Stock Markets

The major stock indexes are mixed for this week, with the broader stock indexes marginally down and the narrower indexes slightly up. The Dow Jones Industrial Average (DJIA) gained by 0.75%, while the Total Stock Market lost by 0.48%. The broad S&P 500 Index slid by 0.83% and the technology-heavy Nasdaq Stock Market Composite down by 2.08%. The NYSE Composite Index is up by 0.86%. The Russell 1000 and 3000 Indexes dipped by less than 1% although the Russell 2000 climbed by 3.47%. The CBOE Volatility Index (VIX), which indicates investor risk perception, is down by 0.79%.

For the second consecutive week, stocks recorded mixed returns with small-cap and value shares outpacing the large-cap growth stocks that led the market for the first half of the year. The past week’s trading continues the rotations in the equities market that has been observed in recent weeks. The mega-cap technology stocks, which for most of the year have been the favorite of investors, have been lagging more recently. Conversely, value and cyclical parts of the market, which include most small- and mid-cap stocks, have been outperforming. More broadly, the theme of the broadening of market leadership in both the tech and non-tech sectors is likely to continue in the second semester of this year.

U.S. Economy

Economic reports for the week paint a mixed picture concerning how well consumers and businesses are faring. More broadly a favorable backdrop exists for equity investors, and while economic growth is cooling the signals sent are positive that inflation is easing and the Fed is poised to lower interest rates in the second half of this year. The housing market slump continues, but business investment is picking up. On Wednesday, a report by the Commerce Department indicated that only 617,000 new homes were sold in June, well below the expected 640,000 homes. It is also the lowest monthly tally since November of last year. Also, the average selling price of new homes fell by approximately 4% from one year ago. S&P Global also reported on the same day that its gauge of manufacturing activity surprisingly fell back into contraction territory for the first time since December, that is, to 49.5 (50.0 being the borderline between contraction and expansion).

On Thursday, the Commerce Department reported that in the second quarter, the economy grew at an annualized rate of 2.8%, well above expectation and double the reading for the first quarter. It is noted, however, that much of the gain in the second quarter came from inventory building and increased government spending. Another factor appeared to be the Commerce Department’s release of its core personal consumption expenditure (PCE) price index, which excludes food and energy. The PCE price index rose slightly more than expected (0.2%) in June but remained steady at an annual rate of 2.6%, which is not too far above the Fed’s inflation target of 2,0%. The inflation data seems to support expectations of the Fed rate cut during its September meeting.

Metals and Mining

Gold saw an intraday record high this week at $2,400 per ounce but lost steam and was unable to hold as investors took profits and sent the metal down due to significant selling pressure. Despite the volatility, however, investors remain bullish and appear poised to buy when the price descends. Analysts view the correction as a buying opportunity, and it is only a matter of time that the metal surges again, particularly since the Federal Reserve is expected to reverse interest rate by September. The approaching presidential election season is also likely to cause some volatility due to political uncertainty. Whichever side wins, though, their policy stances are seen to push the deficit higher leading to growing demand for safe-haven assets like precious metals.

The spot prices of precious metals fell this week. Gold dropped by 0.57% from its closing price last week of $2,400.83 to this week’s closing price of $2,387.19 per troy ounce. Silver came from $29.22 to end this week at $27.93 per troy ounce, a loss of 4.41%. Platinum, which closed last week at $965.95, ended this week at $940.30 per troy ounce for a drop of 2.66%. Palladium lost 0.55% from last week’s close at $910.05 to this week’s close at $905.09 per troy ounce. The three-month LME prices of industrial metals likewise trended down. Copper closed at $9,122.00 per metric ton this week, lower by 2.81% from last week’s close at $9,386.00. Aluminum closed at $2,270.50 per metric ton this week, for a loss of 4.80% from last week’s close of $2,385.00. Zinc ended this week at $2,681.00 per metric ton, losing by 4.56% from its closing price last week of $2,809.00. Tin closed this week at $29,416.00 per metric ton, lower by 6.92% from last week’s close at $31,604.00.

Energy and Oil

The oil markets were volatile last week, leaving investors and analysts guessing where oil prices are eventually headed. Factors that should have lifted market sentiment were continuously decreasing US oil stocks Canada’s wildfires, and GDP figures in the States that came in well above expectations. These events went largely unnoticed, however, due to a widespread selloff in tech stocks and a general disappointment in Chinese commodities. This will be the third straight week of decline as ICE Brent is set to finish the week below $82 per barrel.

Natural Gas

For the report week beginning Wednesday, July 17, and ending Wednesday, July 24, 2024, the Henry Hub spot price rose by $0.05 from $1.98 per million British thermal units (MMBtu) to $2.03/MMBtu. Regarding Henry Hub futures, the price of the August 2024 NYMEX contract increased by $0.082, from $2.035/MMBtu at the start of the week to $2.117/MMBtu at the week’s end. The price of the 12-month strip averaging August 2024 through July 2025 futures contracts rose by $0.06 to $2.887/MMBtu.

