If you’re going to be a new biotech in mRNA, it helps to have the type of technology that can solve a big problem—and draw a big name. That’s what Exsilio Therapeutics, which broke cover today with $82 million to create new genomic medicines sprinkled with a side of mRNA, has done.

The genetic disease biotech’s temporary CEO is none other than Tal Zaks, M.D., Ph.D., of Moderna fame. Since leaving the mRNA powerhouse, Zaks has been spending his time on the investor side, he says. He currently serves—and will continue to serve—as a partner at investment firm OrbiMed, as well as holding director seats at PIC Therapeutics, iECURE, Convergent Therapeutics and Minervax.

But Exsilio’s genomic medicines approach lured him off the bench and into the C-suite again.

“I got introduced to this company and believed that it was in the sweet spot of a problem we need to solve and I had a sense of a mission given my experience with mRNA lipid nanoparticles,” Zaks said in an interview. “I thought I could be able to contribute to the growth of this company.”

Exsilio will be looking for a full-time leader, but in the meantime, Zaks will be there “absolutely as long as necessary to make sure that the potential of that company is brought to bear, put it this way.”

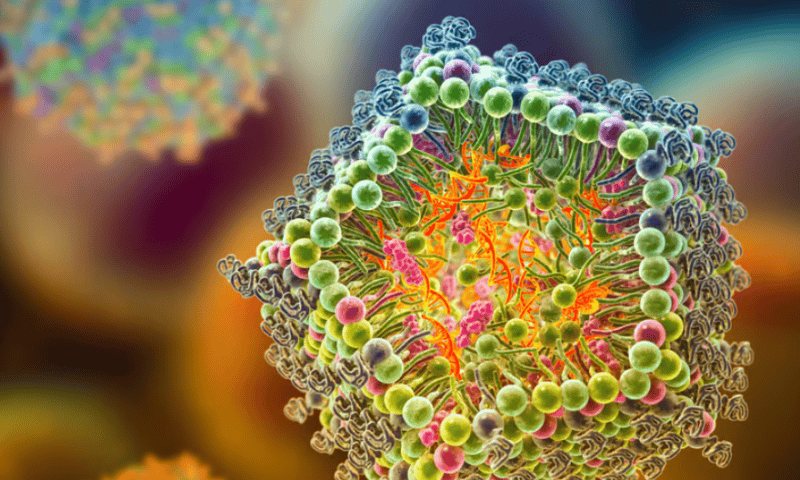

Exsilio is developing genomic medicines using naturally occurring, programmable genetic elements that can insert new genes into the cell through mRNA intermediates. The platform uses in-silico modeling and wet lab-based experimentation to develop therapeutic genes. Since the resulting medicines are encoded with mRNA, they use existing lipid nanoparticle platforms that have been shown to be safe, scalable and cost-effective.

Zaks was swayed by the potential for Exsilio’s technology to insert genes into safe harbor sites, which can accommodate the new genetic material and ensure predictable functionality and no off-sight alterations.

“I am a medical oncologist by training. One of the reasons this is my first foray truly, with such an investment of time into gene therapy, is because I think that the safety bar for genomic medicine is very high. And this one has convinced me in terms of the potential,” Zaks said.

Another key feature for Zaks was that these treatments have the potential to be redosed, which sets Exsilio apart from other companies in the gene editing space that tout the one-and-done strategy.

“One-and-done is really a bug, it’s not a feature,” Zaks said.

Genomic medicines split into two camps, Zaks explained. Gene editors typically encode the payload in an mRNA but can only correct very small sections of DNA at a time. If they are one-and-done, that limits what can be corrected.

Traditional gene editing therapies use viral vectors, which can be challenging because patients can have prior immunity. Gene editing medicines are also typically administered in one large dose, so any adverse events can be difficult to manage up front.

“If you can repeat dose and titrate, it means you don’t have to give a whopping high dose the one time you administer the medicine,” Zaks said. This is also coupled with the proven safety profile of mRNA lipid nanoparticle delivery.

Exsilio’s tech also has the potential to provide an entire therapeutic gene, rather than just pieces or smaller portions.

Exsilio has arrived at a pretty key moment in the history of genomic medicines. One is that mRNA is now a proven modality thanks to Moderna and Pfizer/BioNTech and further work to push the technology into cancer vaccines. There’s also been a burst of scientific ingenuity in genetics, which is being combined with modern protein engineering tools like machine learning, AI and sequencing. And finally, the developmental precedent for these treatments has been established, with the FDA issuing guidance on the regulatory framework.

“If you take together these three elements, I think the timing is really good for us. I don’t think you could have launched this company five years ago,” Zaks said.

Another helpful element is that CRISPR Therapeutics and Vertex Pharmaceuticals just got a gene therapy approved in Casgevy for sickle cell disease, followed by others. CRISPR is an investor in Exsilio’s series A, which was co-led by Novartis Venture Fund and Delos Capital. Other investors include OrbiMed, Insight Partners, J.P. Morgan Life Sciences Private Capital, Innovation Endeavors, Invus, Arc Ventures and Deep Insight.

Zaks could not disclose what disease areas Exsilio will explore initially, only that the targets are genetic diseases or rare diseases where the genetic defect is well understood, such as in cancer or autoimmune.

The series A should support work through preclinical data collection. Zaks specifically was brought on to turn Exsilio into a development organization, he said.