CBI warns uncertainty is crippling UK economy with country at risk of lagging behind G7 competitors

The rising threat of no-deal Brexit has set Britain on course for the biggest decline in business investment since the financial crisis, the Confederation of British Industry has warned.

Paving the way for weaker future economic growth, the CBI warned that business spending in the UK economy was set to decline by about 1.3% in 2019 compared with a year ago – the steepest drop since the last recession in 2009.

The business lobby group warned Brexit uncertainty was preventing firms from investing, crippling the economy and risking the UK falling behind its G7 competitors.

Rain Newton-Smith, the chief economist at the CBI, said: “For any business it’s hard to take spending decisions now. When the risk of a no-deal Brexit feels very real at the moment, why would you take a big decision now? You would wait and see until the end of October. The main risk, though, is we fall off a cliff of no-deal Brexit.”

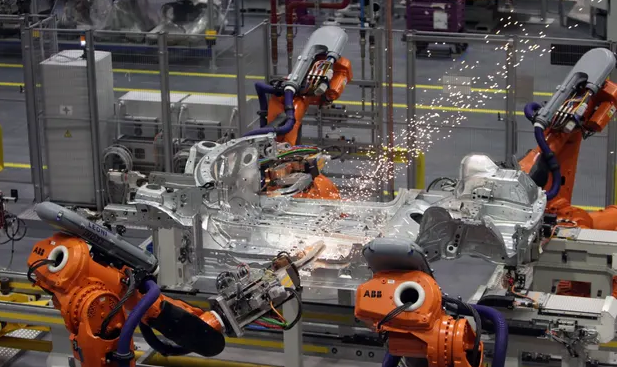

Fears over a no-deal Brexit led business investment to shrink by 0.4% last year, in a marked contrast from other major economies, where investment has continued to rise. Spending by firms on new technologies, buildings and equipment is vital for driving up productivity, which has stuttered in recent years.

The last time business investment dropped further was in 2009, when widespread chaos during the financial crisis caused investment to fall by 16.6% compared with 2008.

Both Tory leadership contenders, Boris Johnson and Jeremy Hunt, have said they would be prepared to walk the UK out of the EU without a deal at the end of October. The potential damage such a scenario could trigger comes at a time when global growth is slowing on the back of the US-China trade dispute, further weighing on growth in Britain.

Despite the mounting risks to the economy, the CBI said it continued to assume that Britain and the EU could reach a deal that would include a smooth transition to a new trading relationship.

It forecast GDP growth would ease slightly to 1.4% in 2019, before a slight acceleration to 1.5% in 2020. The UK economy grew by 1.5% in 2018.

A separate report from the EY Item Club economic forecasting group found that delaying the Brexit deadline beyond Halloween could have an adverse impact on the economy as the uncertainty facing businesses would be extended for longer.

An extension would mean GDP growth slowing to 1.3% next year, compared with a forecast of about 1.5%. However, no-deal Brexit would be worse for the economy, triggering a slowdown that could turn into a recession.

The EY Item Club said growth could fall to 0.3% in 2020 under a no-deal Brexit, before improving to 1.1% in 2021.

The sentiment was echoed in a Deloitte survey of finance chiefs, which found that eight out of 10 believed the long-term business environment would deteriorate as a result of the UK leaving the EU.

Pessimism about the short-term impact remained high, with 62% of finance directors expecting to reduce hiring – the highest level in three years.

Ian Stewart, the chief economist at Deloitte, said: “Events in the last three years, and recent news suggesting the economy shrank in the second quarter, have added to worries about the impact of Brexit. This is not solely a question of the long-term outlook. Brexit has not happened, but it is acting as a drag on corporate sentiment and spending.”