices should be trading at the significantly lower $1,800 level. Instead, gold prices are less than 6% away from hitting a new all-time high. The support may be coming from central bank gold demand, a factor that has fundamentally changed the dynamics of the marketplace. Central banks are exhibiting an insatiable appetite, making them not only net buyers of gold but record buyers, a trend that is likely to persist.

Spot prices of precious metals showed some resilience and ended mixed for the week. Gold inched up by 0.68% from its week-ago close at $1,947.97 to this week’s close at $1,961.19 per troy ounce. Silver climbed by 2.88% from its previous week’s price of $23.61 to this week’s ending price of $24.29 per troy ounce. Platinum gained 0.37% this week to close at $1.011.70 per troy ounce from its closing price last week at $1,007.95. Palladium came from $1,424.29 one week ago to close this week at $1,328.51 per troy ounce, down by 6.72%. The three-month LME prices for base metals were mostly up for the week. Copper came from $8,237.00 last week to close up this week by 1.34% at $8,347.50 per metric ton. Zinc closed at $2,408.50 per metric ton this week, up by 4.42% from last week’s price of $2,306.50. Aluminum ended the week at $2,254.50 per metric ton, down by 0.40% from its price last week of $2,263.50. Tin came from a closing price last week of $25,651.00 to close this week at $25,817.00, up by 0.65%.

Energy and Oil

The oil market ended another week of contradictions. The major focus of the market moved away from production cuts by Saudi Arabia and week-on-week upticks in U.S. product inventories. Instead, attention was diverted to the Iranian nuclear deal, a narrative generally ignored so far this year. According to media reports, the U.S. and Iran are approaching a scaled-down nuclear deal, a story that was quickly debunked by both sides. A Middle East Eye report claimed that an interim nuclear deal with Iran was being discussed under which Iran would accept some limits on its program in return for partial sanctions relief. Both Washington and Tehran quickly and vehemently denied the rumor, however, calling it misleading. This led to heightened volatility in global oil benchmarks, leading Brent to finish the week at around the $76 per barrel mark.

Natural Gas

For the report week beginning on Wednesday, May 31, and ending on Wednesday, June 7, 2023, the Henry Hub spot price rose by $0.01 from $2.10 per million British thermal units (MMBtu) at the start of the week to $2.11/MMBtu by the end of the week. The Henry Hub spot price rose above $2.00 on June 7 for the first time this month, after averaging $1.91/MMBtu for the first five trading days in June. The price of the July 2023 NYMEX contract increased by $0.063, from $2.266/MMBtu on May 31 to $2.329/MMBtu on June 7. The price of the 12-month strip averaging July 2023 through June 2024 futures contracts rose by $0.08 to $3.040/MMBtu.

International natural gas futures prices decreased for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.06 to a weekly average of $9.25/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF)in the Netherlands, the most liquid natural gas market in Europe, fell by $0.03 to a weekly average of $7.95/MMBtu. By comparison, in the corresponding week last year (from June 1 to June 8, 2022), the prices were $23.41/MMBtu and $25.68/MMBtu in East Asia and at the TTF, respectively.

World Markets

Due to caution ahead of central bank meetings in Europe and the U.S. major stock indexes ending mixed, the pan-European STOXX Europe 600 Index ended 0.46% lower for the week. Italy’s FTSE MIB gained 0.35%, Germany’s DAX dipped by 0.63%, while France’s CAC 40 Index fell by 0.79%. The UK’s FTSE 100 Index declined by 0.59%. Officials of the European Central Bank (ECB) signaled that borrowing costs will possibly rise again in June, although there was less of a consensus on implementing rate increases in subsequent months. The median consumer expectations for Eurozone inflation in the year ahead fell from 5.0% in March to 4.1% in April, according to a survey conducted by the ECB. In the meantime, revised data showed that the Eurozone economy contracted by 0.1% sequentially in both the first quarter of this year and the last quarter of 2022, meeting the technical definition of a recession.

Japan’s stock markets climbed during the week to attain a fresh 33-year high. The Nikkei gained by 2.4% and the broader TOPIX rose by 1.9%. An upward revision to Japan’s first-quarter economic growth on the back of stronger corporate investment drove the optimistic sentiment. Hopes were likewise positive that the services sector, which could benefit from rebounding foreign inbound tourism, will continue to fuel further economic expansion. The yen remained close to a six-month low versus the U.S. greenback, trading in the higher JPY 139 range. The ongoing monetary policy divergence between the dovish Bank of Japan (BoJ) and the other major central banks, which continued to pursue a tightening mode, weighed on the Japanese currency. The weak currency continued to benefit Japan’s exporters while boosting the attractiveness of local assets to foreign investors. Japan’s financial authorities continue to watch closely currency market moves, ready to respond as needed and not ruling out any options that may be necessary.

After the latest inflation data increased concerns about China’s faltering post-pandemic recovery, Chinese equities were mixed for the week. The Shanghai Stock Exchange Index gained 0.04% while the blue-chip CSI 300 lost 0.65% in local currency terms. Hong Kong’s benchmark Hang Seng Index advanced by 2.32%, extending the gains of the preceding week. Inflation figures for May pointed to rising risks of deflation weighing on China’s economy, which is dealing with weak domestic and overseas demand, a sluggish property market, and high youth unemployment. The country’s consumer price index rose by 0.2% in May from one year ago, compared with April’s 0.1% expansion, a 26-month low. Core inflation (excluding volatile food and energy prices) slowed to 0.6% from the previous month’s 0.7%. The producer price index declined by 4.6% which was worse than expected, accelerating from a 3.6% decline in April. This marked the weakest reading since May 2020.

The Week Ahead

The CPI data, PPI data, and the FOMC meeting are among the important economic information scheduled for release this week.

Key Topics to Watch

- Federal budget

- NFIB optimism index

- Consumer price index

- Core CPI

- CPI year over year

- Core CPI year over year

- Producer price index

- Core PPI

- PPI year over year

- Core PPI year over year

- Fed decision on interest rate policy

- Fed Chair Powell press conference

- Initial jobless claims

- S. retail sales

- Retail sales minus autos

- Import price index

- Import price index minus fuel

- Empire State manufacturing survey

- Philadelphia Fed manufacturing survey

- Industrial production

- Capacity utilization

- Business inventories

- Fed Gov. Christopher Waller speaks

- Consumer sentiment

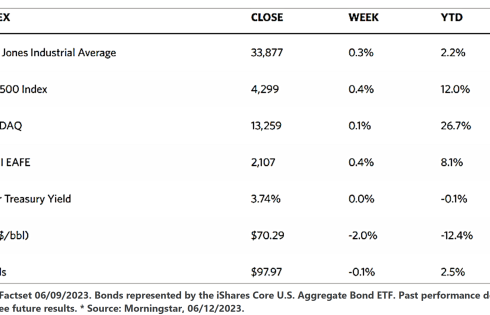

Markets Index Wrap Up