Critical information for the U.S. trading day

Wall Street looks ready to try to break with a three-day selloff, but with no sign of a halt to the devastating carnage nor a diplomatic solution to the Russia-Ukraine war, that looks like a tall order.

Oil swung back into focus on Monday, as investors began to fret not just about problems for Europe when the conflict eventually (hopefully soon) ends, but U.S. economic fallout from commodity inflation. That left the Dow industrials DJIA in correction territory and the Nasdaq COMP in a bear market.

While this month is already standing out for obvious geopolitical reasons, studies show March tends to follow specific equity patterns. As Almanac Investor’s Jeffrey Hirsch has previously explained, most March gains take place in the beginning and middle of the month, while the second half is mostly negative.

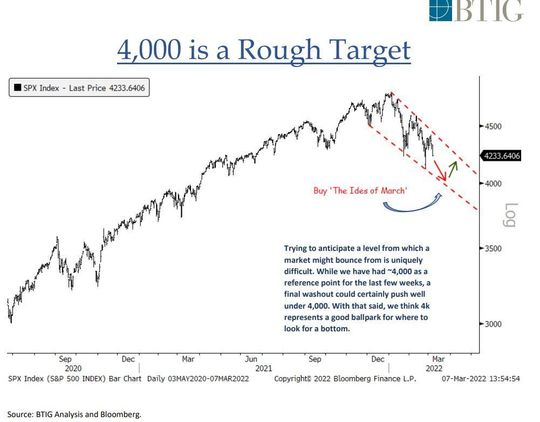

Our call of the day, from BTIG’s chief market technician Jonathan Krinsky, is also looking at March patterns for stocks, and he thinks a bottom could be near. But he also offered a warning that a final “washout” for stocks hasn’t yet arrived.

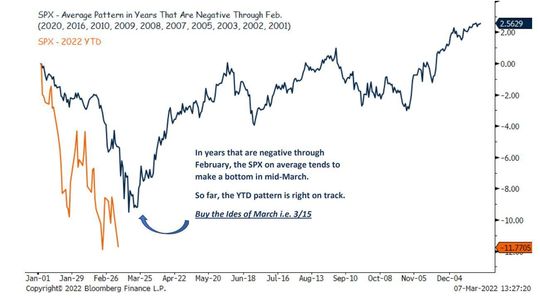

As Krinsky pointed out, in years that are negative through February, the S&P 500 on average tends to bottom in mid-March.

“So far, the YTD pattern is right on track, but we are lacking the full washout. We expect to get that as we approach March 15,” he said. As his chart shows, the S&P 500 was down 8.2% in the first two months of the year, and since 2000, there have been 10 years that were negative through February.

“The good news is that only three of those years (’01, ’02, and ’08) saw the SPX finish the year in negative territory and ‘on average’ they tended to make durable lows in March. The bad news is we don’t think we are quite ‘there’ yet,” said Krinsky.

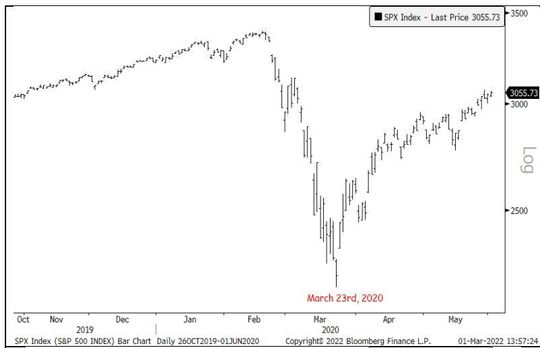

He pointed out that major market bottoms were made in March 2003, March 2009 and March 2020, while temporary bottoms were seen in March 2001, 2007 and 2008.

“While it’s difficult to know which of those we could be approaching, we think at least a tradable low is approaching later this month, albeit from a lower level,” said Krinsky.

As to where that final washout may take place, he said BTIG has been targeting 4,000 for a few weeks, but wouldn’t rule out a level under that marker.

For the bottom to come, Krinsky wants to see further weakness in breadth — advancing stocks versus declining stocks — and he cautioned against “using sentiment in a vacuum.”

“We get the appeal of being bullish because everyone else is bearish, but it’s important to remember it’s not always a contrarian signal. Further, while sentiment surveys are bearish, put/call ratios remain rather complacent,” he said.

As for sectors, he sees more breakdown risk ahead for discretionary/staples, retail and semiductors.

The buzz

The U.S. administration is reportedly expected to announce a ban on Russian oil and gas on Tuesday. Russian Deputy Prime Minister Alexander Novak has warned that the world faces $300-a-barrel oil if a ban goes ahead, and also threatened to cut off Europe’s vital gas pipeline. The EU is expected to announce plans on Tuesday to cut reliance on Russian energy.

Shell UK:SHEL SHEL said it would phase out Russian oil and gas in response to the Ukraine invasion, and will immediately halt all spot purchases of Russian crude.

The European Union is reportedly considering a joint bond issue to finance energy and military spending, news that initially gave European stocks and U.S. equity futures a decent lift.

Two million refugees have flooded out of war-torn Ukraine, with packed buses attempting once again to leave hard-hit cities such as Sumy and Mariupol on Tuesday.

Google GOOG has announced a $5.4 billion in deal to buy cybersecurity company Mandiant MNDT.

Meanwhile, commodities volatility found a fresh target on Tuesday, with nickel prices surging past $100,000 on the London Metal Exchange before a trading halt.