International natural gas futures price changes were mixed for the week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.15 to a weekly average of $12.13/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.10 to a weekly average of $10.26/MMBtu. In the week last year corresponding to this report week (for the week beginning July 19 and ending July 26, 2023), the prices were $11.13/MMBtu in East Asia and $9.67/MMBtu at the TTF.

World Markets

In Europe, stocks rose for the week with the pan-European STOXX Europe 600 Index ending 0.55% higher in local currency terms. The positive ending was largely due to a rally on Friday brought about by investors focusing on a better day of quarterly earnings reports. The major continental indexes were mixed. Italy’s FTSE MIB plunged by 1.27% and France’s CAC 40 Index gave up 0.22%, but Germany’s DAX ended up gaining by 1.35%. The UK’s FTSE 100 Index climbed by 1.59%. By midweek, European equity markets were weighed down as technology and luxury goods sectors reported disappointing returns. Negative sentiment pervaded the tech sector because of steep declines in Tesla and other “Magnificent Seven” mega-cap U.S. stocks. As Paris headed into Friday’s official opening ceremonies for the Summer Olympics, French President Emmanuel Macron called for a political truce during the games. The opening was marred somewhat by travel disruptions caused by Friday’s arson attacks on the country’s high-speed rail infrastructure. Otherwise, however, the incident did not affect the equities trading for the day.

Sharp weekly losses beset Japanese equities. The broad TOPIX Index lost by 5.6% while the benchmark Nikkei 225 Index declined by 6.0%. As the shares of U.S. mega-cap technology companies continued their sell-off, Japanese stocks remained under pressure. The yen strengthened for the third consecutive week. The exchange rate settled at around JPY 154.2 versus the U.S. dollar, from the JPY 157.45 per USD rate the week before. This rise continued to hurt the profit outlook for Japanese exporters. It appears to confirm that the government intervened in the foreign exchange market earlier in July to support the yen. The strength of the currency was also attributed to the recovery of short positions in anticipation of narrowing U.S.-Japan interest rate differentials. On the economic situation, a potential rate hike is expected in response to rising inflation. Tokyo’s core consumer price index rose by 2.2% year-on-year in July, mostly in line with expectations and up from 2.1% in June. A constraint against raising rates, however, is seen in the weakness in private consumption. Flash Purchasing Managers’ Index data showed Japan’s private sector firms’ activity returning to expansion in July. Service providers are expected to lead the expansion while manufacturers anticipate a marginal reduction in output.

Chinese stocks fell in reaction to unexpected rate cuts by the central bank which failed to instill confidence in the economic outlook. The blue-chip CSI 300 was down by 3.67% while the Shanghai Composite Index gave back 3.07%. The Hang Seng Index, Hong Kong’s benchmark, retreated by 2.28%. The People’s Bank of China (PBOC) reduced its medium-term lending facility (MLF) by 20 basis points to 2.3%. This is its first rate cut since August 2023 after holding the rate steady at its regularly scheduled operation on July 15. This is one of several rate cuts adopted by the PBOC aimed at making it cheaper for consumers to take out mortgages and other loans. The string of rate cuts hinted at Beijing’s growing urgency to support growth. China’s gross domestic product (GDP) fell below expectations in the second quarter. Other economic data, such as the slowdown in June of industrial production, retail sales, and property investment, pointed to weakness in the economy. The central bank is expected to further loosen policy and potentially reduce its reserve requirement ratio to bolster the economy.

The Week Ahead

In the coming week, included among the important economic releases are the job openings for June, the nonfarm payrolls report for July, and the minutes of the FOMC meeting.

Key Topics to Watch

- S&P Case-Shiller home price index (20 cities) for May

- Consumer confidence for July

- Job openings for June

- ADP employment for July

- Employment cost index for Q2

- Chicago Business Barometer (PMI) for July

- FOMC interest-rate decision

- Fed Chair Powell press conference (July 31)

- Initial jobless claims for July 27

- U.S. productivity for Q2

- S&P U.S. manufacturing PMI for July

- ISM manufacturing for July

- Construction spending for June

- U.S. employment report for July

- U.S. unemployment rate for July

- U.S. hourly wages for July

- Hourly wages year over year

- Factory orders for June

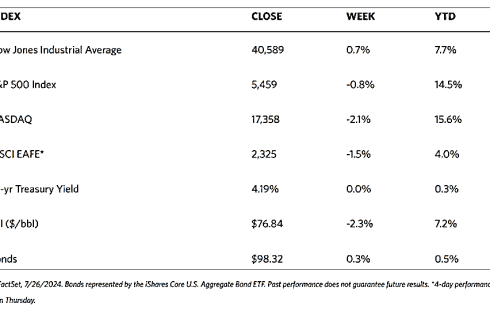

Markets Index Wrap-Up