U.S. stock index futures were mixed Thursday as Nvidia results boosted the tech sector and Nasdaq but debt ceiling concerns weighed on the Dow.

How are stock-index futures trading

- S&P 500 futures ES00 rose 21 points, or 0.5%, to 4147

- Dow Jones Industrial Average futures YM00 fell 107 points, or 0.3%, to 32747

- Nasdaq 100 futures NQ00 jumped 225 points, or 1.6%, to 13875

On Wednesday, the Dow Jones Industrial Average DJIA fell 256 points, or 0.77%, to 32800, the S&P 500 SPX declined 30 points, or 0.73%, to 4115, and the Nasdaq Composite COMP dropped 76 points, or 0.61%, to 12484.

What’s driving markets

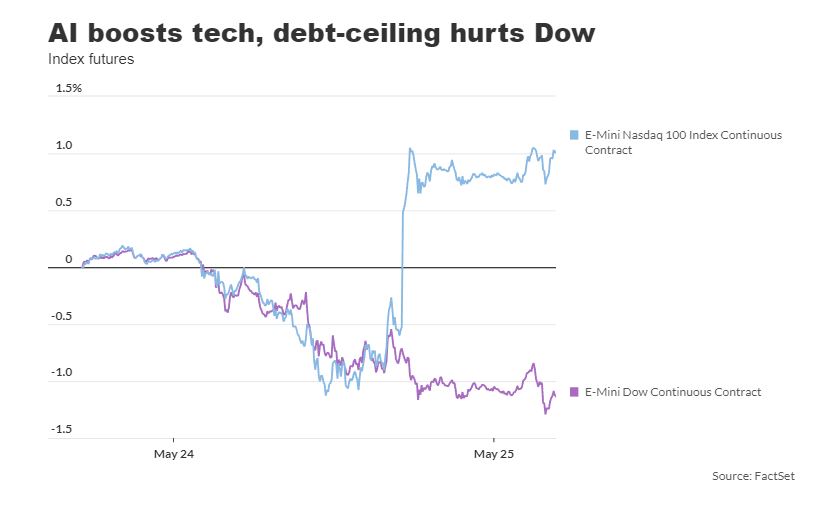

Fears about the looming debt-ceiling deadline is being counteracted Thursday by ebullience over artificial intelligence technology after chipmaker Nvidia’s results late Wednesday, resulting in a stark bifurcation between the Nasdaq and the Dow.

Futures for the Dow Jones Industrial Average, a gauge arguably currently more sensitive to broader economic conditions, were under pressure early Thursday, while futures for the tech-rich Nasdaq 100 index, powered by optimism over a secular AI shift, rallied strongly.

“The prospect of the U.S. government being unable to meet its financial obligations continues to be a key influence on investor sentiment in global equity markets,” said Derren Nathan, head of equity research at Hargreaves Lansdown.

Ructions at the short end of the Treasury market — where some 1-month bill yields BX:TMUBMUSD01Y broke above 7% — illustrate trader anxiety that unless Congress can reach an agreement to extend the debt-ceiling the U.S. government may technically default at the beginning of June.

Ratings agency Fitch late Wednesday said it was placing the U.S. AAA credit rating on watch for a possible downgrade given what it termed the debt ceiling “brinkmanship”.

However, results and comments from chipmaker Nvidia NVDA, whose stock is soaring 25% in premarket action, have boosted hopes that AI will deliver the next period of strong growth for a number of tech companies.

“The AI revolution may be making a lot of noise but results from microchip firm Nvidia hint at some substance behind the hype,” said Russ Mould, investment director at AJ Bell.

CS.ai Inc. AI and Advanced Micro Devices AMD were among those bathing in Nvidia’s AI glow early Thursday.

The optimism over semiconductors bade well for the wider tech sector, according to Mark Newton, head of technical strategy at Fundstrat: “Semis in relative terms to broader technology, have the potential to break back out to new all-time highs this week on a ratio basis. That would be important and positive for this leading sector to show such strength.”

U.S. economic updates set for release on Thursday include the weekly initial jobless benefit claims data and the second reading of first quarter GDP, both at 8:30 a.m. Eastern. Pending home sales for April will be published at 10 a.m..

Fed officials making comments include Richmond Fed President Tom Barkin speaking at 9:50 a.m. and Boston Fed President Susan Collins talking at 10:30 a.m.

Companies in focus

- Nvidia Corp.‘s stock NVDA jumped 24% in premarket trade as the chip maker guided for a record $11 billion revenue in the second quarter and first-quarter earnings topped Wall Street views. Other AI plays gained as well: Advanced Micro Devices shares AMD rose 9%, and those of C3.ai AI also added 9%.

- Shares of Snowflake Inc. SNOW dropped 14% after the data-software company topped expectations with its latest results but cut its outlook for the full year.

- Shares of American Eagle Outfitters Inc. AEO fell 20% after the clothing chain forecast a “low-single digits” sales decline for the second quarter, amid “ongoing macro challenges” that have led to subdued clothing demand.