JPMorgan strategists say the Fed’s easing and China stimulus are reviving hopes for a late-cycle reflation trade

When Marko Kolanovic departed JPMorgan last summer, he took with him a pessimistic outlook on U.S. stocks that just hasn’t materialized. The S&P 500 is up 21% this year, after a 24% increase last year.

His replacements aren’t necessarily wide-eyed optimists, but they are starting to sound a more positive tone.

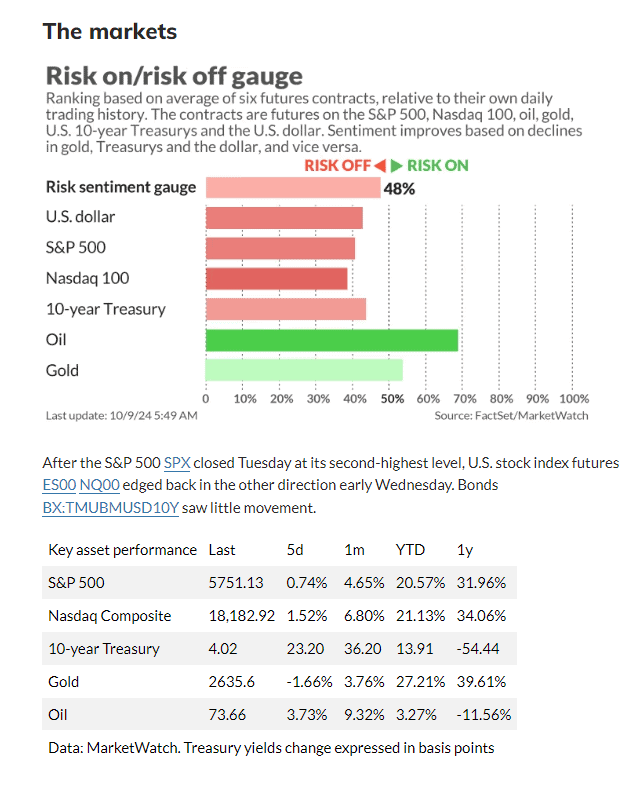

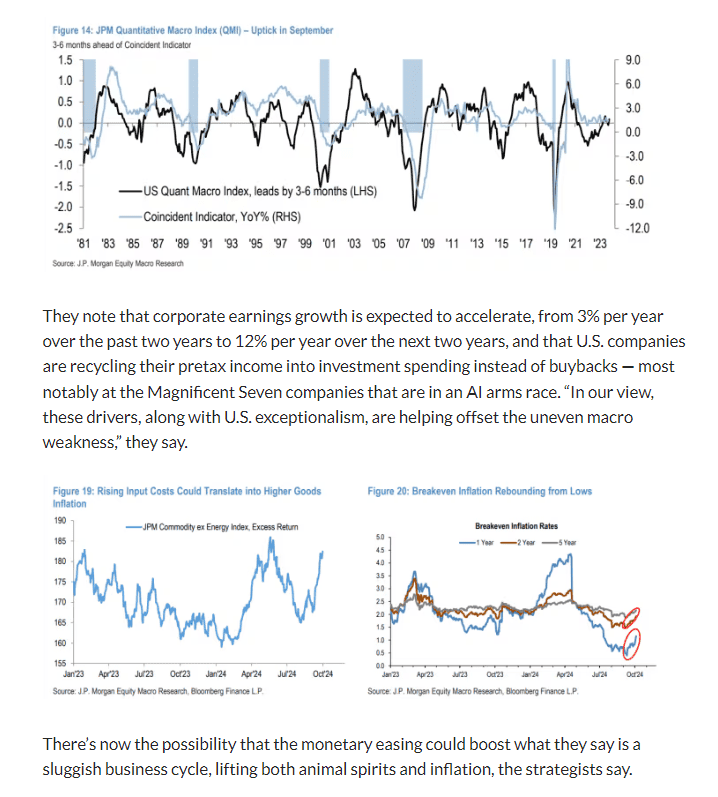

The team now led by Dubravko Lakos-Bujas say the Federal Reserve’s interest rate cut and China’s monetary stimulus are reviving hopes for a late-cycle reflation trade. And they note the policy support comes at a time of surprisingly resilient U.S. economic growth, with tight labor markets, ongoing government deficit spending, and record highs across equities, credit and housing.

For confirmation, they need to see improvements in the weak areas of the economy, which they identify as low-income consumers, private-sector jobs, manufacturing and retail. And if the market backpedals on rate-cut expectations — the 2-year yield BX:TMUBMUSD02Y is up around 50 basis points over the last two weeks — the “higher for longer” areas of the market that have been dormant for the last several months like the megacap techs and quality growth stocks are likely to gain interest at the expense of both defensives and cyclicals.

If this late-cycle reflation takes hold, they like a basket of AI, datacenter and electrification beneficiaries, which of course includes Nvidia as well as other chips stocks like Broadcom AVGO, industrials including Eaton ETN and GE Vernova GEV, and utilities Constellation Energy CEG and NRG Energy NRG.

The firm is now ending its long defensive/short cyclicals view, pointing out in particular energy stocks are beneficiaries of China’s stimulus, rising geopolitical uncertainty and Fed easing, and supported by low ownership and investor interest.

For investors looking to play the broadening cyclical recovery ahead of the year-end holiday season, they like what they call U.S. consumer laggards with brand value, which include Tesla TSLA, General Motors GM, Ford F, Nike NKE, Starbucks SBUXand Etsy ETSY.

They also identify U.S. and European companies that are tied to China, which include casinos Las Vegas Sands LVS and Wynn Resorts WYNN, chemicals companies including Dow DOW and DuPont DD, and chip stocks including Nvidia (again), Advanced Micro Devices AMD and Applied Materials AMAT.