Microsoft shares aim for record after solid earnings

The Nasdaq gained ground, while the Dow Jones Industrial Average and S&P 500 flipped between small gains and losses as investors absorbed a huge batch of earnings from technology heavyweights, including Alphabet Inc. and Microsoft, as well as McDonald’s Corp., Boeing Co. and others.

Tensions between Washington and Beijing were also in focus after U.S. regulators banned China Telecom Corp. from operating in the U.S.

How are stock-index futures trading?

- The Dow Jones Industrial Average DJIA fell 78.89 points, or 0.2%, to 35,677.99.

- The S&P 500 SPX was off 2.52 points, or 0.1%, at 4,572.27.

- The Nasdaq Composite COMP was up 48.36 points, or 0.3%, at 15,284.08.

On Tuesday, the Dow and S&P 500 both finished at records, while the Nasdaq Composite finished less than 1% below its record close from Sept. 7.

What’s driving the market?

Investors have pushed stocks higher, and inflation and economic concerns to the side, amid a robust third-quarter earnings reporting season.

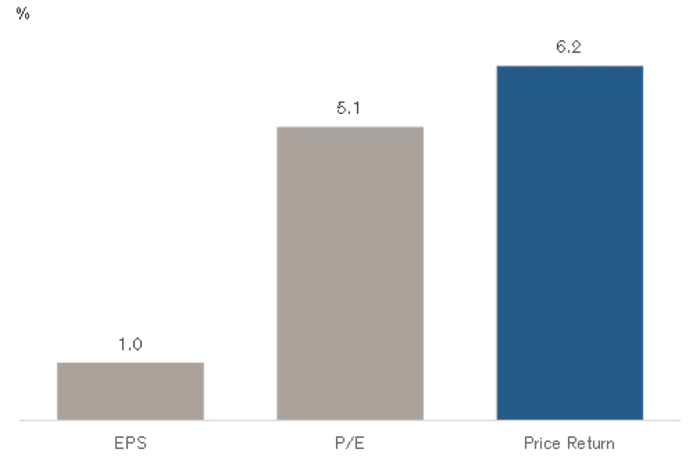

And while earnings have been “particularly strong,” posting a sixth straight quarter of double-digit beats, investor willingness to pay more for higher earnings has been the key to a rally that’s taken the S&P 500 up by more than 6% so far this month, said Jonathan Golub, a rise in stock multiples from 20 times earnings to 21.1 “has been the real driver of the market’s advance,” said Jonathan Golub, chief U.S. equity strategist at Credit Suisse Securities, in a Wednesday note (see chart below).

“Although investors fear that higher interest rates, inflation, and energy prices are potential headwinds, these indicators reflect economic vibrancy, supporting higher stock prices,” Golub said.

Late Tuesday a lineup of corporate results included several big tech companies with Microsoft Corp. MSFT reporting quarterly earnings that shot over $20 billion for the first time. Shares rose 4% to $322.38, on track for a record close, according to Dow Jones Market Data.

Twitter Inc. TWTR share were down more than 8%, after the microblogging social-media group added users, and reported a revenue rise. Google parent Alphabet Inc. GOOGL reported earnings that topped estimates amid resilient advertising sales. Its shares rose 3.4%.

Data showed U.S. durable goods orders fell 0.4% in October, compared with expectations for a 1% decline. “Core” orders rose by 0.8%. Separately, the government said the trade deficit widened in September.

“The weakness in headline durable goods orders last month was driven by another fall in transport orders, which mostly reflects worsening supply problems in the auto market,” said Michael Pearce, senior U.S. economist at Capital Economics. “The strong increase in underlying orders and shipments suggests that demand remains solid.”

Elsewhere, Sino-U.S. tensions were in focus after the Federal Communications Commission gave China Telecom HK:728 60 days to leave the U.S. market. Regulators cited a potential national security threat from the company, such as the disruption of U.S. communications, amid rising tensions between the countries.

Which companies are in focus?

- Boeing BA shares fell 0.2%, after the aerospace and defense company reporting a big loss and revenue misses amid weakness in the commercial airplanes and defense, space and security businesses, while free cash flow was a lot less negative than projected.

- McDonald’s MCD shares rose 3.4% after the fast-food giant reported third-quarter earnings and sales that beat expectations.

- Shares of Coca-Cola Co. KO were down 0.9%, after the beverage giant reported third-quarter profit and revenue that rose topped expectations, with all geographic regions seeing revenue and unit case volume growth. It also raised its full-year earnings growth view.

- General Motors Co. GM shares were up 1.1% after the auto maker blew past profit estimates for the third quarter and offered above-consensus guidance for the full year, offsetting a revenue miss.

- Shares of Robinhood Markets Inc. HOOD fell sharply in after-hours trade but were up 1.3% in early action, after the online trading platform reported a wider quarterly loss and lower-than-expected sales amid weak crypto-related revenue.

- Shares of Texas Instruments Inc. TXN rose 1%, after the chip maker’s third-quarter results met Wall Street forecasts. It also noted “hot spots” of components shortages.

- Visa Inc. V shares fell 4.5% after the credit-card company topped earnings expectations but disappointed some over its revenue outlook.

What are other markets doing?

- The yield on the 10-year Treasury note BX:TMUBMUSD10Y fell 4.7 basis points to 1.572%. Yields and debt prices move in opposite directions.

- The ICE U.S. Dollar Index DXY, a measure of the currency against a basket of six major rivals, was off 0.2%.

- Oil futures pulled back from multiyear highs, with the U.S. benchmark CL00 down 0.8% at $83.96 a barrel. Gold futures GC00 edged down 0.2% to $1,789.80 an ounce.

- In European equities, the Stoxx Europe 600 XX:SXXP fell 0.4% and London’s FTSE 100 UK:UKX shed 0.3%.

- The Shanghai Composite CN:SHCOMP fell 1%, while the Hang Seng Index HK:HSI dropped 1.6% in Hong Kong, while Japan’s Nikkei 225 JP:NIK saw a marginal decline.