Stock Markets

The stock market index benchmarks closed the week mixed as the large-cap and growth stocks surge higher for the second week in a row. Sectors sensitive to interest rate movement, such as the real estate sector, outperformed the rest of the market due to the plunge of the longer-term Treasury yields. Underperforming other sectors are the energy stocks, on the back of worries that the failure of major oil producers to see eye-to-eye will result in some of them disregarding the output agreements. The communication services sector was weighed down by weakness among media stocks. Friday’s recovery appeared to lift the markets higher, however, with the broader S&P 500 and Nasdaq Composite Index reaching record highs, possibly due to anticipation of strong second-quarter earnings reports in the coming week. This week’s trading was shortened by the observance of Independence Day on Monday, during which time markets remained closed.

U.S. Economy

The sentiment during the week was principally driven by the decline in U.S. Treasury yields. The benchmark 10-year Treasury note hit close to a five-month low on Thursday and retraced some ground thereafter before the week’s end. Early in the week, investors were heartened by the decline as equities were pushed up by the shift from fixed-income investments to corporate dividends, and the implied lower discount on future earnings. While equities investors welcomed the initial drop in Treasury yields, later in the week they became concerned that this decline signaled a slowdown in the future global growth. There were also worries that Chinese officials may ease monetary policy to drive its economy higher. Other economic news that came out during the week still indicated strong growth, but did come out more modest than expected. The ISM gauge of service sector activity in June was below expectations, while the IBD/TIPP Economic Optimism Index slid to its lowest level in four months. What went higher were the weekly jobless claims, and the May job openings rose less than anticipated.

- The labor market is expected to resume its momentum upward for the second half of the year, as a result of the expiration of extended unemployment benefits, rising wages, and the return of children to school. The unemployment rate will likely drop and job growth speed up. Together with high levels of household savings, these developments should drive an above-average rate of consumer spending that will likely result in an extension of the economic expansion.

- The quarterly GDP growth rates likely peaked during the first semester, but the U.S. GDP growth rate is historically more robust in the second half as it is expected to approximate 6% in the remaining two quarters of the current year. The possibility of imposing restrictions due to the emergence of more covid variants is remote but still concerning. Rising inflation still looms as consumer prices continue to increase at the fastest rate in three decades. Consumer demand continues to outpace supply. It is uncertain how soon supply will catch up because supply chain disruptions and labor shortages continue to remain tenuous. Steep increases in the prices of commodities such as lumber may prevail in the near future.

Metals and Mining

Gold rose 1.18% during the week, from $1,787.30 per ounce the previous week to $1.808.32 on Friday’s close. This was its best weekly performance in nearly two months, drawing its momentum from a weaker performance by the dollar and worries of the possible spread of the Delta variant of the coronavirus that may slow down global economic recovery. In light of the possibility that the country may see full employment in the next few quarters and that the U.S Federal Reserve is convinced that inflation may not breach the targets for the period, the gold may see $1,850 before the end of the year. Since gold is a hedge against economic and political risks as well as soaring inflation, buyers continue to be attracted by the uncertainties posed by the coronavirus in the future. The weakening of the dollar also made the yellow metal cheaper and therefore more enticing for investors holding other currencies.

As for the other precious metals, silver softened slightly, losing 1.40% when it closed the week at $26.10 from last week’s $26.47. Platinum gained by 1.00%, closing at $1,104.67 from the previous week’s $1,093.74 per ounce. Palladium likewise gained, higher by 0.78% from $2.790.29 at its previous close to $2,812.18 on Friday. Base metals were also mixed for the week. Among those that gained in value is copper, rising 1.53% from $9,376.50 to $9,519.50 per tonne. Zinc also rose by 16.20%, from $2,562.00 to $2,977.00. per tonne. Aluminum slid downwards by 14.77%, descending from the previous week’s close at $2,935.00 to $2,501.50 per tonne. Tin saw a slight gain, from $31.520.00 to $31.680.00 per tonne, or a marginal increase of 0.51%.

Energy and Oil

Oil prices surged forward on strong demand for fuel manifested by seven straight weeks of inventory draws. According to the U.S. Energy Information Association or the EIA, gasoline demand in the U.S. surged by 870,000 barrels per day (bpd) in the week just concluded. In light of the summer driving season, the country’s gasoline consumption figures reached a two-year record high. The crude oil inventory report of yesterday enabled prices to recover to profitable levels. Any further upside to oil prices appears limited, however, without an OPEC+ agreement as market participants continue to weigh the possibility of disagreements within the alliance. Prices will only be sustained if further discord is contained within the oil price cartel. Worries about a possible price war seem so far unfounded and pre-emptive, as the risk of such price war materializing is quite low. The OPEC+ is generally highly benefitted by the workings of the tight oil market, and would only expect this advantageous working relationship to be compromised in the event of a serious departure from their mutual agreement.

