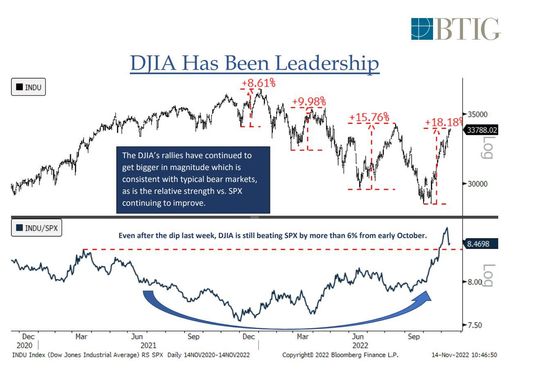

While investors seek shelter in more defensively oriented equity names, one market technician sees the Dow’s growing margin of outperformance over the S&P 500 and Nasdaq as a sign that the latest rebound in stocks might fade away quickly like the last one did.

In a Monday note to clients, Jonathan Krinsky, chief market technician at BTIG, said the Dow Jones Industrial Average DJIA almost never outperforms during the early stages of an enduring equity rally — and when it does, these rallies typically fizzle.

“I don’t think we’re in a durable rebound,” Krinsky said during a phone interview with MarketWatch.

“People are trying to catch upside, but in more of a defensive manner.”

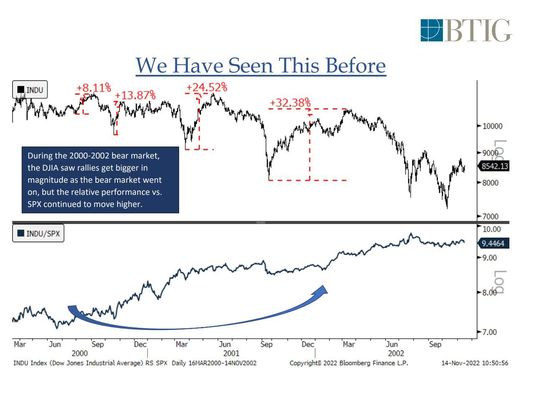

First, Krinsky said that periods of Dow outperformance during the early stages of an equity rebound are incredibly rare over the past four decades of financial-market history. He pointed to four “new bull” markets — 1982, 2002, 2009 and 2020 — as examples.

He pointed to 2002 as a particularly notable example. Like then, U.S. stocks have been caught up in a cycle where the Dow’s margin of outperformance has continued to widen.

Krinsky compared this with a similar pattern that emerged before U.S. stocks finally tumbled to their post-dotcom bottom in late 2002.

As defensive stocks have outperformed previously hot sectors like information-technology or consumer discretionary, professional investors have increasingly pitched them to clients.

Just the other day, UBS Group Chief Investment Officer Mark Hafaele reiterated that he has advised clients to favor defensive sectors like health-care stocks and consumer staples, while avoiding growth stocks like tech.

“We remain least preferred on [information technology] and growth,” he said in a note.

This year, the trend of Dow outperformance started during the first-quarter, when weak big-tech earnings sent shares of Netflix Inc. NFLX, Meta Platforms Inc. META and their peers reeling.

But it has intensified recently. The Dow outperformed both the Nasdaq Composite COMP and S&P 500 SPX during five of the past eight weeks, according to Dow Jones Market Data. And during the eight-week period that ended Nov. 4, the Dow had outperformed both rival benchmarks during six out of the past eight weeks.

A similar pattern emerged during the stretch leading into mid-June, where stocks eventually tumbled to their lowest levels in more than a year.

By the time October’s stellar run for stocks was over, the Dow had risen just shy of 14%, logging its strongest October performance on record. What’s more, it beat the Nasdaq Composite by 3.7 percentage points, the widest margin since 2002, and the S&P 500 by nearly six percentage points, the widest margin since April 1999, according to DJMD.

One reason the Dow is doing so well right now is because it’s heavily composed of defensive stocks. As Krinsky pointed out, UnitedHealth Group Inc. UNH, Goldman Sachs Group GS, Home Depot Inc. HD, Amgen Inc. AMGN and McDonald’s Corp. MCD are responsible for more than one-third of the value of the Dow.

Consumer staples, utilities, health-care stocks, large telecommunications stocks like Verizon and AT&T (although they haven’t been performing so well as of late) and certain types of real-estate investment trusts are typically considered defensive stocks, market strategists said.

So far this year, defensive stocks have performed well, along with energy stocks, which have been by far the best performers of 2022. The S&P 500 energy sector is up more than 70% year-to-date, and Chevron Corp. CVX is the best performer on the Dow, up 60.5%.

Although all three major benchmarks finished lower on Monday, the Dow again outperformed, falling 0.6%, compared with a 0.9% pullback for the S&P 500 and a 1.1% drop for the Nasdaq year-to-date, the Dow has fallen just 7.1%, compared with 17% for the S&P 500 and 28.4% for the Nasdaq.