Following the company’s first drug approval in 2021, ADC Therapeutics is looking for FDA nods, and appears to have landed on phase 2 data for a Hodgkin lymphoma drug that could do just that.

Switzerland-based ADC reported Friday that camidanlumab tesirine (known as Cami) had a 70.1% response rate, including a third of treated patients recording a complete response. The median response time was 13.7 months among the select group of patients with relapsed or refractory Hodgkin lymphoma who had endured a staggering six lines of prior treatment. The latest analysis was on 117 patients in ADC’s open-label, single-arm phase 2 trial and is being presented at the European Hematology Association 2022 Hybrid Congress.

ADC Chief Medical Officer Joseph Camardo, M.D., said the results “offer hope to patients and doctors who need a new option.” He added that the company plans to march this data to regulators for another approval ask.

The most common side effect of the regimen was low blood platelet count, which affected more than 9% of patients, followed by anemia and hypophosphatemia (low phosphorous levels). Fourteen patients received chemotherapy after treatment and nearly 7% of patients developed Guillain-Barré syndrome, a condition in which a patient’s immune cells attack their nerves.

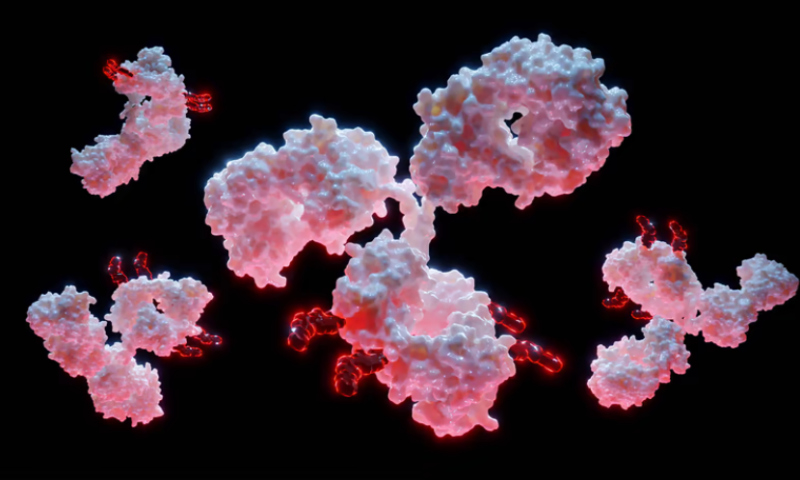

The 11-year-old company, which launched as a spinoff from Spirogen, has hitched its wagon to antibody drug conjugates, which are basically supercharged monoclonal antibodies armed with a cytotoxic agent. Whereas monoclonal antibodies alone help redirect the immune system to fight cancer, ADCs also help kill cancer cells themselves. It’s a budding mechanism for fighting cancer and as of September 2021, 11 ADCs had been approved by the FDA.

Cami would be ADC’s second therapy approval should regulators give it the greenlight. In April 2021, Zynlonta nabbed accelerated approval to treat relapsed or refractory large B-cell lymphoma after two or more lines of treatment. Following a May launch, the drug brought in more than $33 million. Cami is also being tested in solid tumors, an area that fills much of the company’s earlier pipeline.

Right behind Cami in the clinical race is ADCT-601, which is slated to enter a phase 1 clinical trial this month, according to the clinical trial record.

But indicative of a public biotech market that appears to be sparing no one, the company’s shares have hardly moved on the phase 2 news. The stock has fallen 68.5% in the last year, from $22.22 apiece in June 2020 to $7 as of Friday morning.