Nvidia shares fall 1.8% as investors weigh potential new restrictions on sales to China

U.S. stocks finished a choppy session mostly lower on Wednesday after Federal Reserve Chairman Jerome Powell reiterated that the central bank is likely to raise interest rates twice more this year.

Investors also focused on the potential for the Biden administration to consider new restrictions on exports of artificial-intelligence-related products to China, which hit technology stocks.

How stocks traded

- The Dow Jones Industrial Average DJIA, -0.22% lost 74.08 points, or 0.2%, to end at 33,852.66

- The S&P 500 SPX, -0.04% dropped 1.55 points, leaving it nearly flat at 4,376.86

- The Nasdaq Composite COMP, +0.27% gained 36.08 points, or 0.3%, to finish at 13,591.75

On Tuesday, the Dow Jones Industrial Average rose 212 points, or 0.63%, to 33,927, the S&P 500 increased 50 points, or 1.15%, to 4,378, and the Nasdaq Composite gained 220 points, or 1.65%, to 13,556.

What drove markets

Traders Wednesday digested the latest commentary by central bank leaders from around the world at the European Central Bank’s annual forum in Sintra, Portugal. Fed Chairman Powell, Bank of England Governor Andrew Bailey, ECB President Christine Lagarde and Bank of Japan Governor Kazuo Ueda took the stage to defend their monetary policies and vowed to keep working to combat the inflation.

Powell reiterated in the panel discussion on Wednesday that a “strong majority” of Fed policy makers were looking for two more quarter-percentage-point interest-rate increases this year, potentially at the next policy meeting in July. The Federal Open Market Committee will hold its next meeting from July 25 to July 26, and the following one from Sept. 19 to September 20.

Powell also said he, “wouldn’t take moving consecutive meetings off the table at all.”

“Although policy is restrictive, it may not be restrictive enough and it has not been restrictive for long enough,” Powell said.

Central bankers at the gathering struck a hawkish tone, suggesting that interest rates haven’t yet peaked, and cuts are not on the cards for some time, said Jennifer McKeown, chief global economist at Capital Economics. However, there were some differences in tone, she said.

The Fed seems closer to peak rates than either the ECB or the Bank of England, said McKeown. While officials all three sounded distinctly hawkish, Powell highlighted early signs of loosening in the labor market, but neither Lagarde nor Bailey had seen any such cause for relief, she said.

“Powell was keener to stress that interest rates are in restrictive territory and that the closer they come to the peak, the higher the risk of doing too much,” wrote McKeown in emailed commentary on Wednesday. “Both Lagarde and Bailey seemed more concerned about the risk of doing too little and allowing inflation expectations to become unanchored.”

Fed fund futures traders were pricing in an 82% chance that the Fed will raise its key interest rate by 25 basis point in July, according to CME FedWatch Tool.

“There’s still some level of uncertainty out there about what the Fed’s going to do and how many more times they are going to hike,” said Chris Fasciano, portfolio manager at Commonwealth Financial Network. “So I think we are going to continue to see this volatility in the market based on the news or the Fed commentary of the day.”

Meanwhile, positive economic data, including the consumer-confidence index published on Tuesday, point to “the soft landing scenario is in play,” Fasciano said in a call. “I think that’s all part of this data point-to-data point volatility.”

Powell said on Wednesday that a recession is “not the most likely case,” but certainly possible.

Weighing on sentiment though was a report that said the Biden administration is considering a new ban on sales of AI chips to China.

Nvidia’s chief financial officer Colette Kress said during a webinar on Wednesday that she sees no near-term impact to its business should the Biden administration widen U.S. export bans on AI tech to China, but voiced concern about long-term impacts of a move.

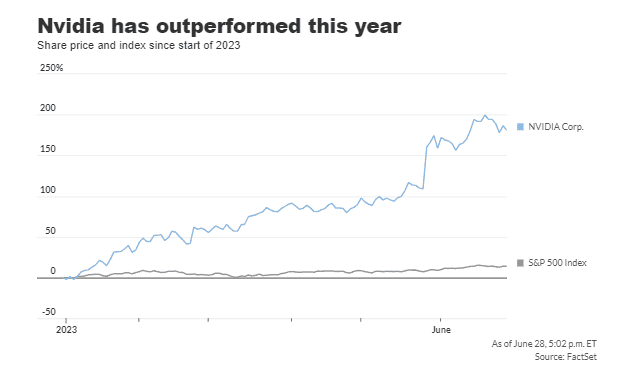

Nvidia NVDA, -1.81% stock ended down 1.8% Wednesday, while Advanced Micro Devices AMD, -0.20% was off 0.2% and Intel Corporation INTC, -1.55% tumbled 1.6%. The iShares Semiconductor ETF SOXX, -0.77% declined by 0.8%.

“Nvidia, which makes 20% of its revenues in China, has produced lower-end chips that don’t require an external export license. However, [The Wall Street Journal] article suggests that even these may be included going forward,” said Jim Reid, strategist at Deutsche Bank.

U.S. bank shares slipped ahead of the Fed’s annual “stress test” results, which would help determine whether the nation’s largest banks could withstand a severe economic downturn. The Invesco KBW Regional Banking ETF KBWR, -0.62% shed 0.6%, while the SPDR S&P Bank ETF KBE, -0.36% was down 0.4%. The Fed is set to release the results after the closing bell on Wednesday.

In U.S. economic data, the trade deficit in goods narrowed 6% in May due to lower oil prices and less demand among consumers for imports, perhaps a sign of a softer U.S. economy. The trade gap in goods declined to $91.1 billion from a six-month high of $97.1 billion in April, the Census Bureau said. U.S. advanced retail inventories in May jumped 0.8%, while U.S. advanced wholesale inventories in May drop 0.1%.

Investors awaited initial jobless claims data and the final reading of first-quarter GDP Thursday morning, as well as the personal-consumption expenditures (PCE) index update on Friday to assess the state of the economy.

Companies in focus

- General Mills GIS, -5.17%Inc.’s stock finished 5.2% lower Wednesday, after the parent of brands including Cheerios, Nature Valley, Blue Buffalo pet products and Pillsbury, posted a steep decline in profit and weaker-than-expected sales for its fiscal fourth quarter.

- Mullen Automotive Inc. MULN, -19.52% sank 19.5%. The ongoing selloff comes even after the company said Tuesday that it received an additional $100 million in funding from certain investors, which leaves the company with more than $235 million in cash and cash equivalents on its balance sheet.

- Roivant Sciences Ltd. ROIV, +11.27% shares went up 11.3% after the company said it had a net loss of $33.6 million, or 20 cents a share, for its fiscal fourth quarter to March 31, narrower than the loss of $270.1 million, o4 39 cent a share, in the year-earlier period.

- Cruise stocks soared on Wednesday with shares of Carnival Corporation CCL, +8.81% up 8.8% and Norwegian Cruise Line Holdings NCLH, +7.55% jumped 7.6%.