The obesity game is only in its early innings, and the future market will be defined by who can ease administration of the medicines, according to a new report from Evaluate.

Market leaders Wegovy (Novo Nordisk) and Zepbound (Eli Lilly) are only capturing a fraction of the estimated $130 billion market that’s available, with less than $5 billion in sales clocked for the two drugs in 2023, Evaluate said in the World Preview 2024: Pharma’s Growth boost report issued Wednesday.

“The battle for market share has barely begun, and, by the end of the decade, there will likely be more than two in the fight,” Evaluate wrote.

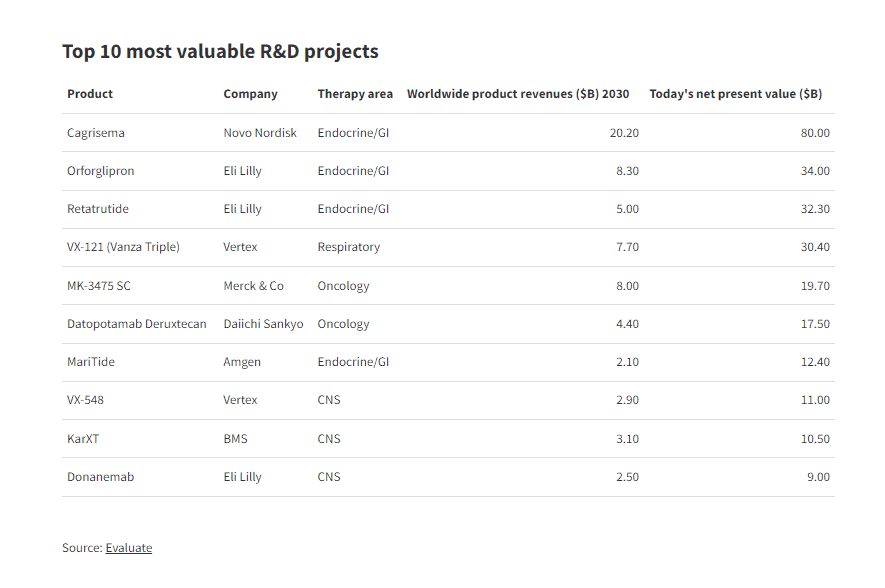

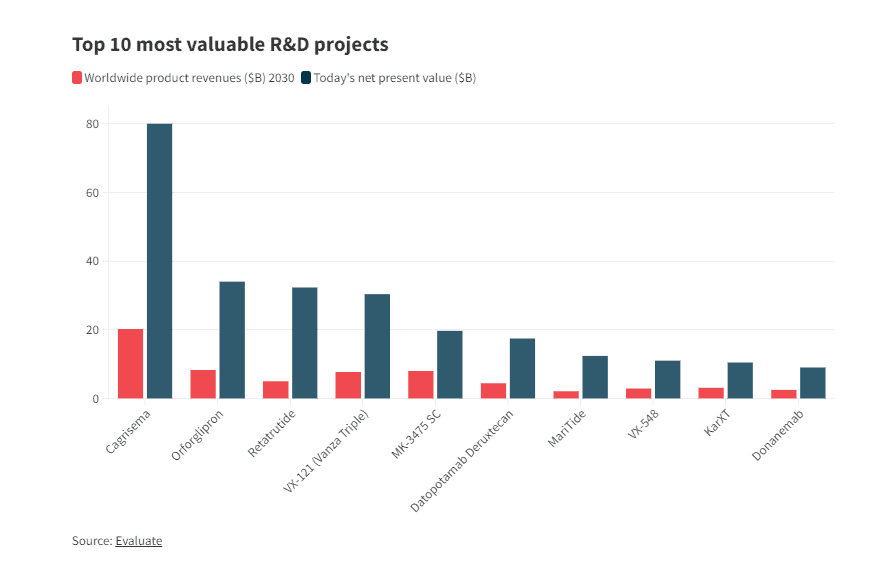

With that kind of cash on the line, three of the top 10 pipeline products are in obesity, with Novo’s phase 3 combo CagriSema in the lead. Evaluate estimates worldwide revenues of $20.2 billion by 2030, and a net present value of $80 billion for CagriSema, which combines Wegovy’s active ingredient semaglutide with an amylin analogue called cagrilintide.

Lilly’s orforglipron is second on the list, with $8.3 billion in 2030 revenue predicted worldwide and a net present value of $34 billion. Another Lilly pipeline med, retatrutide, takes the third slot with $5 billion expected by 2030 and a net present value of $32.3 billion.

Elsewhere on the list, Amgen’s effort MariTide is in seventh place for the most valuable R&D projects ranked by Evaluate. The firm expects $2.1 billion in sales for the obesity candidate by 2030 worldwide with a net present value of $12.4 billion.

Despite the first-to-market advantage owned by Novo and then Lilly, Evaluate says there is plenty of room for new obesity drugs to make their mark.

“Going forward, precise percentages shed—even once in-trial comparisons are available—may be less important than route of administration or dosing frequency,” the report said.

That means orals and injections that can be done further apart than the current once-a-week options like Wegovy and Zepbound will define the next phase. Lilly’s orforglipron is an oral medicine, while Amgen’s MariTide could end up as a once-a-month injection with better tolerability.

The world got its first glimpse of a head-to-head trial of the market leaders this week when Lilly and Novo’s active ingredients went up against each other in their diabetes forms, which are marketed as Mounjaro and Ozempic, respectively. Mounjaro, which contains tirzepatide just like Zepbound, edged Ozempic with patients losing an average of 5.9% of their body weight compared to 3.6% for semaglutide. Over a year, those on tirzepatide lost an average of 15.3% of their body weight compared to 8.3% for semaglutide users.

The study was not a perfect apples-to-apples comparison and involved the diabetes products rather than those marketed specifically for weight loss, which Novo pointed out. But previous separate studies have suggested Lilly’s product is more effective at spurring weight loss.

Other inhabitants of Evaluate’s top 10 most valuable list include Vertex Pharmaceuticals’ cystic fibrosis triple candidate VX-121, oncology meds from Merck & Co. and Daiichi Sankyo, with central nervous system assets from Vertex, Bristol Myers Squibb and Lilly rounding out the list.

All together, the top R&D programs have $65 billion in worldwide sales potential by 2030, according to Evaluate.