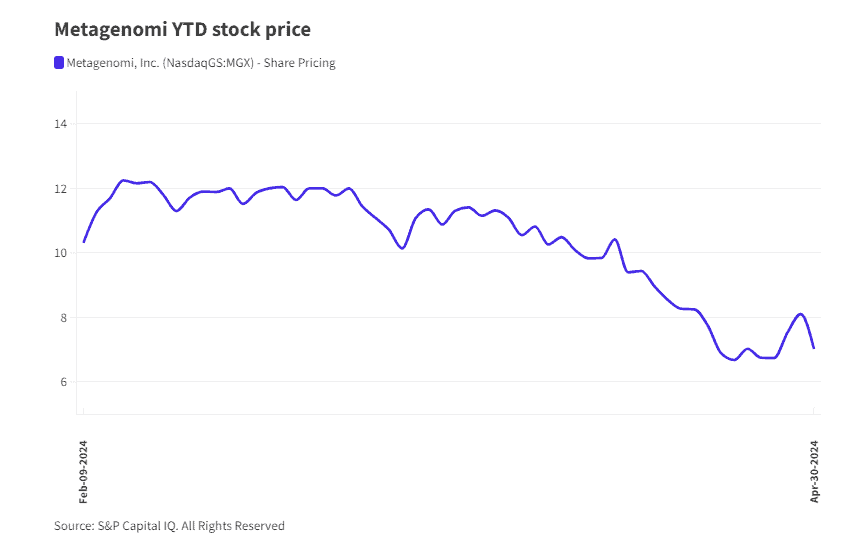

Earlier this year, Metagenomi had the spotlight with a $93.7 million IPO. Now, Moderna is exiting stage left on a partnership worth up to $3 billion in biobucks.

Back in 2021, Moderna entered the gene editing space via a four-year partnership with young Metagenomi. The research pact went after in vivo treatment options for serious genetic diseases, with Metagenomi offering access to its gene editing tools and Moderna sharing expertise in mRNA and lipid nanoparticle delivery technologies.

Now, both companies have come to the mutual decision to end the collaboration, Metagenomi CEO Brian Thomas, Ph.D., told Fierce Biotech in a May 1 interview. The move coincides with a strategic prioritization at Moderna. Requests for comment sent to Moderna were not returned as of publication.

Since Metagenomi has emerged on the Nasdaq, the terms of the deal have become public. Moderna handed over $70 million upfront in equity and cash and offered Metagenomi more than $3 billion in potential biobucks, according to Securities and Exchange Commission (SEC) documents.

Any unrealized biobuck payments haven’t been included in the company’s cash projections, Metagenomi’s chief investment officer Simon Harnest said. The biotech had received $49.6 million from the collaboration as of Dec. 31, according to SEC documents.

“There’s no significant impact to our horizon of cash or use of our cash runway,” Metagenomi CFO Pamela Wapnick told Fierce Biotech. “So, we still have runway out to 2027, which is what we said at the time of our IPO. This really isn’t a significant impact on the business.”

Moderna and Metagenomi had been working on a preclinical primary hyperoxaluria type 1 (PH1) program, which Metagenomi Chief Medical Officer Sarah Noonberg, M.D., Ph.D., says the company is currently evaluating.

“We are, right now, taking the opportunity to assess this program and make sure that it continues to meet our criteria for further investment and advancement,” Noonberg said. “There have been a number of advances in the standard of care for primary hyperoxaluria type 1, and so we’d like to just take a closer look at the therapeutic landscape and we’ll be making a decision about our plans for PH1 in the near future.”

Nothing in the early data prompted any concern, according to Noonberg.

Metagenomi will now regain full development rights to its gene editing technologies that Moderna previously had rights to, such as its base editing and RNA-mediated integration systems (RIGS).

Metagenomi leadership is slated to discuss the terminated partnership during a conference call today at 5:00 p.m. ET.

Moderna remains a shareholder of Metagenomi, while Metagenomi maintains a separate partnership with Ionis Pharmaceuticals that could total almost $3 billion in biobucks. The two are developing programs for transthyretin amyloidosis and cardiovascular disease and have two other undisclosed programs selected that have yet to be announced, Thomas said.

A preclinical company going public is rare, especially amid the frozen-over IPO market the biotech industry has endured for more than a year. When asked whether the timing was right to publicly debut, Thomas has no regrets.

“We’re very excited with the outcome of the IPO,” Thomas said. “This is an opportunity for us to get the resources that we need in order to ensure a runway that goes out three years, so that we can get through those critical milestones that we’ve set for ourselves.”

Those milestones include an investigational new drug filing slated for 2026 for the company’s lead program, a hemophilia A candidate. The company also plans to share preclinical data on the asset in the second half of this year.

“I think investors have had a really difficult time in biotech over the last couple of years and we were very aware of that going into the IPO,” Thomas explained. “I think they need to see a little bit more progress and I think that’s one of the challenges as a preclinical company.”

Ultimately, Thomas said he believes Metagenomi can overcome that challenge, citing the company’s ability to execute.

“We really feel that we’re the premier gene editing company, given this broad base of technologies that we have,” Thomas said. “That makes us unique.”