A new tool from Siemens Healthineers’ Varian Medical Systems unit allows doctors to capture images of tumors in mere seconds and calculate changes in both the tumor and nearby organs, then use those data to adapt a patient’s treatment over time.

The HyperSight technology will soon be available to healthcare providers in the U.S. and Europe, as a pair of Varian radiation therapy systems equipped with the imaging tool recently received both FDA and CE mark clearance, the company announced this week.

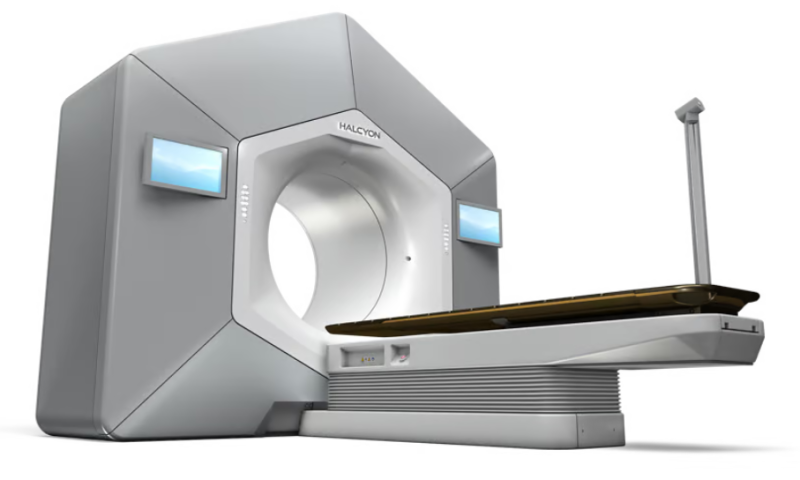

The cleared systems are Varian’s Ethos and Halcyon image-guided radiotherapy machines. The latter was used in the first official HyperSight-equipped procedure, which took place at Penn Medicine on Wednesday, per Varian’s announcement.

The HyperSight cone-beam computed tomography (CBCT) technology works while an Ethos or Halcyon machine delivers its radiation therapy. According to Varian, while other CBCT scanners can take up to 60 seconds and require some cancer patients to repeatedly hold their breath in order to capture a steady image during that time, HyperSight churns out clear images in as few as six seconds.

Not content to beat them only in speed, Varian claims its technology also produces larger and higher-contrast images than the conventional linear accelerator-based scanners of its competitors. The resulting images are used to pinpoint the location of a tumor and therefore guide daily radiation treatments.

They may also help doctors adjust treatment as needed. HyperSight’s scans include quantitative data showing how the radiotherapy is changing the tumor and surrounding anatomy, allowing doctors to map out radiation dose distribution—which has typically required a separate CT scan to calculate—and so alter the treatment if necessary.

In a statement, Kevin O’Reilly, Varian’s president of radiation oncology solutions, cited its recent acquisition by Siemens for improving the subsidiary’s ability to churn out high-tech products like HyperSight.

“Becoming a Siemens Healthineers company has given us an opportunity to sharpen and accelerate these efforts, with a focus on connecting the power of imaging inside and outside the treatment room,” he said.

The $16.4 billion buyout was completed in April 2021. In just its first six months under the Siemens umbrella, Varian added 1.3 billion euros to Siemens’ earnings, contributing to a fiscal year that the medtech giant said brought in record revenues. A year later, Varian added nearly 3.1 billion euros to its parent company’s fiscal 2022 revenues—which broke the record set the previous year.

But things have taken a slight turn in fiscal year 2023, which kicked off in October. After posting consistent growth throughout Varian’s first year and a half on Siemens soil, a first-quarter earnings report released this week shows that the subsidiary’s revenues dropped 4.5% on a comparable basis.

Siemens attributed the fall to “supply chain delays due to a problem at a supplier”—focused specifically in the Asia-Pacific region—but assured investors that the issue has since been resolved and that revenues will return to normal in subsequent quarters.