Alphabet, Meta and Microsoft rank among the most overowned companies

Big investors may be taking the money and running when it comes to some, though not all, heavyweight technology-related stocks right now, with Apple Inc. and Tesla Inc. topping a Jefferies list of the most underowned stocks right now.

The S&P 500 index SPX has nearly made up for a 19% loss in 2022, with a 15% gain so far this year. That’s been driven by tech stocks, with the Nasdaq Composite COMP up 30% to date in 2023, versus a 33% loss in 2022. But the Nasdaq recently capped its worst two-week stretch since December, weighed down in part by rising bond yields.

Up 36% for 2023 so far, Apple AAPL, -0.50% topped this Jefferies list published Wednesday of the top 20 stocks owned by U.S. long-only funds, followed by EV leader Tesla TSLA, -3.16% :

Apple is up 36% since the start of the year, while Tesla has climbed 89%. Both have more than recouped 2022’s losses. Warren Buffett’s Berkshire Hathaway BRK.B, -0.11% BRK.A, -0.11% ranked as the No. 5 most underowned company on the Jefferies list.

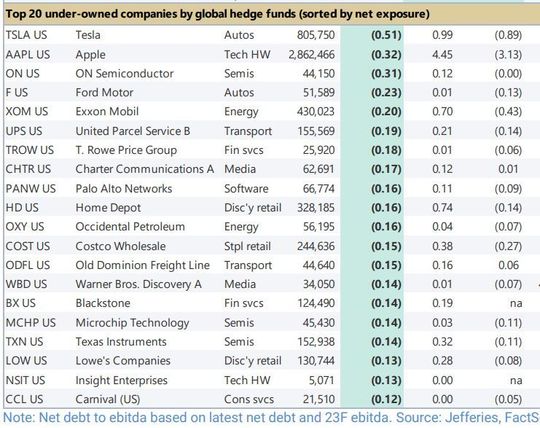

Jefferies offered a separate breakdown for the most underowned stocks among global hedge funds, with Tesla and Apple again at the top, along with Ford F, -1.42% and Exxon XOM, -1.68% :

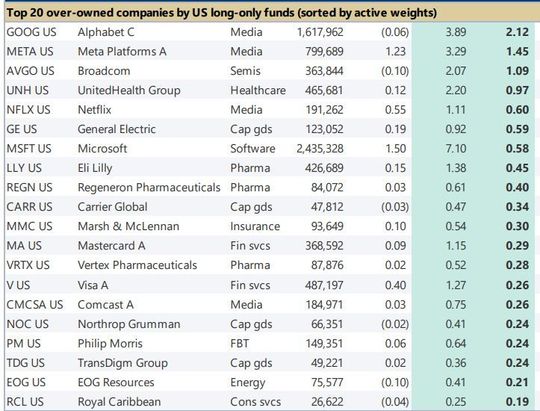

As for overowned stocks, Alphabet GOOGL, -0.83% GOOG, -0.89% and Meta Platforms META, -2.54% were at the top of a list of 20 names held by U.S. long-only funds, with Netflix NFLX, -1.95% also in the top five. Meta has surged 150% this year, while Alphabet has gained 47% and Netflix 43%.

Among global hedge funds, Microsoft MSFT, -0.24%, Meta and Nvidia NVDA, -1.03% were the top three overowned names, followed by Amazon.com AMZN, -1.89% and Activision Blizzard ATVI, -0.07%. Nvidia stands out in that group with a gain of 200% this year, amid a clamor for artificial-intelligence-related holdings.

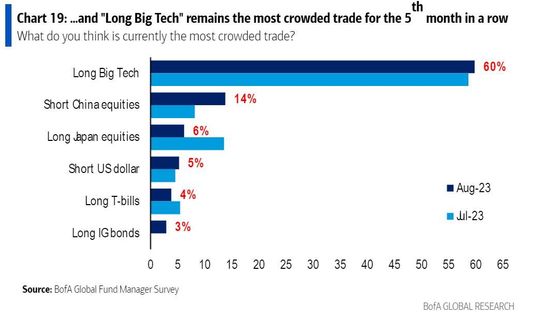

For those investors growing wary of sticking with tech stocks, and maybe feeling that it’s time to cash in on their recent winnings, Bank of America’s August global fund managers’ report revealed that a bullish position in tech stocks was the most crowded trade for a fifth straight month:

That report also revealed that fund managers are the least bearish they’ve been in over a year, viewed as a contrarian indicator for investors.