Ben Lofthouse of Janus Henderson says investors need to look ahead to avoid companies in disrupted industries

Ben Lofthouse, the head of global equity income at Janus Henderson Investors, understands how difficult life can be in this years-long low-interest-rate environment. But he advises income-seeking investors to think carefully about companies that might look like solid dividend payers but whose industries are changing so dramatically that the stocks (and their dividends) may be headed over a cliff.

“The danger for income investors is picking up a disproportion of disrupted businesses,” he said during an interview, citing high-yielding stocks of retailers as an example. “It is important to consider how you generate the yield, rather than how high the yield is.”

He believes managing this type of risk is more important than worrying about headline-driving events, such as the ongoing trade conflict between the U.S. and China.

‘There are new businesses evolving very quickly, and old, very profitable businesses that are being disrupted.’Ben Lofthouse, head of global equity income at Janus Henderson Investors

Lofthouse co-manages the $4.4 billion Janus Henderson Global Equity Income Fund HFQIX, +0.16% and the $169 million Janus Henderson Dividend & Income Builder Fund HDIVX, +0.24%.

The August edition of the Janus Henderson Global Dividend Index study makes for fascinating reading and can be downloaded here in full. You might not expect such a high-level review of corporate dividend payment trends to apply to you, but it is informative, not only about opportunities in dividend stocks in a world that is starving for yield, but for investors who want to avoid getting burned.

Avoiding ‘disruption’

Lofthouse pointed to dividend cuts this year by Daimler AG DAI, +0.76% and BMW AG BMW, +0.24% as examples of what can happen to venerable companies when an industry is being transformed.

“Where the biggest danger and threat lies at the moment is disruption,” he said, adding: “There are new businesses evolving very quickly, and old, very profitable businesses that are being disrupted.”

It is important for two of those words, “very profitable,” to sink in. Preconceived notions aren’t the friend of a long-term investor.

Think ahead. Do you believe a company you are considering for investment is likely to remain competitive in providing goods and services for the next decade or two? The auto industry is certainly in a transitional phase — probably a very long one.

You might also be careful with companies in cyclical industries, but Lofthouse made another interesting point: “Some of the biggest cuts we highlight in the index come from companies such as Anheuser-Busch InBev BUD, +0.70% and Kraft Heinz KHC, +0.68%, which are not cyclical.”

Lofthouse said: “What may be a bigger threat to dividends are debt levels.” Anheuser-Busch InBev cut its dividend in October, while Kraft Heinz did so in February. Both companies cited “deleveraging” plans when announcing the reduced payouts.

Consider merger-deal announcements you have read: Some of those have included massive issuance of debt, which the combined company is saddled with. Nothing new has been created, but the combined company is, arguably, less healthy than the cobbled-together parts. Unless you have a fervent belief in the breathless, flowery language about “transformation” and “innovation” boards of directors will use when describing such deals, maybe the best thing to do is sell your shares of the acquirer or the target as soon as a large leveraged merger is announced.

Equities for income

The S&P 500 SPX, +0.65% had a weighted aggregate dividend yield of 2.03% as of the market close on Aug. 26, according to FactSet. That was well above the 1.46% yield on 10-year U.S. Treasury notes TMUBMUSD10Y, -1.53%, and it even exceeded the 1.96% yield on 30-year U.S. Treasury bonds TMUBMUSD30Y, -0.41%.

When asked if traditional bond-oriented income investors had gotten the message that equities were a reasonable place to look for yield, Lofthouse said that “the biggest switches have been in sovereign entities,” including the Norwegian pension fund, the Swiss National Bank and the Japanese government pension fund. Other entities with mandates to purchase European bonds are now suffering with negative-yielding bond investments. We may be in for a long period of transformation as insurers and other institutional entities go through the formal processes of changing their rules to allow more equity investments. That potentially means even more support for U.S. stocks than we are already seeing in the low-rate environment.

Attractive equity income opportunities

Lofthouse said investors seeking stocks with attractive dividends should build diversified portfolios that include a combination of higher payers and those that can increase payouts as they grow income.

He cited Nestlé NESN, +0.20% and pharmaceutical giants NovartisNOVN, -0.68% and Roche ROG, -0.52% (all based in Switzerland) as examples of businesses that “are not very cyclical” and have “quite a lot of brand or intellectual property.”

Looking to the U.S., Lofthouse said “things that have worked” have included Crown Castle CCI, +0.26%, a real estate investment trust that owns cell towers and related fiber networks, and data-center REITs, such as CyrusOneCONE, +0.93%.

All those companies “are quite cash generative. Some have decent barriers to entry or some uniqueness — location or intellectual property,” he said.

When screening stocks, Lofthouse said he and his team look for yields of at least 2% to 2.5% that are covered by free cash flow, while making sure the companies haven’t been “levering up.” Then they consider historical records for generating attractive returns, and the moats mentioned above.

