The online brokerage’s third-quarter earnings missed analyst forecasts for both revenue and earnings per share

Despite pulling in more revenue over its past three quarters than it had in any other full year, online brokerage Robinhood Markets Inc. saw its shares slide in extended trading Wednesday after reporting its third-quarter earnings.

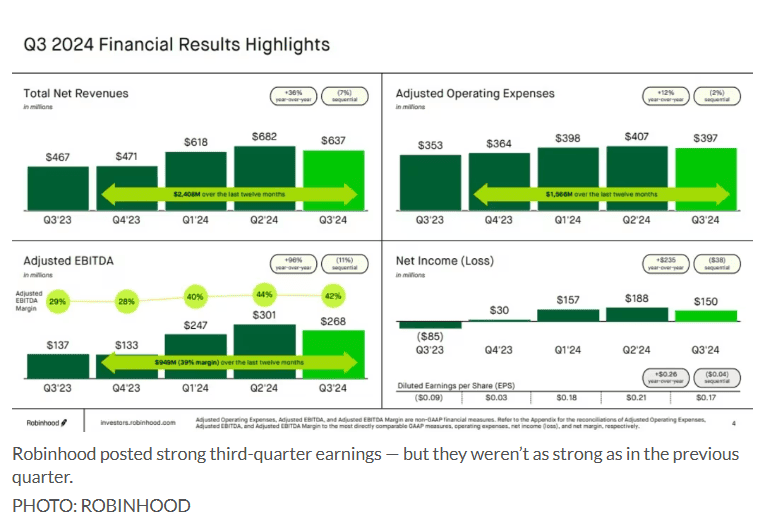

Robinhood HOOD0.64% announced adjusted earnings per share of 17 cents and $637 million in revenue after the closing bell — figures that fell short of the 18 cents and $661 million, respectively, that analysts had expected, according to FactSet.

The company’s stock dropped 12% in after-hours trading following the earnings release.

Prior to the third-quarter report, shares of Robinhood were up 121.4% this year to date, reflecting a strong year for the company in terms of revenue and customer growth.

Despite missing analyst estimates, Robinhood’s third-quarter revenue was the second highest on record for the company, ranking only behind its previous, second quarter. However, revenue wasn’t the only business metric that fell short of Robinhood’s stellar Q2; customer net deposits dropped from $13.2 billion to $10 billion, adjusted EBITDA fell from $301 million to $268 million and net income fell from $188 million to $150 million.

The relatively muted quarter-over-quarter performance comes amid two major pushes launched by the company this year.

Earlier this year, Robinhood unveiled several promotions with the intention of pulling more customers into its paid Robinhood Gold subscription service. The promotions included a physical Gold credit card, retirement-account matching and a 1% deposit boost; they helped pull customers from other brokerages to Robinhood, and have contributed to the company’s strong 2024 growth.

However, the momentum from those promotions may be starting to slow down. On its third-quarter earnings call, Robinhood Chief Financial Officer Jason Warnick said the company was ending its 1% deposit boost for Gold customers.

“The 1% Gold deposit boost has not driven as much incremental customer activity as our other promotions, so we’ve decided to wind it down in November to focus on offers that resonate more with customers,” Warnick said during the call.

On top of that, Robinhood announced a handful of new products in October. It hosted its Hood Summit in Miami for its most active customers, where it unveiled its new futures-trading feature and an advanced web-based trading platform, Robinhood Legend. Then earlier this week, Robinhood announced that it was rolling out event contracts to let people place bets on the Nov. 5 presidential election.

Robinhood has already begun rolling out those products. The election contracts were announced on Monday but were already made available to 100% of eligible customers, according to the company. Robinhood has been much more measured with its Legend release, but it noted that the first 1,000 available slots for Robinhood Legend were claimed in 45 seconds.

These new products didn’t impact Robinhood’s third-quarter earnings, as they were just announced this month — though their impact on the company’s business should be more apparent in its future earnings reports.