SEATTLE — Neoleukin Therapeutics, Inc. (“Neoleukin”) (Nasdaq: NLTX), a biopharmaceutical company utilizing sophisticated computational methods to design de novo protein therapeutics, today announced the pricing of an underwritten public offering of 3,262,471 shares of its common stock at a price to the public of $15.25 per share. In addition, and in lieu of common stock, Neoleukin is offering to certain investors pre-funded warrants to purchase up to an aggregate of 1,737,529 shares of common stock at a purchase price of $15.249999 per pre-funded warrant, which represents the per share public offering price for the common stock less the $0.000001 per share exercise price for each such pre-funded warrant. The aggregate gross proceeds from this offering are expected to be approximately $76.2 million, before deducting underwriting discounts and commissions and estimated offering expenses payable by Neoleukin. The offering is expected to close on or about July 7, 2020, subject to customary closing conditions. Neoleukin has also granted the underwriters a 30-day option to purchase up to an additional 750,000 shares of common stock in connection with the public offering. All of the securities are being offered by Neoleukin.

BofA Securities, Piper Sandler and Guggenheim Securities are acting as joint book-running managers for the offering. Canaccord Genuity is acting as lead manager and H.C Wainwright & Co. is acting as co-manager for the offering. Neoleukin intends to use the net proceeds from the offering, together with its existing cash resources, to advance development of its lead program, NL-201, to expand its de novo protein design technology, to develop its preclinical pipeline and to fund working capital and for general corporate purposes, including capital improvements to properties it leases.

The securities are being offered by Neoleukin pursuant to a registration statement on Form S-3 previously filed and declared effective by the Securities and Exchange Commission (SEC). A final prospectus supplement and accompanying base prospectus relating to and describing the terms of the offering will be filed with the SEC and will be available on the SEC’s website at www.sec.gov. Copies of the final prospectus supplement and accompanying base prospectus may also be obtained, when available, from BofA Securities, Attention: Prospectus Department, NC1-004-03-43, 200 North College Street, 3rd Floor, Charlotte, North Carolina 28255-0001 or by email at dg.prospectus_requests@bofa.com; Piper Sandler & Co., Attention: Prospectus Department, 800 Nicollet Mall, J12S03, Minneapolis, MN 55402, by telephone at (800) 747-3924 or by email at prospectus@psc.com; or Guggenheim Securities, LLC, Attention: Equity Syndicate Department, 330 Madison Avenue, New York, NY 10017, by telephone at (212) 518-9544 or by email at GSEquityProspectusDelivery@guggenheimpartners.com.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities of Neoleukin, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

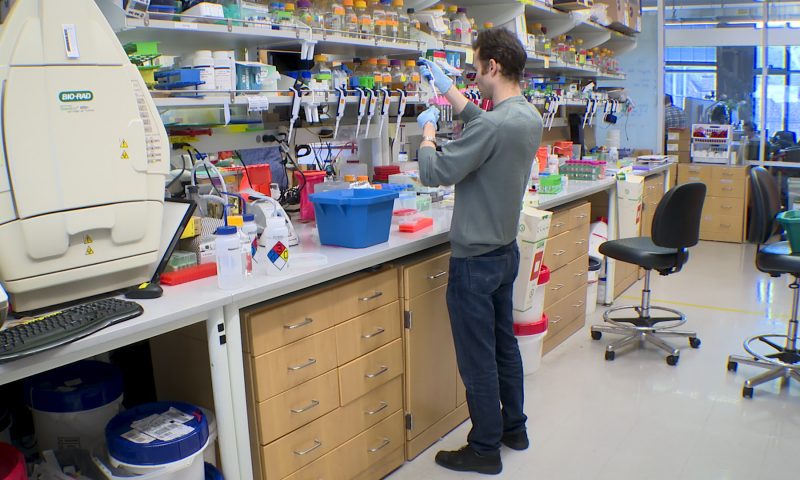

About Neoleukin Therapeutics, Inc.

Neoleukin is a biopharmaceutical company creating next generation immunotherapies for cancer, inflammation and autoimmunity using de novo protein design technology. Neoleukin uses sophisticated computational methods to design proteins that demonstrate specific pharmaceutical properties that provide potentially superior therapeutic benefit over native proteins. Neoleukin’s lead product candidate, NL-201, is a combined IL-2 and IL-15 agonist designed to improve tolerability and activity by eliminating the alpha receptor binding interface.

Safe Harbor / Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements Neoleukin makes regarding its ability to complete the offering and expected use of proceeds. These statements are subject to numerous risks and uncertainties, including market conditions and the global pandemic resulting from the novel coronavirus known as COVID-19, that could cause actual results to differ materially from what Neoleukin expects. Further information on potential risk factors that could affect Neoleukin’s business and its financial results are detailed in its most recent Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 filed with the Securities and Exchange Commission (SEC), and other reports as filed with the SEC. Neoleukin undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.