Oil futures fell Friday, pulling back from seven-year highs set earlier in the week, after a rise in U.S. crude inventories and a continued selloff in stocks that weighed on overall sentiment.

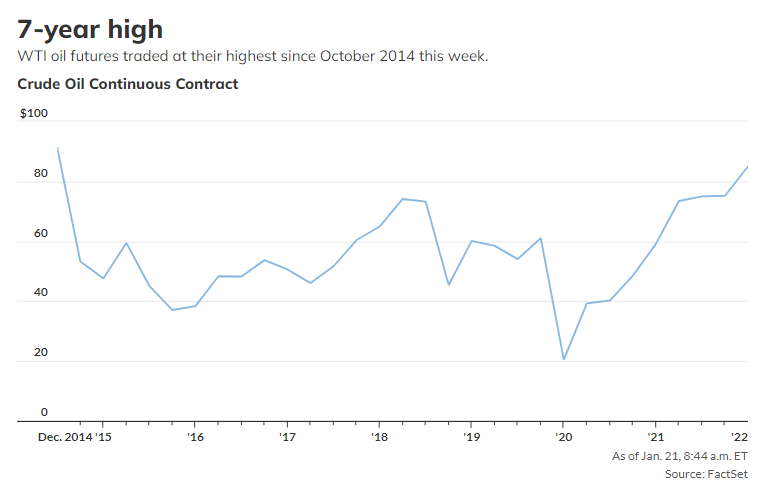

West Texas Intermediate crude for March delivery CL00, -0.71% CLH22, -0.70% fell $1.15, or 1.3%, to $84.40 a barrel on the New York Mercantile Exchange, trimming the U.S. benchmark’s weekly advance to 0.7%, according to FactSet.

March Brent crude BRN00, -0.80% BRNH22, -0.80%, the global benchmark, was off $1.07, or 1.2%, at $87.31 a barrel on ICE Futures Europe, headed for a 1.5% weekly gain. Both WTI and Brent closed Wednesday at their highest since October 2014.

Crude prices had “recently been reacting only to news that supported higher prices, such as temporary supply outages that have meanwhile been resolved. The question now is whether the correction will continue or whether the lower price level will be viewed by market participants as a buying opportunity,” said Carsten Fritsch, analyst at Commerzbank, in a note. “Both scenarios are possible as things currently stand.”

Analysts said a continued slide in equities was taking a toll on sentiment for other assets viewed as risky. A sharp rise in Treasury yields tied to expectations for a more aggressive than previously expected series of rate increases by the Fed has been blamed for a stock-market selloff that’s sent the tech-heavy Nasdaq Composite COMP, -1.30% into correction territory, while also dragging down other major indexes, including the Dow Jones Industrial Average DJIA, -0.89% and the S&P 500 SPX, -1.10%.

The Energy Information Administration on Thursday reported that U.S. crude inventories, excluding the SPR, climbed by 500,000 barrels for the week ended Jan. 14, compared with expectations for a drop of 700,000 barrels. The EIA also reported a weekly inventory increase of 5.9 million barrels for gasoline, while distillate stockpiles fell by 1.4 million barrels.