Natural Gas

The spot prices of natural gas descended at most locations during the report period June 30, Wednesday, to July 7, Wednesday. The Henry Hub spot price fell this past week to $3.60 per million British thermal units (MMBtu) from the previous week’s $3.72/MMBtu. The price of the August 2021 New York Mercantile Exchange (NYMEX) contract fell from $3.650/MMBtu to $3.596/MMBtu, a loss of $0.05. The price of the 12-month strip averaging August 2021 through July 2022 futures contracts slid to $3.416/MMBtu, a decrease of $0,01/MMBtu.

World Markets

European shares moved sideways during the week. It recovered from a sharp pullback earlier due to concerns of a resurgence of pandemic cases in light of new variants of the coronavirus. It was speculated that another round of restraints will likely jeopardize the global economic recovery and growth. The pan-European STOXX Europe 600 Index ended 0.19% higher for the week while major indexes were mixed. Italy’s FTSE MIB Index fell 0.91% and France’s CAC 40 Index descended 0.36%. On the other hand, Germany’s Xetra DAX Index climbed 0.24%. The UK’s FTSE 100 Index remained unchanged. The core eurozone bond yields mirrored the U.S. Treasury yields which ended lower for the week, although global bonds rallied. Weak U.S. services economic activity data, as well as coronavirus variant concerns brought equities lower, although they drove demand for high-quality government bonds, pushing yields down. U.K. gilts and peripheral eurozone government bonds followed core markets for the week’s trading.

Japan’s equities markets fell sharply during the week. The Nikkei 225 Index fell 2.93% while the broader TOPIX Index likewise slid 2.25%. The concerns about emerging coronavirus variants slowing economic growth were again echoed in this country, dampening investor sentiment and sending stocks lower. The yield on the 10-year Japanese government bond declined to 0.03% in anticipation that major central banks will continue with supportive monetary policy without any intentions of tightening anytime soon while the pandemic poses risks of resurgence. The yen rose to 110.01 against the U.S. dollar as a result of the strengthening of safe-haven demand. In the meantime, Tokyo will soon be placed under a state of emergency for the fourth time.

In China, stocks ended the week in mixed trading with equities registering mixed signals. The benchmark Shanghai Composite Index inched higher slightly, while the large-cap CSI 300 Index lost marginally. There was heavy selling in the technology sector in response to increased regulatory risk, as Beijing was reported to intensify oversight of U.S.-listed Chinese counters, most of which are classified under the technology sector. Additionally, domestic tech companies will continue to be the subject of a government crackdown. Regarding its monetary policy, the People’s Bank of China announced unexpectedly that it shall reduce its reserve requirement ratio (RRR). This is the amount of cash that the central bank requires banks to hold. This is expected to unleash some RMB 1 trillion worth of long-term liquidity into the economy. The RRR was more about the government reallocating credit to China’s small and medium-sized enterprises rather than about monetary easing. Since it was undertaken days before July 15 when China is scheduled to report its second-quarter GDP, the decision appears to be as much motivated by Beijing’s worries about flagging economic growth. China’s 10-year sovereign bond declined eight basis points to 3.02%. The renminbi lost 0.2% to end at 6.487 versus the U.S. dollar.

The Week Ahead

The coming week brings several important economic data, among which are the Retail Sales growth, the Consumer Price Index (CPI) report, and the Hourly Earnings Growth

Key Topics to Watch

- NFIB small-business index

- Consumer price index

- Core CPI

- Federal budget

- Producer price index

- Beige book

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Import price index

- Empire state index

- Philadelphia Fed index

- Industrial production

- Capacity utilization rate

- Retail sales

- Retail sales excluding autos

- Consumer sentiment index

- Business inventories

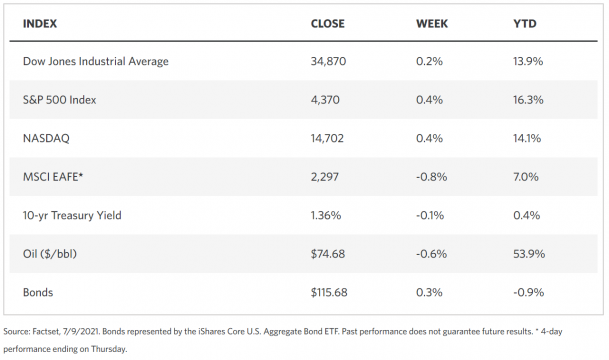

Markets Index Wrap Up