While Sanofi is looking to move more of its R&D in-house, there is still room for deals, and today it’s penned a big one with Fierce 15 winner Kymera Therapeutics.

This is a pivotal year for Kymera: After spending four years building the company around its protein degradation technology, it’s now setting its sights on the clinic—bagging $102 million in a series C to help back in March.

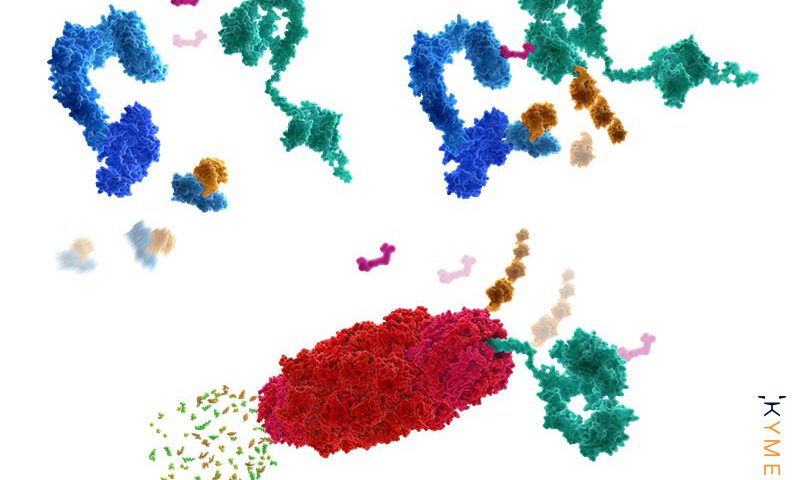

The Cambridge, Massachusetts-based biotech’s approach makes use of the body’s protein degradation machinery to get rid of disease-causing proteins. Sanofi is now buying into its platform, laying a sizable $150 million as an upfront with more than $2 billion in potential milestones plus royalty payments, should all go to plan.

This is a multi-program collab that sees the French Big Pharma tap Kymera to develop and sell first-in-class protein degrader therapies targeting IRAK4 in patients with immune-inflammatory diseases.

The companies will also partner on a second, earlier-stage program. Kymera retains the option to participate in U.S. development and sales for both programs.

The R&D focus is on its small-molecule IRAK4 protein degraders: IRAK4 is believed to play a key role in multiple immune-inflammatory diseases, including hidradenitis suppurativa, atopic dermatitis and rheumatoid arthritis.

Kymera will advance the IRAK4 program through phase 1; should all go well, Sanofi will then take over, while also leading all clinical development activities for the second program. Kymera holds on to the rights for its IRAK4 program in cancer.

IRAK4 is a key protein involved in inflammation mediated by the activation of toll-like receptors (TLRs) and IL-1 receptors (IL-1Rs). While TLR and IL-1R signaling via IRAK4 is involved in the normal immune response, aberrant activation of these pathways is the underlying cause of multiple immune-inflammatory conditions

Fierce Biotech spoke to both companies about the deal, asking Kymera’s CEO Nello Mainolfi what it’s like to make a pact like this in the time of a pandemic and the importance of keeping these non-COVID-19 deals going.

“Obviously also through a global pandemic, patients are still suffering debilitating and life altering diseases. It is important that the biopharma community continues to look for ways to advance innovative therapies for patients in needs,” Mainolfi told Fierce Biotech.

“Kymera has a long-standing relationship with Sanofi that goes back to the investment in their series B from the Sanofi venture group. More recently, we had been discussing the opportunity with the R&D group pre-COVID and then completed negotiations via video.”

In terms of timelines, he said the biotech is now working with Sanofi to “determine the best path forward for the program and plan to enter the clinic in the first half of 2021.”

Sanofi is no stranger to immunology and inflammation with its partnered work on Dupixent (a mAb for allergic diseases), but clearly wants a next-gen pipeline hope teed up for the future, as well as a drug that could complement Dupixent.

Frank Nestle, Sanofi’s global head of immunology and inflammation research and chief scientific officer of North America, told Fierce Biotech: “We see IRAK4 as an exciting new target space for immune mediated disease as a master regulator of a range of proinflammatory IL-1 family cytokine members (e.g. IL1a, IL1b, IL36, IL33) and TLR signaling. IRAK4 inhibition promises to follow JAK inhibitors as oral immunology compounds but without the Jaki associated safety implications.

“Sanofi has deep expertise in immune-inflammatory diseases, with Dupixent as a core growth driver in our portfolio.”

He said that, despite advances in immune-inflammatory disease, there are still many patients and disease indications with limited or no treatment options. “Kymera’s IRAK4 platform demonstrates the clinical potential of targeted protein degradation, a new treatment modality that is complementary to that of Dupixent and can treat patients with a high disease burden and unmet need.”

In terms of its new R&D focus set out last year that sees it want to reduce external R&D and focus more internally, there is still room for clear-sighted deals, such as with Kymera.

He explained: “We have communicated at our recent R&D event that we expect about two-thirds of medicine to be discovered and developed internally. For the third of externally sourced compounds we focus on first and best in class potential, clearly the case here with Kymera’s IRAK4 degrader program in I&I indications.

“Sanofi is transforming our R&D organization to focus on the development of first-in-class or best-in-class medicines. While 65% of Sanofi’s pipeline is internally driven, we continue to collaborate with partners who have expertise in specific technologies or mechanisms, leveraging innovative technology platforms to ensure we are maximizing potential patient benefit. Our collaboration with Kymera is integral to the overall strategy.

“We believe Sanofi’s deep resources in immune-inflammatory diseases will be critical in successfully developing Kymera’s technology, and the agreement is structured in such a way that Sanofi’s expertise in both clinical development and commercialization will be maximized.”