Chipmakers appear primed for rapid growth for years to come

The shortage of microchips might prompt an investor to believe that these are golden times for semiconductor manufacturers because high demand and limited supply can combine for higher prices and rising profits.

But the low supply can also hurt sales in the short run. Analysts are sending mixed signals.

So it might be best for investors to focus on the industry players that are expected to increase their sales the most over the next few years.

Earnings season for semiconductor manufacturers is long, running until mid-November. But several of the largest industry players will report financial results this week, according to schedules supplied by FactSet:

- Entegris Inc. ENTG will report quarterly results on Oct. 26, before the market opens.

- Advanced Micro Devices Inc. AMD will announce results on Oct. 26 after the market closes. Wallace Witkowski previews AMD’s results, which may stand in contrast with last week’s disappointment for Intel Corp. INTC.

- Texas Instruments Inc. TXN and Teradyne Inc TER. will also report on Oct. 26, after the market closes.

- KLA Corp. KLAC will report on Oct. 27, after the close, as will Xilinx Inc. XLNX.

- STMicroelectronics NV STM will report on Oct. 28, before the market opens, as will United Microelectronics Corp. UMC and ASE Technology Co. ASX.

- Monolithic Power Systems Inc. MPWR will report after the close on Oct. 28.

An analysis of longer-term sales-growth prospects for the 30 components of the iShares Semiconductor ETF SOXX is below.

Short-term or long-term?

Are you a long-term investor or a stock trader? That’s an important question when it comes to the semiconductor industry group.

Consider this comment from Cowen Research analyst Krish Sankar in his earnings preview for the semiconductor industry on Oct. 12: “We really like the sector, but the next catalyst feels like Intel analyst day (11/18) rather than this earnings season.” That was from a “trading standpoint,” he wrote.

Sankar also wrote that the fundamentals for semiconductor manufacturers remained strong, but added that “the stocks can’t seem to hit escape velocity from double ordering and memory cycle concerns.”

Demand for data storage runs in cycles. But demand for microprocessors for myriad applications, from electric vehicles to just about any electric device or appliance you can imagine, seems likely to continue increasing over the years.

Sankar’s colleague Joseph Giordano tied the current economic environment (which features shortages of materials, semiconductors and labor, among other things) with a longer-term thesis in his “Seeing Robots Everywhere” report on Oct. 18. “If 100 humans are required but only 50 will be available, then robotics must fill that void,” he wrote.

Giordano believes we are still in the early stages for development of robotics, but he added that “deployments are scaling, and we are well past the conceptual stage as companies are acting now to protect their futures.”

That concept — companies protecting themselves by automating various processes — points to the continued growth of demand for all sorts of electronic components. The long-term thesis for chip makers and related equipment and systems providers remains solid.

And the industry as a whole isn’t trading at a premium to the broad U.S. stock market, as represented by the S&P 500 Index SPX. The SOXX group trades for 19.6 times weighted consensus earnings estimates for the next 12 months among analysts polled by Fact Set — below the forward price-to-earnings ratio of 20.9 for the SPDR S&P 500 ETF Trust SPY.

Regardless of the industry’s valuation based on the next year’s earnings, long-term investors looking to book significant profits a few years down the line might want to focus on the industry players expected to increase their sales the most.

The SOXX group — sales-growth buckets

Analysts love uniform data. The problem is that they usually cannot get it. So we will break down the 30 SOXX stocks by how far out available sales estimates go.

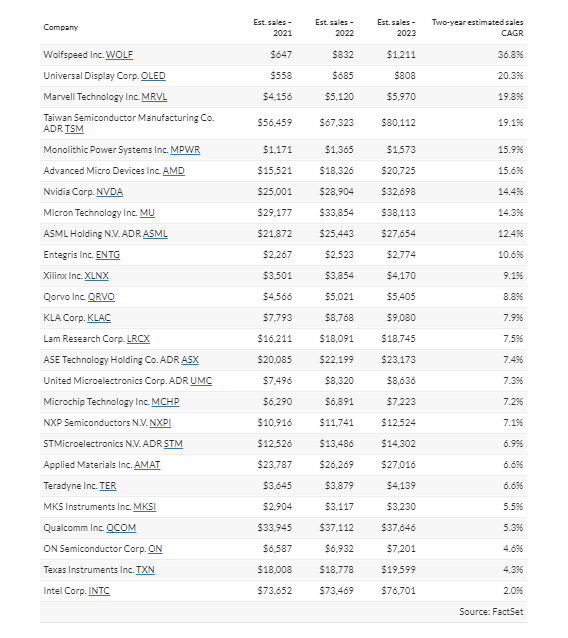

For starters, here are consensus sales-per-share estimates for the SOXX ETF itself, among analysts polled by FactSet, for the next two full calendar years, which is as far out as the available data goes:

We are using calendar-year estimates because many companies report fiscal years that don’t match the calendar.

A compound annual growth rate (CAGR) for sales per share of 10.55% is nothing to sneeze at. In comparison, the sales-per-share CAGR for the S&P 500 is expected to be 5.65% through 2023. while the S&P 500 information technology sector’s sales CAGR from 2021 through 2023 is expected to be 5.24%.

But you might want to look further out, if possible.

