Stock Markets

All major indexes moved sharply lower when it was determined that only two rate cuts would be taking place in 2025 instead of the expected four rate cuts. The 30-stock Dow Jones Industrial Average (DJIA) fell by 2.25% for the week while the Total Stock Market Index was not far behind, having lost 2.26%. The broad S&P 500 Index finished the week 1.99% lower and the technology-heavy Nasdaq Stock Market Composite ended 1.78% lower than its close last week. The NYSE Composite dropped by 3.09% for the week. The CBOE Volatility Index (VIX), a measure of investor risk perception, shot up by 32.95%.

U.S. stocks plummeted during the week but a rally on Friday helped major indexes recover some of their lost ground. While smaller-cap indexes generally fared worse, losses were broad-based. Traders observed that Thursday marked the 14th consecutive trading session wherein decliners outnumbered gainers in the S&P 500 Index, the longest record since 1978. The dominant event during the week seems to be the Fed’s rate announcement after its highly-awaited policy meeting on Wednesday. The policymakers announced a quarter basis point cut to the Fed’s policy rate as expected, bringing the total rate reduction to 100 basis points (1.00 percentage point) since the start of the rate-cutting cycle in September. Investor sentiment turned sour when Fed Chair Jerome Powell noted that core inflation in 2025 rose to 2.5% from 2.2% in September, prompting greater caution before adopting future rate cuts.

U.S. Economy

The U.S. economy grew at an annualized rate of 3.1% in the third quarter, the Commerce Department reported on Thursday. The reading outpaces a previous estimate of 2.8%, partly due to increases in consumer spending. Also possibly related is the increase in retail sales in November by 0.7%, up from 0.5% in October. Also ringing a positive tone is the jobs data for the week. Initial jobless claims of 220,000 were reported by the Labor Department, as well as continuing claims of 1.87 million. Both indicators were down from the week before. Finally, on Friday morning the personal consumption expenditure (PCE) inflation report was released. The core PCE index, which is the Fed’s preferred inflation metric, rose by 2.8% year-over-year in November. This is in line with October’s reading and slightly lower than consensus expectations. The better-than-expected report appeared to have helped push stocks higher on Friday to end the week above their lowest levels.

Metals and Mining

The spot price of precious metals generally fell for this week. Gold closed at $2,622.91 per troy ounce, 0.96% lower than last week’s closing price of $2,648.23. Silver settled this week at $29.52 per troy ounce for a loss of 3.37% from its final price last week of $30.55. Platinum bucked the trend and closed this week at $927.80 per troy ounce, 0.10% higher than last week’s closing price of $926.91. Palladium ended this week at $919.54 per troy ounce for a loss of 3.86% from last week’s close of $956.42. The three-month LME prices of industrial metals also lost ground over the week. Copper settled this week at $8,883.00 per metric ton, 1.87% lower than last week’s closing price of $9,052.50. Aluminum ended this week at $2,507.00 per metric ton which is lower by 3.76% from last week’s close at $2,605.00. Zinc, which ended last week at $3,095.50 and this week at $2,967.00 per metric ton for a loss of 4.15%. Tin closed one week ago at $29,097.00 and this week at $28,399.00 per metric ton for a drop of 2.40%.

Energy and Oil

The 2025 rate policy outlook of the Federal Reserve produced two key takeaways. The foreseen policy will be slower and shallower, with a suggested prolonged break in rate-cutting next year. This adds insult to the injury suffered by the oil market. China remains bearish on its oil market for 2025, with the country’s state refining giant Sinoper expecting the country’s oil consumption to peak by 2027 at 16 million barrels per day. As both gasoline and diesel are expected to fall next year by 2.4% and 5.5% respectively, growth is seen to come only from the petrochemicals sector. Almost all 2025 outlooks are trying to outcompete one another in terms of bearishness. As a result, Brent prices dipped to $72 per barrel again.

Natural Gas

For the report week beginning Wednesday, December 11, and ending Wednesday, December 18, 2024, the Henry Hub spot price fell by $0.09 from $3.11 per million British thermal units (MMBtu) to $3.02/MMBtu. Regarding the Henry Hub futures, the price of the January 2025 NYMEX contract was generally unchanged from $3.378/MMBtu to $3.374/MMBtu for the report week. The price of the 12-month strip averaging January 2025 through December 2025 futures contracts declined by $0.05 to $3.232/MMBtu. At most locations this report week, natural gas spot prices fell. Price changes ranged from a decline of $6.99 at the Algonquin Citygate to an advance of $0.07 at the Waha Hub.

International natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $1.26/MMBtu to a weekly average of $13.78/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands declined by $1.38/MMBtu to a weekly average of $12.73/MMBtu. In the week last year corresponding to this report week (beginning December 13 and ending December 20, 2023), the prices were $13.30/MMBtu in East Asia and $10.89/MMBtu at the TTF.

World Markets

European stocks lost ground this week on concerns regarding the uncertainty of interest rate reductions and potential U.S. trade tariffs to be imposed on the European Union. The pan-European STOXX Europe 600 Index ended 2.76% lower this week in local currency terms. The region’s major stock indexes also fell for the week. France’s CAC 40 Index lost by 1.82%, Germany’s DAX declined by 2.55%, and Italy’s FTSE MIB dropped by 3.22%. The UK’s FTSE 100 Index gave up 2.60%. The Bank of England (BoE) maintained its key interest rate at 4.75%, which was in line with expectations. Also as expected, headline annual inflation accelerated in November to 2.6% from 2.3% in October as gasoline and clothing costs went higher. Sweden’s central bank reduced its key interest rate by a quarter-point to 2.50% as expected, with the potential of one more cut in the first half of 2025 if conditions remain unchanged. Norway’s central bank left its policy rate unchanged at 4.50%, a 16-year-high, as it attempts to stabilize inflation around its target. Activity in the Eurozone’s private sector closed the year in contraction. A rebound in the services sector, however, kept the overall decline marginal, according to the S&P Global purchasing managers’ surveys. The slowdown in business activity in Germany and France, the bloc’s largest economies, eased only modestly.

Japan’s stock markets fell this week, with the Nikkei 225 Index losing by 2.0% and the broader TOPIX Index falling by 1.6%. Banks faced tougher challenges due to a slight increase in expectations that the pace of monetary policy normalization by the Bank of Japan (BoJ) could be slower than anticipated. Broadly unchanged during the week at 1.05% was the yield on the 10-year Japanese government bond. The profit outlook for Japan’s exporters, especially automakers, was supported by the sell-off in the yen, reducing the currency’s value and making Japanese exports more attractive to foreign markets. The yen softened to within the high-JPY 156 range against the US dollar, from about JPY 153.7 at the end of the previous week. The situation prompted fresh verbal intervention by Japanese authorities to prop up the yen. At its December 18-19 meeting, the BoJ maintained its policy rate steady at approximately 0.25%. BoJ Governor Kazuo Ueda’s post-meeting comments were read as dovish by investors. Market expectations are strengthening around the possibility of a rate hike in January. It is more likely that a rate hike may be delayed beyond January, according to analysts, as Ueda mentioned that wage trends will be clearer in March or April and that the economic policy of the new U.S. administrations will continue to pose a risk. In the meantime, consumer inflation rose to a three-month high, pressure remains on the BoJ to raise interest rates.

Disappointing data raised concerns about the economy and sent Chinese stocks retreating. The Shanghai Composite Index declined by 0.7% while the blue-chip CSI 300 gave up 0.14%. The Hong Kong benchmark Hang Seng Index fell by 1.25%. Amid a looming trade war with the U.S., November activity data pointed to the uneven nature of China’s recovery. From a year ago, retail sales expanded a below-consensus 3%, down from 4.8% in October and highlighting the unwillingness of Chinese consumers to spend. In the January to November period, fixed asset investment grew by 3.3%, lagging forecasts and less than the 3.4% increase in the calendar year to October. In the same period, property investment fell by 10.4%. On the contrary, a bright spot was industrial production rising by a better-than-expected 5.4% year-on-year attributed to an increased demand for robots, passenger cars, and solar panels. For the third straight month, China’s youth unemployment rate eased after hitting its highest level this year in August. According to official data, the jobless rate for 16- to 24-year-olds (excluding students) was 16.1% in November, down from, 17.1% in October. As expected, urban unemployment remained steady at 5%. After Beijing unveiled a sweeping package in late September aimed at revising the crisis-hit sector, China’s property market has shown signs of stabilizing.

The Week Ahead

New home sales and consumer confidence reports are among the important economic releases scheduled for this coming week.

Key Topics to Watch

- Consumer confidence for Dec.

- Durable-goods orders for Nov.

- Durable-goods minus transportation for Nov.

- New home sales for Nov.

- Initial jobless claims for Dec. 21

- Advanced U.S. trade balance in goods for Nov.

- Advanced retail inventories for Nov.

- Advanced wholesale inventories for Nov.

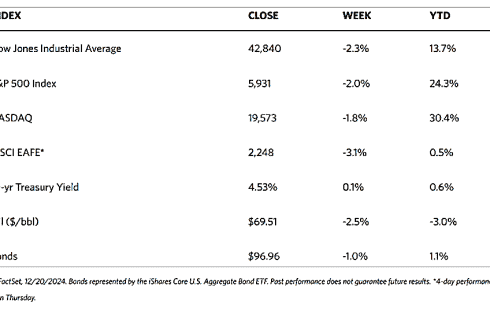

Markets Index Wrap-Up