He cited two long-term holdings of the Janus Henderson Dividend & Income Builder Fund — Microsoft MSFT, -0.13% and Coca-Cola KO, +0.71%.

Even after several years of success in building its cloud business and moving products to a subscription model, Microsoft’s “growth rate has been accelerating,” Lofthouse said. He said Coca-Cola was “showing signs of life.”

Top fund holdings

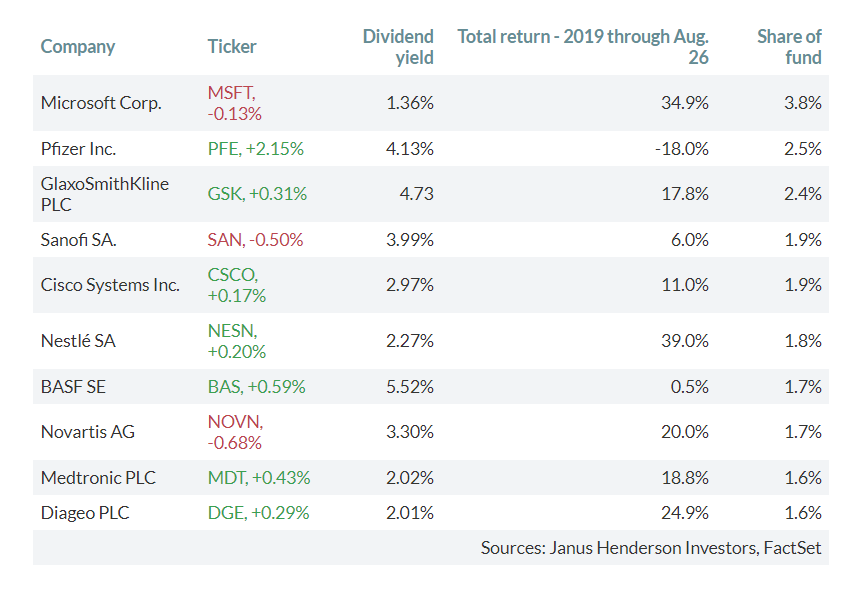

The Janus Henderson Global Equity Income fund had 67% of its portfolio invested in Europe, with 16% in the U.S., and 15% in Asia and Japan as of July 31. Here are the fund’s top 10 holdings (of 81) as of that date:

You can click on the tickers for more about each company.

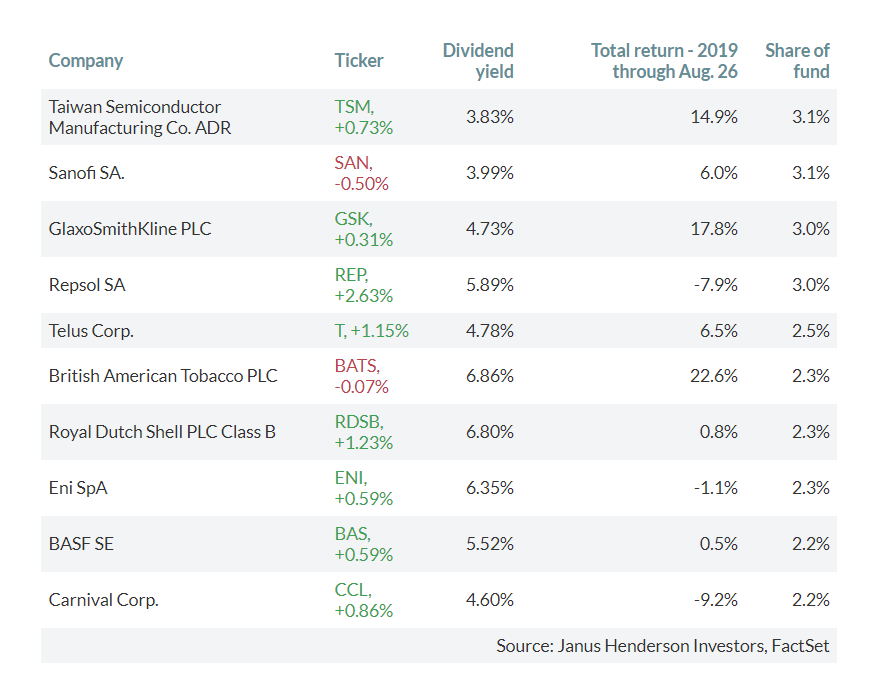

The Janus Henderson Dividend & Income Builder Fund was about 21% invested in bonds as of July 31, with the rest in equities. The fund was 52% allocated to Europe, with 43% in the U.S. and 3% in Asia and Japan. Here are the fund’s top 10 equity holdings (of 75) as of July 31: