Recessionary concerns again top the agenda, underpinned by high inflation and rising interest rates

U.S. stocks edged lower on Tuesday, finishing up the new year’s first trading session with an all too familiar 2022 pattern of volatile moves that trend downward amid worries about high inflation and a possible recession.

How stocks traded

- The S&P 500 SPX, -0.40% dropped 15.36 points, or 0.4%, to end at 3,824.14.

- The Dow Jones Industrial Average DJIA, -0.03% shed 10.88 points, or less than 0.1%, to finish at 33,136.37.

- The Nasdaq Composite COMP, -4.72% fell 79.50 points, or 0.8%, ending at 10,386.98.

On Friday, the Dow Jones Industrial Average fell 74 points, or 0.22%, to 33,147, the S&P 500 declined 10 points, or 0.25%, to 3,840, and the Nasdaq Composite dropped 12 points, or 0.11%, to 10,466. The Nasdaq Composite fell 33.1% in 2022. The yearly declines for the three stock indices were the worst since 2008.

What drove markets

After Wall Street’s S&P 500 index dropped nearly 20% in 2022, equity trading on Tuesday started with a modest pop with all three indexes opening higher, but that rally fizzled with the three benchmarks trading lower in the afternoon trade. Stocks closed well off their lows of the first trading session of 2023, but still finished in the red.

Tesla shares TSLA, -12.24% led the market lower, ending more than 12% lower to its lowest point in over two years after the electric carmaker delivered fewer vehicles than expected last quarter despite offering hefty incentives in its biggest markets. It’s the third straight quarter that deliveries have missed estimates and several analysts cut price targets on the stock Tuesday.

There’s the investor excitement that’s going to come with the start of a new year and a new chance at gains and opportunities, said Scott Sheridan, CEO of tastyworks, an online brokerage. However, the underlying “structural issues” — like high inflation and the ongoing war in Ukraine — are still there, he said.

“I don’t think the market cares that it’s January 3rd. This is a continuation of the move we’ve been in, which is going to be a choppy move,” Sheridan said. For all new year goals of better-looking portfolio, Sheridan thinks the market “might not be ready for the bold move people are hoping for.”

Market consolidation is a “healthy response” ahead of whenever an upswing materializes, he said. The near term volatility could present “good trading opportunities,” but for longer term investors, there “might be some rough spots.”

Indeed, the International Monetary Fund greeted the new year with a warning that a third of the global economy will suffer recession in 2023, a downturn that will likely trim corporate profits.

“On a tactical basis, we are bearish, expecting investors to return from their New Years revelry in a sour mood,” said Marko Papic, chief strategist at the Clocktower Group. “Recession is yet to be priced in by the cyclical sectors and more downside may be ahead as the end-of-the-month FOMC meeting looms. However, we posit that the risk of a recession is overstated.”

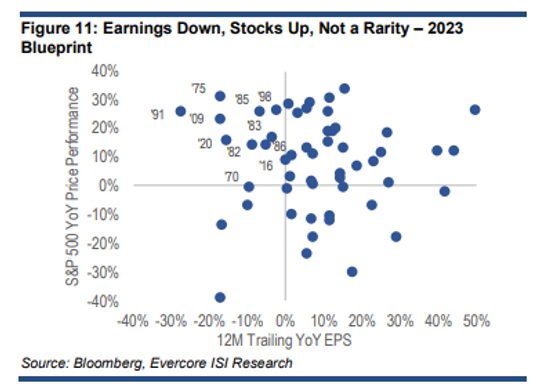

However, Julian Emanuel, strategist at Evercore ISI, reckoned that such concerns don’t necessarily mean stocks can’t rally.

“Forecasting an earnings recession in 2023 to accompany the economic recession that now seems inevitable, along with a 2023 year end S&P 500 price target of 4,150, would seem impossible,” he said in a note to clients.

“Yet not only is there a long history of earnings down/stocks up years (1970, 1982 and 1985 stand out, but there is also the tendency for strong stock/bond return years to follow historically forceful tightening cycles (1982, 1985) particularly in years (1995) following ‘havoc being wreaked’ on a 60/40 portfolio such as 2022’s declines.” Emanuel added.

In addition, a burst of fresh strength in the U.S. dollar on Tuesday – a common reaction to global economic slowdown worries – was likely to further crimp earnings of U.S. multinationals. The ICE U.S. Dollar Index DXY, -0.04%, a gauge of the dollar’s strength against a basket of major currencies, rose 1.1% to 104.64.

Meanwhile, precious metals prices jumped in the first trading session of 2023. Gold prices due in February GCG23, 0.30% advanced to fresh 6-month highs on Tuesday, while March silver SIH23, 0.10% climbed to settle at the highest since mid-April.

U.S. economic data on Tuesday included the December S&P U.S. manufacturing PMI, which showed a read of 46.2, down from 47.7 the prior month. November construction spending was up 0.2% in November, following revised 0.2% loses in October.

Later in the week, investors will be waiting for the release of the FOMC’s meeting minutes on Wednesday and a spate of economic data, including ISM Manufacturing index, job openings and quits, and Friday’s December jobs report.

Companies in focus

- Shares of AMC Entertainment Holdings, Inc. AMC, -3.44% finished 3.4% lower after its rival Cineworld Group PLC CNWGQ, +17.75% said Tuesday that neither the company nor its advisors are in talks with AMC regarding the sale of its cinema assets. AMC said last month that it held discussions regarding a potential strategic acquisition of theaters from the bankrupted Cineworld. Shares of Cineworld jumped 17.8%.

- Shares of Apple Inc. AAPL, -3.74% fell 3.7% on a report that the company has cut MacBook, Apple Watch and AirPod orders from its Asian suppliers, citing weakening demand.

- Linde PLC LIN, -2.40% stocks fell 2.4% after Reuters reported that Russia froze $488 million in the German industrial gas company’s assets.

- Shares of Wynn Resorts, Limited WYNN, +3.81% gained 3.8% with the help of an upgrade from Wells Fargo, which saw a significant reopening opportunity for the hotel and casino operator, citing China’s moves toward a full reopening.