Treasury yields and the dollar are trading at levels that represent ‘headwinds’ for stocks, analyst says

Stocks rose to kick off a holiday-shortened week on Monday, but the bond market and the U.S. dollar will likely need to cooperate for the equities rally to resume in smooth fashion, a closely followed market watcher said Monday.

The U.S. dollar and Treasury yields both extended their recent rise Monday, trading at levels that don’t do stock-market bulls any favors, analysts said. Both the dollar and yields soared last Wednesday after the Federal Reserve signaled it would deliver fewer interest-rate cuts in 2025 than policymakers previously anticipated.

The 10-year yield TMUBMUSD10Y+4.615% reached its highest level since late May, while the ICE U.S. Dollar Index DXY-0.09%hit its highest in more than two years. Yields move opposite to bond prices.

Both yields and the dollar pulled back on Friday after a key inflation reading sparked relief, but were on the rise again Monday. The 10-year Treasury yield saw a 7.2 basis point rise to 4.594%, its highest finish based on 3 p.m. Eastern time levels since May 29, according to Dow Jones Market Data. The dollar index, which measures the currency against a basket of six major rivals, rose 0.4% to trade at 108.09. The DXY on Friday hit a high of 108.54, its loftiest since November 2022.

The dollar is a “slight” headwind and the 10-year yield a “mild” one at recent levels — but those will become more of a problem the higher they go from here, said Tom Essaye, founder of Sevens Report Research, in a Monday note.

Stocks managed to withstand those headwinds Monday, albeit in thin preholiday trading conditions. The Dow Jones Industrial Average DJIA+0.91% erased a decline ahead of the closing bell to finish with a gain just shy of 100 points, or around 0.2%. The S&P 500 SPX+1.10% rose 0.8%, lifted by chip stocks, while the tech-heavy Nasdaq Composite COMP+1.35% gained 1%.

Major indexes suffered losses last week, and the Dow and S&P 500 remain in negative territory for the month. The S&P 500 is on track for a stellar 2024 gain of more than 25%, however. The stock and bond markets close early Tuesday and will be shut Wednesday for Christmas Day.

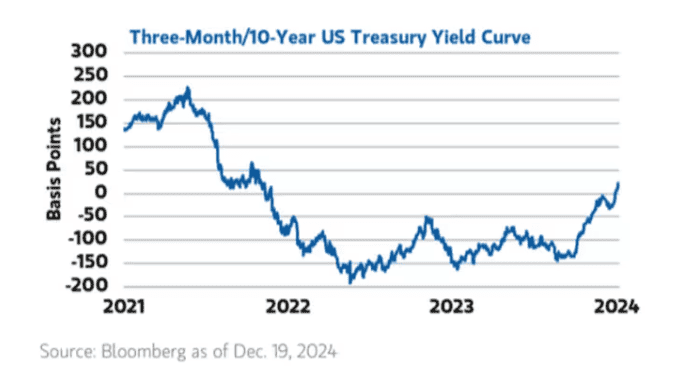

Meanwhile, the yield curve — a line measuring yields from the shortest to the longest Treasury maturities — last week fully uninverted, strategists noted. In other words, it’s returned to its normal shape, where long-dated yields are higher than short-dated ones. It ends a lengthy period where some long-dated yields were trading below short-dated yields.

The inversion of the 3-month Treasury bill/10-year Treasury note yield raised alarm bells, as it’s been seen as a reliable harbinger of recessions in the past. The lengthy inversion amid a resilient U.S. economy raised doubts about its forecasting power this time around — though analysts have also noted that it’s the subsequent reversal of an inversion that has tended to more immediately precede a downturn.

Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, argued that the significance of the end of the 3-month/10-year inversion is that it may signal that investors “finally understand that the disinflationary growth formula that powered the past 15 years is giving way to a reflationary nominal growth paradigm.”

“This suggests long-duration stock valuations will eventually push lower,” Shallett wrote in a note Monday.

Higher long-term yields, meanwhile, are seen as a headwind for stocks in large part because they make it harder to justify loftier valuations. A higher yield means the present value of future profits is lower.

Essaye argued that both bonds and the dollar may hold the key to whether stocks find their footing soon.

“Bottom line, calm currency and bond markets are what stocks need to continue to rally and we got the opposite last week. The sooner these markets calm (meaning declines in the 10-year yield and the dollar Index), the better it will be for markets (and some reassuring data or Fed speak on their commitment to continuing rate cuts will help that effort),” he wrote.