Stock Markets

Global stock markets have recorded their first back-to-back monthly gains in more than a year. Major U.S. equities ended higher, driven by investor optimism that the Federal Reserve may soon slow the pace of interest rate hikes. The Dow Jones Industrial Average (DJIA) gained 0.24% and its total stock market index climbed 1.20%. The S&P 500 Index added 1.13% while the Nasdaq Stock Market Composite increased by 2.09%. The NYSE Composite rose by 1.03%, and the CBOE Volatility Index fell by 7.02%. In the S&P 500 Index, growth stocks outperformed their value counterparts while the technology sector posted solid gains. The DJIA, despite rising only incrementally, closed more than 20% above the low it hit in September 2022 thereby entering bull market territory on the last day of November. The strong rally by equities markets on the final day of November was in reaction to the speech delivered by Federal Reserve Chairman Jerome Powell that signaled the likelihood of smaller interest rate hikes going forward. He admitted that the central bank was aware that it may take time for the effects of monetary policy to filter through to the economy. With this realization, the Fed may slow the pace of rate increases as early as the Federal Open Market Committee’s (FMOC’s) meeting that will take place by mid-December 2022.

U.S. Economy

In his speech before members of the Brookings Institution, Powell focused on the jobs market. He stated that the labor demand would likely need to soften for the Fed to bring inflation under control. Based on data released by the Bureau of Labor Statistics, the number of job openings fell by about 353,000 to 10.3 million, slightly below the consensus estimate of 10.4 million available job positions. The U.S. economy added 263,000 jobs as shown by the nonfarm payrolls data. This exceeded the consensus estimate for the pace of additional jobs to fall to 200,000. Job gains were in the sectors of leisure and hospitality, health care, and government. Employment declined in the retail, transportation, and warehousing industries. The unemployment rate was unchanged at 3.7%.

In other economic news, consumer confidence and manufacturing activity demonstrated signs of weakening. Sequentially in October, consumer spending rose by 0.8%, but when adjusted for inflation this increase falls to 0.5%. The core personal consumption expenditure price index, which includes volatile food and energy costs, grew 5% year-over-year. This slowed down from the 5.2% inflation rate recorded in September. On the other hand, consumer confidence slipped in November based on the Conference Board’s metric. The survey providing this basis registered an increase in inflation expectations and, therefore, an increased reluctance among households to purchase big-ticket items over the next six months. The purchasing manager’s index (PMI) of the Institute for Supply Management slid to levels indicative of a contraction in activity for the first time since May 2020, as demand was weighed down by the uncertain economic environment.

Metals and Mining

The gold and silver markets came to life as the prices of the precious metals rallied to their highest in months. Both metals ended the week at their significant support levels, silver above $23 and gold at about $1,800 per ounce. The week constituted a significant reversal in the monthly chart. Gold ended November with a 7.5% gain following seven consecutive months of losses. Silver, on the other hand, gained 14% in November. The price action has turned bullish, in addition to which gold has held to its critical support level for three months in a row. It suggests that investor sentiment is certainly changing, but there remains some uncertainty that the bulls are going to be sustained. Investors are sitting on the sidelines, prepared to buy upon confirmation of the reversal.

Gold gained 2.43% week-on-week, from $1,754.93 to $1,797.63 per troy ounce. Silver added 6.39%, from the previous week’s close at $21.75 to this week’s close at $23.14 per troy ounce. Platinum ascended 3.61% from its earlier close at $983.56 to its recent close at $1,019.11 per troy ounce. Palladium began at $1,847.69 and ended this week at $1,901.40 per troy ounce for an increase of 2.91%. The three-month LME prices of base metals tracked the trend of the precious metals’ spot prices. Copper, which ended the previous week at $8,008.00, ended the week at $8,336.00 per metric tonne, for a gain of 4.10%. Zinc began at $2,920.50 and rose to end the week at $3,079.50 per metric tonne, climbing 5.44% week-on-week. Aluminum rose by 5.19% from the previous week’s price of $2,362.50 to close the week at $2,485.00 per metric tonne. Tin, which ended the week earlier at $22,231.00, ended this week at $23,331.00 per metric tonne, for an increase of 4.95%.

Energy and Oil

The OPEC+ meetings were customarily held physically; their purpose was to revisit the group’s production strategy as the oil community carefully analyzed the post-meeting statements. The meeting switched from a physical gathering in Vienna to an online conference call, suggesting to many analysts that the most likely outcome will be a rollover of production quotas. As a result, there are no drastic moves expected on Sunday. It is a given that the EU has tentatively agreed to an oil price cap level for crude. EU member states have tentatively agreed to a $60 per barrel oil price cap on Russian seaborne oil which comes into effect on December 5. The agreement comes with an automatic adjustment mechanism that will keep the cap at 5% below the market price. Because of this, there is a possibility that OPEC may spring a surprise at its next meeting. On the other hand, OPEC+ has been supported by rumors of China’s reduction of its COVID restrictions and lockdowns, which led oil prices to close the week with a significant gain.

Natural Gas

This report covers the week beginning Wednesday, November 23, to Wednesday, November 30, 2022. The Henry Hub spot price rose $0.34 from $6.46 per million British thermal units (MMBtu) at the beginning of the week to $6.80/MMBtu at the end of the week. The December 2022 NYMEX contract expired Monday at $6.712/MMBtu, down by $0.60 from the preceding Wednesday. The January 2023 NYMEX contract price decreased to $6.930/MMBtu, lower by $0.78 for the week. The price of the 12-month strip averaging January 2023 through December 2023 futures contracts fell by $0.15 to $5.709/MMBtu. International gas futures prices rose during the report week. The weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia rose by $2.95 to a weekly average of $31.01/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, ascended $4.07 to a weekly average of $40.01/MMBtu.

World Markets

European shares climbed for the seventh straight week as investors gained optimism from the receding inflation rates. There is greater confidence that central banks are likely to slow the rate of their interest rate increase, gradually loosening their tight monetary policies. China’s announcement that it would be relaxing its strict coronavirus measures was also well-received and helped to improve market sentiment. The pan-European STOXX Europe 600 Index closed the week higher by 0.58% in local currency terms. The major country stock indexes were mixed. Italy’s FTSE MIB Index dipped 0.39%, Germany’s DAX Index moved sideways, and France’s CAC 40 Index ascended 0.44%. The UK’s FTSE 100 Index climbed 0.93%. European government bond yields dropped in reaction to data showing that euro area November inflation slowed more than expected. The market also reacted to comments by U.S. Fed Chair Jerome Powell indicating that the Fed may slow the pace of its rate increases. The announcement fueled a broader rally in bond markets, causing a decline in Italian, French, and Swiss yields. The 10-year gilt yields in the UK hardly changed.

Japan’s stock market returns were negative for the past trading week. The Nikkei 225 Index lost 1.79% while the broader TOPIX Index plummeted by 3.17% due to exports suffering as a result of a strong yen. Investors generally directed their attention toward COVID-related developments in China as government authorities suggested that they will begin to ease the strict coronavirus containment measures they had been implementing. There were also expectations among investors that the U.S. Federal Reserve will likely slow the pace of interest rate hikes, further raising investor sentiments. The yield on the 10-year Japanese government bond was hardly impacted by developments during the week prior and remained broadly unchanged at 0.25% as it traded around the implicit policy cap of the Bank of Japan (BoJ). Simultaneously, the yen rose to about JPY 134.5 from JPY 139.1 against the U.S. dollar, its strongest level in more than three months. The move was in anticipation of the Fed shifting to a more dovish stance.

Chinese stocks rallied amid indications that the U.S. Federal Reserve is poised to lower the pace at which it was hiking interest rates, and that Beijing was inching closer to fully reopening the economy after months of pandemic lockdowns. The blue-chip CSI 300 Index surged by 2.5% during the past week’s trading, the best weekly gain it had in a month. Early in the week, however, markets plunged on reports that civil unrest broke out in major cities nationwide over the weekend. The unrest was sparked by a fire in Urumqi, the capital of Xinjiang province, that killed 10 people purportedly locked in their residences due to coronavirus restrictions. After the incident, Beijing expressed intentions of moving away from its zero-tolerance approach to coronavirus control, lifting investor sentiments.

The Week Ahead

Productivity, jobless claims, and the producer price index are among the important economic data being released this week.

Key Topics to Watch

- S&P U.S. services PMI (final)

- ISM services index

- Factory orders

- Trade deficit

- Productivity (SAAR) revision

- Unit labor costs (SAAR) revision

- Consumer credit (level change)

- Initial jobless claims

- Continuing jobless claims

- Producer price index final demand

- UMich consumer sentiment index (early)

- UMich 5-year inflation expectations (early)

- Wholesale inventories revision

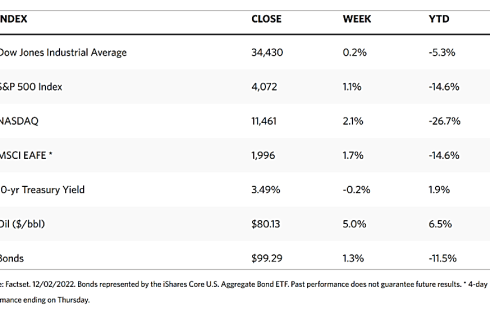

Markets Index Wrap Up