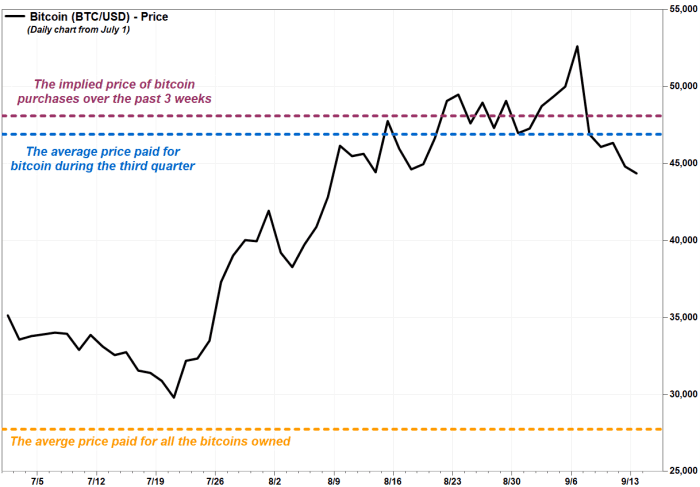

Software company effectively paid roughly $48,000 for each bitcoin on average during the past 3 weeks

Enterprise software company MicroStrategy Inc. keeps swapping out its shares for more bitcoin.

The company, which has previously said it uses bitcoin as a primary Treasury reserve asset, disclosed Monday that it bought 8,957 bitcoins for $419.9 million in cash, including fees and expenses, between July 1 and Sept. 12. The average price paid for the bitcoin was $46,875, the company said.

Last month, the company had disclosed that between July 1 and Aug. 23, it spent $177.0 million to buy 3,907 bitcoins, at an average price of $45,294 per bitcoin.

That indicates that over the past three weeks, the company bought 5,050 bitcoins for $242.9 million. That implies an average per-bitcoin price of $48,099, according to a MarketWatch calculation.

Bitcoin BTCUSD, 1.44% was shedding 3.1% to $44,737 in afternoon trading Monday, according to FactSet, while MicroStrategy shares MSTR, +4.41% rallied 2.2%.

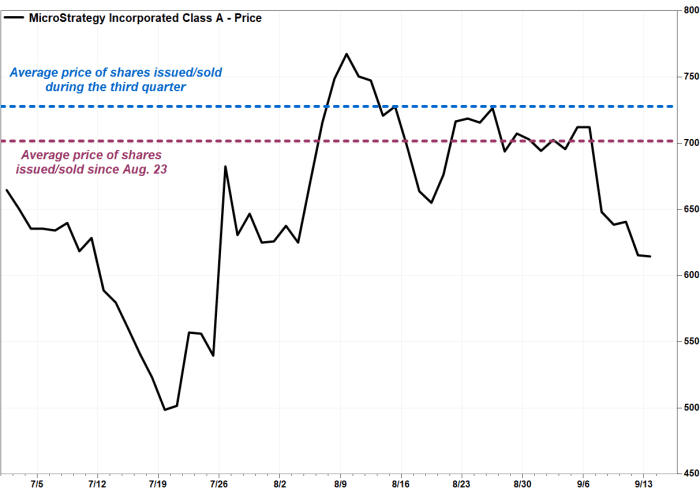

MicroStrategy also disclosed Monday that it had issued and sold a total of 555,179 shares of common stock at an average price of $727.64, to raise about $399.9 million, between July 1 and Sept. 12.

That follows the company’s previous announcement between July 1 and Aug. 23, it had sold 238,053 shares at an average price of $753.21 to raise $177.5 million.

That indicates the company sold 317,126 shares to raise $222.4 million since Aug. 23, implying an average sale price of $701.30 per share.

Not a bad sale over the past three weeks, as the stock was recently trading just below $629.

The share sales are part of an open-market sales agreement with Jefferies LLC announced on June 14 for the sale of up to $1 billion worth of stock.

Overall, the company said it now holds about 114,042 bitcoins that were bought for $3.16 billion, at an average price of $27,713 per bitcoin. That implies a gain of about $1.94 billion on the company’s bitcoin investment at current bitcoin prices.

Separately, the company disclosed late Friday that Morgan Stanley MS, +0.75% owned 138,345 MicroStrategy shares, or 1.8% of the shares outstanding. In Morgan Stanley’s 13F filing with the Securities and Exchange Commission last month, the broker didn’t own any MicroStrategy shares as of June 30.

MicroStrategy’s stock has rallied 21.8% over the past three months, while bitcoin has climbed 19.9%, the SPDR S&P Software and Services exchange-traded fund XSW, -0.18% has edged up 4.5% and the S&P 500 index SPX, +0.23% has gained 4.8%.