Oil futures remained strongly higher Monday, after Saudi Arabia over the weekend agreed to deliver an additional 1 million–barrel daily production cut next month as the Organization of the Petroleum Exporting Countries and its allies moved to extend existing production targets.

Price action

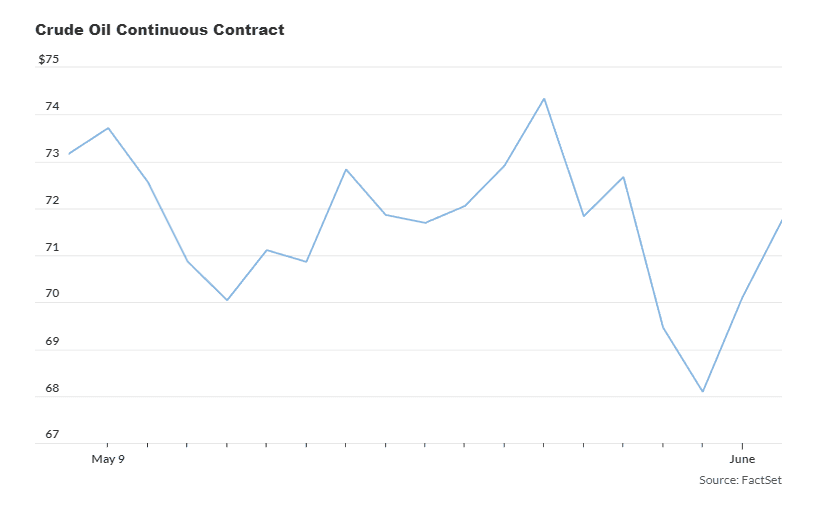

- West Texas Intermediate crude for July delivery CL00, 2.54% CL.1, 2.54% CLN23, 2.58% remained up $1.51, or 2.1%, at $73.25 a barrel on the New York Mercantile Exchange, after trading as high as $75.06 Sunday evening.

- August Brent crude BRN00, 2.42% BRNQ23, 2.38%, the global benchmark, gained $1.56, or 2%, to trade at $77.69 a barrel on ICE Futures Europe, after touching $78.73 after the open.

- Back on Nymex, July gasoline RBN23, 2.22% rose 1.6% to $2.54 a gallon, while July heating oil HON23, 1.77% was up 1.7% at $2.396 a gallon.

- July natural gas NGN23, 3.04% rose 2.9% to $2.235 per million British thermal units.

Market drivers

Saudi Arabia on Sunday said it would cut oil output by 1 million barrels a day in July, and that the reduction could be extended if needed. The announcement came as OPEC+ agreed to extend current production levels through the end of 2024 at a contentious meeting in Vienna.

OPEC+ agreed last October to cut production by 2 million barrels a day. Some OPEC+ members in early April announced further cuts totaling 1.6 million barrels a day through year-end, including 500,000 barrels a day in reductions by Saudi Arabia.

Saudi Energy Minister Abdulaziz bin Salman last month warned that short sellers should “watch out” and that they would be “ouching” much as they did in early April, when the surprise cuts caused a sharp, but short-lived, spike in crude prices.

The outcome of the meeting reinforces Saudi Arabia’s “uneasiness with the level of short positions in the market rather than signaling concerns around demand outlook,” said Giacomo Romeo, energy equity analyst at Jefferies, in a Sunday evening note to clients.

“The open-ended part of the measure was likely put in place to discourage future short positioning,” he wrote.

Analysts said bears didn’t appear to be that intimidated. Crude popped sharply higher at the open Sunday evening, but soon trimmed gains.

“Oil bears, decidedly daring, rushed in to sell the rally triggered by the Saudi decision, as expected,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, in a note.

The short-term price risk remains tilted to the upside, she said, rallies continue to be seen as a “top-selling opportunity” as China’s post-COVID reopening continues to disappoint and tight monetary policies by major central banks threaten global growth.