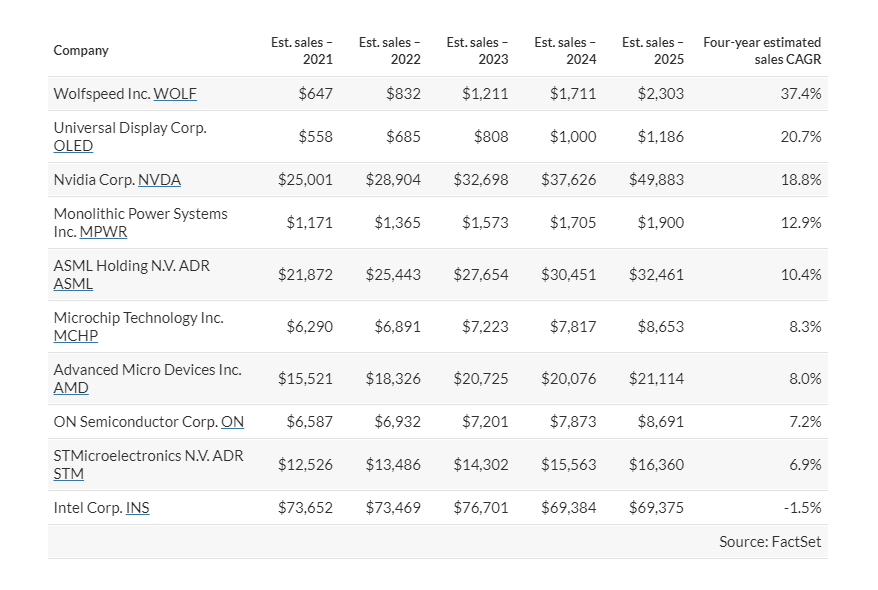

The 2025 group

Among the 30 stocks in the SOXX group, calendar-year consensus sales estimates through 2025 are available for 10 companies. Here they are, ranked by expected four-year sales CAGR. Sales figures are in millions of dollars:

Click on the tickers for more about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on MarketWatch’s quote page.

Wolfspeed Inc. WOLF tops the four-year CAGR list, with analysts expecting rapid growth following a transformation, through which the company divested several business lines and increased production capacity to become a pure-play chip manufacturer. The company was known as Cree Inc. until Oct. 4.

Intel Corp. is on the bottom of the list. The company is going through a transition under CEO Patrick Gelsinger, who rejoined Intel in February and is now focused on developing new technology and expanding manufacturing capacity.

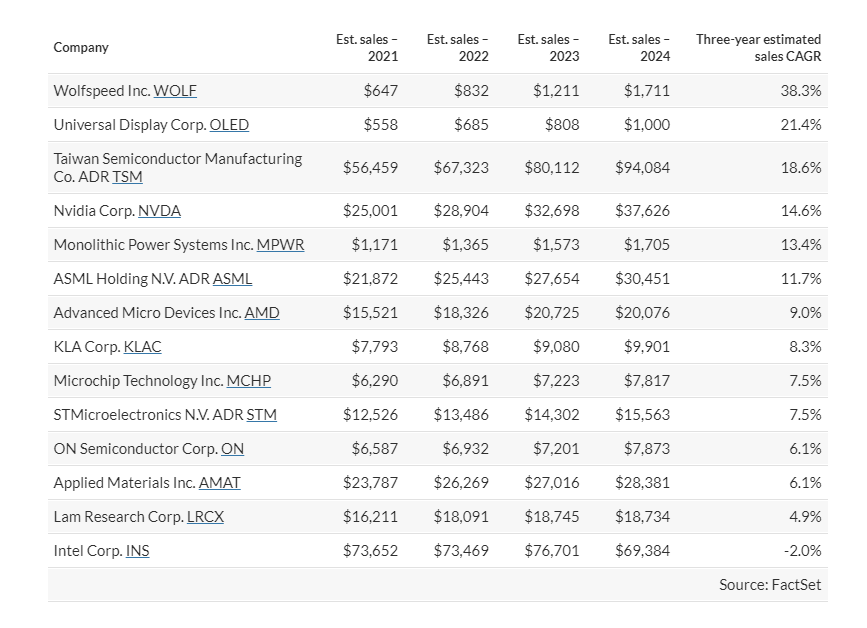

The 2024 group

Among the 30 stocks, sales estimates are available through 2024 for 14 companies. Here they are, ranked by expected three-year sales CAGR:

Full SOXX group through 2023

Among the 30 companies in the SOXX group, consensus sales estimates are available through calendar 2023 for all but four companies:

- Analysts estimate Broadcom Inc. will grow sales 7.1% to $29.72 billion in 2022 from $27.74 billion in 2021.

- Analog Devices Inc. ADI is expected to increase its sales 28.9% to $9.76 billion in 2022 from $7.57 billion in 2021.

- Analysts expect Skyworks Solutions Inc. SWKS to book sales of $5.86 billion in 2022, up 11.4% from an estimated $5.26 billion in 2021.

- Lattice Semiconductor Corp. LSCC is expected to increase sales 11.7% to $557 million in 2022 from $499 million in 2021.

Here are the remaining 26 companies in the SOXX semiconductor industry group ranked by expected two-year sales CAGR through 2023: